-

As we farewell 2023, the key question in 2024 remains how high and how long central banks keep interest rates elevated. At this stage, the outlook appears more favourable for bonds in the year ahead. Our Chief Investment Office explains further.

Our view

Following October’s capitulation, equities rose sharply and bond yields tumbled. The US 10-year yield has fallen more than 80 basis points from its peak in late October and the S&P 500 has climbed more than 10 per cent over a similar timeframe – extreme in any context.

The moves were premised on growing expectations that central banks have finished tightening monetary policy. And despite Fed Chair Jerome Powell’s recent efforts to push back on the potential for rate cuts, markets are now pricing for five from the Fed over 2024 – starting in H1.

While the equity moves over November were significant, in our view, there are a few catalysts that could continue to support equities in the near-term.

- Inflation is trending lower, economic data is continuing to deteriorate and yields are declining (for now). There remains scope for PE expansion should yields decline further ahead of central bank cuts.

- Seasonality is typically a strong support for equities over the final month of the year. Despite the November rally there is little historical evidence to suggest a strong November detracts markedly from December’s potential.

- Although investors have become more bullish and inflows to equity market funds have increased, positioning remains relatively light (particularly in some segments of the market) and sentiment closer to neutral.

Further out, however, we continue to be more confident of the outlook for bonds relative to equities. Similarly, this is for a few key reasons.

- The US consumer appears vulnerable in the year ahead. Credit card balances have risen sharply over the past two years, pandemic savings are declining, unemployment is rising and so too are credit card delinquencies. Given consumer spending accounts for roughly 70 per cent of US GDP this could spell trouble for corporates in the year ahead.

- Against this backdrop, analysts are still expecting double-digit earnings growth for the S&P 500 next year. Taking into consideration a slower economic backdrop, rising unemployment and disinflation, it is difficult to reconcile where this earnings growth comes from and therefore leaves little room for disappointment when earnings are released.

- Unless inflation reaccelerates, we expect to have seen a peak in yields this cycle. Moreover, if growth continues to decline and central banks turn toward rate cuts then this is typically an environment in which bonds perform well and equities (at least initially) stumble.

So, can central banks deliver immaculate disinflation and the much-vaunted soft landing? Much will depend on where their priorities lie. At present, it still seems inflation is front of mind for policymakers. While economic growth is falling and unemployment is turning, with inflation remaining above target, it may be premature to suggest rate cuts will materialise over the first half of next year.

The market is pricing for more than 100 basis points of easing in 2024 – we are less convinced. For this to transpire we would likely need to see a much sharper downturn than is currently expected and for economic growth to become the focus once more.

Rather, we believe the Fed will err on the side of caution and keep policy restrictive for longer. At this stage of the cycle, assessing the level of necessary tightening becomes an incredibly difficult task. We continue to believe the risk of overtightening remains acute.

Even with a potential Santa rally, equities are expensive across most segments of the market and with bonds offering significant carry, the case to shift overweight risk assets remains unconvincing.

Fear the cut, not the pause

Trading days from first Fed rate cut to S&P 500 market low vs. S&P 500 per cent change from first Fed cut to market low.

Info-01

Source: Strategas

What this means for our diversified portfolios

With the potential for equities to climb further in the near-term, but with less conviction over the medium-term, we seek to increase exposure to those segments that have underperformed the broader market by wide margins this year and/or where positioning and sentiment remains particularly downtrodden.

In the event of a near-term pullback these segments may be less susceptible to an unexpected slide while holding potential for greater participation in rallies should they transpire, as equity managers shift away from the more expensive sectors of the market that have already rallied strongly.

Within portfolios we have increased our exposure to both global real estate investment trusts (GREITs) and listed infrastructure, taking both positions back to benchmark. On a 12-month basis, GREITs and listed infrastructure trail global share markets by more than 15 per cent. Elevated yields have weighed heavily on both segments this year. With valuations remaining relatively attractive, sentiment weak and a likely peak in the rate cycle being reached, we have elected to take both positions back to benchmark this month.

Similarly, the Australian market – where we have remained underweight for most of the year – trails global shares by more than 10 per cent over 2023. Within the domestic market, positioning in the Materials sector remains particularly light. Here, we look for any near-term pullbacks as a potential opportunity to lift our position closer to benchmark.

Overall, we remain positioned defensively across portfolios with global and domestic bonds our preferred exposures as we farewell 2023.

ANZ investment strategy positions – December 2023

Info-02Equity markets rose strongly over November as yields fell appreciably alongside expectations that central banks have reached the end of this tightening cycle. Although we noted the potential for this increase last month, owing primarily to seasonality and the solid sell-off from mid-July, the magnitude of the gains caught us somewhat by surprise.

We continue to see scope for shares to rally further into year-end with seasonality continuing to be a strong positive factor. Furthermore, while broader market positioning in equities has increased it remains relatively light (typically a contrarian indicator) and with central banks now likely on hold the backdrop for equities could be constructive in the months ahead.

