Buying your next home?

See our home loan tools, articles and resources to help you explore your home loan options. We'll help you get to a good place.

Buying your next home?

See our home loan tools, articles and resources to help you explore your home loan options. We'll help you get to a good place.

Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.

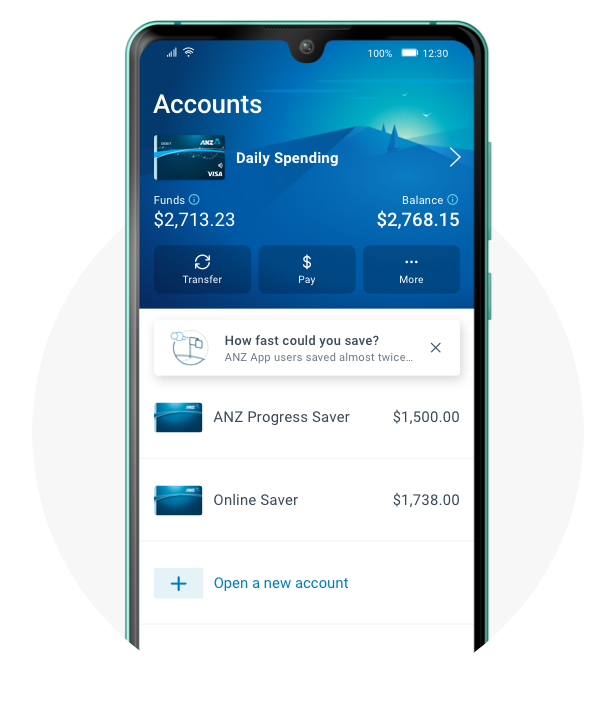

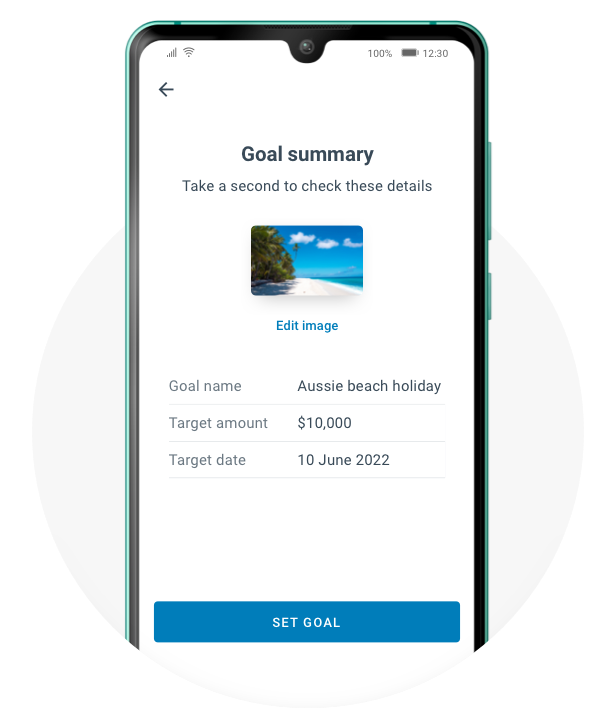

Saving for something? Customers who have set a savings goal in the ANZ App, have saved 2x faster.Superscript: 1

No matter how big or small, it won’t feel so far away when you know what you need to save and how you’re tracking.

You can set a goal on your ANZ Progress Saver or ANZ Online Saver account today.

Don’t have the app? Get it from the

App Store or Google Play

Not seeing How fast could you save? Tap For You at the bottom of the screen, and scroll down to Goals.

Don’t have one of these accounts? You can learn more or apply for one in just a few minutes here.

Payday? Cha-ching! It may help to transfer some money straight into your savings as soon as you’re paid.

Make it realistic, with a small stretch target, based on what is manageable for you to live and save.

Put it on auto-pilot with an automatic transfer so you’re saving regularly without even knowing. You can set this up via Internet Banking or by calling or visiting us.

Saving for different things? It can be helpful to create individual goals to stay focused. You can set one goal on each eligible ANZ savings account.

Check in on your goal regularly to see how you’re going and adjust your goal if needed.

Getting to 5% or 50% of your goal are both big deals. Celebrate each achievement, we’ll help you.

Think about locking it away or hiding it from sight. You can set this up by calling or visiting us.

We all go off track at one point or another. Don’t let it stop you. We’ll help you get back on track.

Understanding your spending is a good way to find opportunities to save. Your Money Report in the ANZ App is a tool designed to help you do this.

Don’t have an eligible savings account? With one of these goal saving accounts you can set a goal in the ANZ App.

Learn more, or apply for one in just a few minutes below.Superscript: 2

Goal-based saving

Be rewarded with bonus interest for regular savings when you make at least one single deposit of $10 or more and no withdrawals in a month

You could earn:

3.75% p.a.Superscript: 3

0.01% p.a. base rate + 3.74% p.a. bonus interest rate, when you make at least one single deposit of $10 or more and no withdrawals in a month.Superscript: 3

Flexible saving

Earn interest and access your savings anytime online via your linked everyday accountSuperscript: 4

You could earn:

1.15% p.a.Superscript: 5

1.15% p.a. standard variable rate (subject to change)Superscript: 5

The ANZ App is provided by Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522. Super and Insurance (if available) are not provided by ANZ but entities which are not banks. ANZ does not guarantee them. This information is general in nature only and does not take into account your personal objectives, financial situation or needs. ANZ recommends that you read the ANZ App Terms and Conditions available at www.anz.com and consider if this service is appropriate to you prior to making a decision to acquire or use the ANZ App.

ANZ App for Android is only available on Google Play™. ANZ App for iPhone is only available from the App Store.

Apple, Apple Pay, Apple Watch, Face ID, iPad, iPhone and Touch ID are trade marks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android, Google Play and the Google Play logo are trade marks of Google Inc.

1. Compares avg monthly uplift in savings growth for a number of ANZ Progress Saver and/or ANZ Online Saver accounts with a goal vs accounts without for Aug-19 to July-21.

Return2. ANZ recommends you read the ANZ Saving & Transaction Products Terms and Conditions (PDF 746kB) and the Financial Services Guide (PDF 104kB) which are available at anz.com or by calling 13 13 14, before deciding whether to acquire, or continue to hold, any product. Fees, charges and eligibility criteria apply.

Return3. Bonus interest is subject to eligibility. ANZ Progress Saver pays bonus interest (in addition to the current variable base interest) in respect of a particular month if the set minimum deposit (currently single deposit of $10) and no withdrawals, fees or charges are processed to the account on or before the last business day of that calendar month, and after the last business day of the previous calendar month. Refer to ANZ Saving & Transaction Products Terms and Conditions for further details about transactions processed outside of this period. Bonus and base rates are variable and subject to change.

ReturnFor all applicable fees and charges please see the ANZ Personal Banking Account Fees and Charges (PDF 139kB) and ANZ Personal Banking General Fees and Charges (PDF 155kB). For ANZ Online Saver accounts, a monthly account service fee may apply to a linked ANZ everyday banking account.

ReturnFor children under 12, a parent or guardian will need to open the account in Trust for the child. Customers aged 12 to 17 who can sign a consistent satisfactory signature can open an account in their own name or as a joint account with a parent or guardian.

Return4. ANZ Online Saver is only available to customers who open or who are the account holders of, or signatories to, eligible ANZ everyday banking accounts with ANZ Internet Banking or ANZ Phone Banking access. Eligible accounts include ANZ Access Advantage, ANZ Access Basic, ANZ Pensioner Advantage, ANZ Progress Saver, ANZ V2 PLUS and ANZ Premium Cash Management Account. Terms and conditions and fees and charges apply to the eligible account. Monthly fees may apply to the linked account.

Return5. ANZ Online Saver account earns a standard variable rate (currently 1.15% p.a.), which is subject to change.

Return