However, while valuations had improved at the margin prior to the November rally, that was washed away over the course of only a few weeks as the S&P 500 rose by almost 10 per cent. Although the risk-free rate (10-year US Treasury yield) has declined over that period also, the required return hurdle for equities remains significant – particularly in the context of a deteriorating economic growth and softer labour markets. And with valuations high, prevailing recession risks and a belief that central banks may be over cautious in keeping monetary policy restrictive, the attractiveness of equities is diminished over the medium-term – particularly when considering the yields available on high quality fixed income assets.

Weighing up these factors we remain at benchmark to global developed market shares this month.Developed Markets – Regional Performance

Source: Bloomberg, ANZ CIO as at 30 November 2023

Info-03Official Chinese PMIs declined for a second month in November, albeit modestly, with non-manufacturing weakening to 50.2 in November from 50.6 in October and manufacturing contracting further to 49.4 from 49.5 the month prior. This stood in contrast to the Caixin manufacturing purchasing managers' index released a day later that unexpectedly rose to 50.7 in November from a 49.5 reading in October.

Despite the disparity, and Q3 GDP that printed above expectations, the downward trend in PMIs suggests there may be further pressure and stimulus required for the Chinese economy – one that has failed to recover from the period of ‘zero-covid’ as quickly as some investors had hoped.

Countering this is the recent thawing in geopolitical tensions that can be viewed as positive – how long this will last will be a key question in the year ahead. Moreover, valuations remain relatively cheap with Chinese shares having endured significant underperformance to the broader equity market on a year-to-date basis.

We hold our benchmark position to emerging markets this month. With sentiment remaining downtrodden and performance underwhelming, seasonality and economic surprises could assist this segment of the market over the short-term. Moreover, broader emerging markets could also be a beneficiary of fading US dollar exceptionalism into year-end.Emerging Markets – Regional Performance

Source: Bloomberg, ANZ CIO as at 30 November 2023

Info-04The Australian market is at an interesting juncture. On the one hand the outlook for global growth remains weak and concerns surrounding China continue to simmer. On this basis and given the Australian market’s heavy reliance on Materials and Banks, there is an argument that the Australian market will continue to underperform over the short-to-medium term.

On the other hand, at the end of November, the Australian market sat more than 12 per cent behind the MSCI World Index (Hedged) over the year to date. On both a price-to-earnings and price-to-book basis, the market is cheap by historical standards versus the MSCI All Country World Index. Moreover, domestic EPS estimates for 2024 have been falling as opposed to rising across many other developed markets.

Within the domestic market, positioning in Materials is incredibly light and could benefit from upside surprises. Although the global growth outlook remains weak and demand for iron ore tepid, supply constraints should see the commodity price remain well supported throughout 2024.

We are far from bullish on the outlook and on a relative basis the segment remains our least preferred exposure across portfolios. However, based on cheap valuations, positive seasonality factors and the potential that a peak in policy rates has been reached we look for opportunities to modestly add to our position this month, with a view to taking the position to neutral, albeit modestly below benchmark across portfolios.ASX 300 – Performance

Source: Bloomberg, ANZ CIO as at 30 November 2023

Info-05The underperformance of listed real assets has been pronounced over 2023. This has been particularly acute within global real estate investment trusts (GREITs). On a 12-month basis, GREITs and listed infrastructure trail global share markets by more than 15 per cent.

We have held an underweight to listed infrastructure for most of 2023 and have been positioned between benchmark and mildly underweight GREITs over the same period. Both segments have suffered against the spectre of rising interest rates. As witnessed over November, a steep fall in yields has seen both segments stabilise, and with an expectation that the terminal level for interest rates has been reached across most of the globe we believe there is better scope for each to perform more positively over the coming period.

With valuations remaining relatively attractive, sentiment weak and a likely peak in the rate cycle being reached we have elected to take both positions back to benchmark this month.

Both strategies continue to provide a hedge to inflationary pressures, diversification characteristics and valuable income benefits for portfolios.Global Infrastructure vs. Global REITs vs. Global Equities

Source: Bloomberg, ANZ CIO as at 30 November 2023

Info-06The Q3 US earnings season provided the first quarter of year-over-year earnings growth in 12-months, and while earnings could remain supported over the next couple of quarters, with growth expected to slow we do look to the potential for some form of earnings slump over the first half of next year.

We continue to believe the Fed will keep rates elevated through the first half of next year and possibly beyond. If this coincides with disinflation, softer labour markets, deteriorating economic growth and a US consumer that comes under further duress, then we would expect pressure on corporates to build also.

With a significant amount of debt needing to be reissued out of the high yield market over the coming year there also remains a reasonable refinancing risk given the generally shorter duration of high yield versus investment grade credit.

In our view, spreads are likely to widen from here, even without pricing for a deeper recession. And while we continue to point to the likelihood of a relatively shallow recession, if the Fed and other central banks hold rates at these levels deep into next year then recession risks will rise accordingly.

Given these factors, we remain underweight global high yield this month, maintaining our preference for higher quality assets across portfolios in this late-cycle environment.Bloomberg Global High Yield – Option Adjusted Spread to Treasury

Source: Bloomberg, ANZ CIO as at 30 November 2023

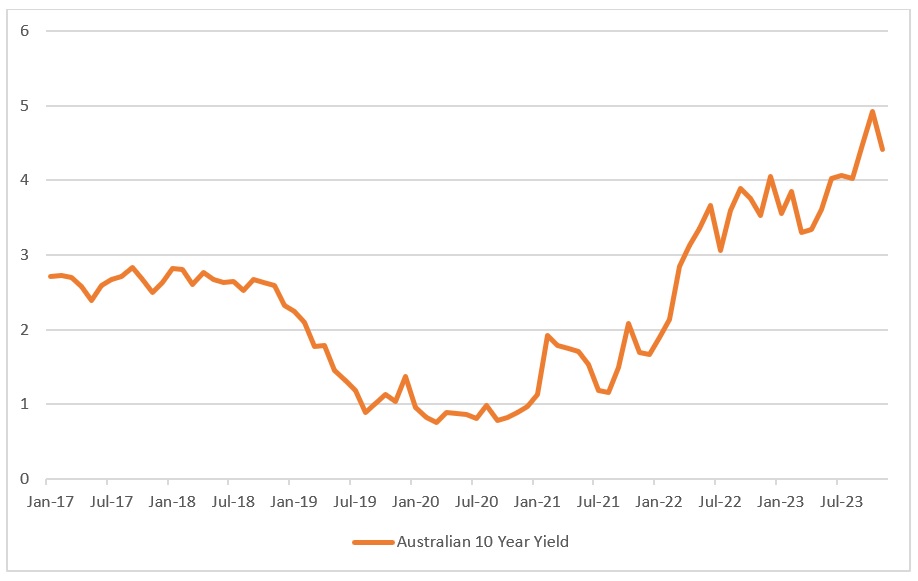

Info-07Last month we upgraded our preference for duration, making further purchases of Australian bonds. The change came just prior to the sharp decline in yields and has so far assisted absolute returns across portfolios.

The outlook for the Australian economy continues to look reasonable and we expect the RBA to be finished tightening policy this cycle. The downward surprises in the October monthly CPI (+4.9 per cent y/y) and retail sales data (-0.2 per cent m/m) support the case for the RBA to hold rates steady for the time-being at least. That said, we note that risks remain skewed towards the next move in policy being an increase rather than decrease.

With Australia’s terminal point looking likely to remain below the US and with the economy remaining reasonable we would also expect any cutting cycle here to commence later and be shallower than the US. Although we expect to have seen a peak in yields this cycle, the recent falls have been steep and there remains scope for them to push higher once more, particularly if economic data surprises to the upside.

Nonetheless, with yields remaining elevated and comparable to those available on the ASX 200, on a risk/reward basis we continue to favour fixed income across portfolios. We hold our position this month and remain mildly overweight Australian fixed income as a result.10-yr Australian Government Bond Yield (%)

Source: Bloomberg, ANZ CIO as at 30 November 2023

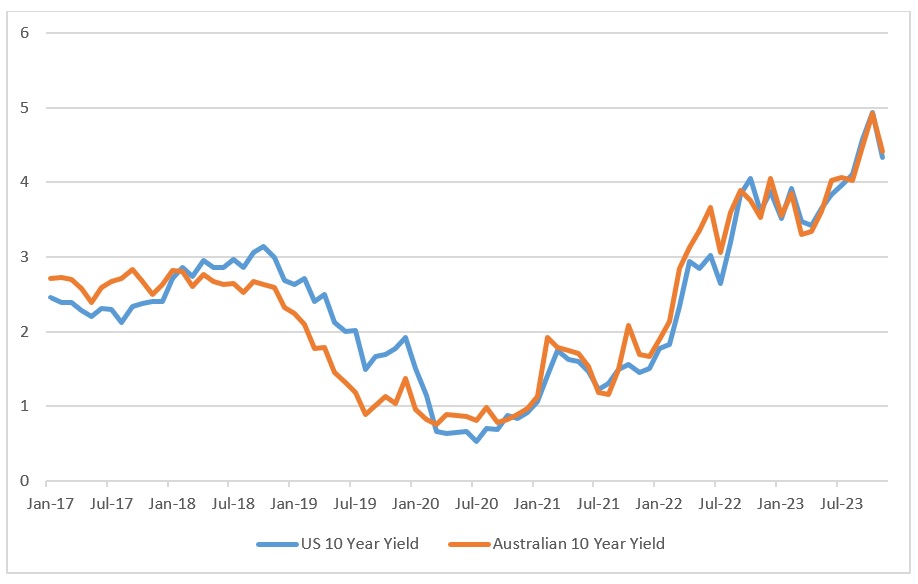

Info-08Global bond yields fell sharply over November alongside easing expectations for global monetary policy rates when the Fed stood pat at its November meeting and the US Treasury indicated it will slow the pace of bond auctions this quarter.

The decline in yields has been incredibly steep and could potentially be overdone should data not continue to deteriorate over the period ahead. Markets have started to bring forward to prospect of rate cuts into the first half of next year and we are inclined to think the Fed will want to be certain that inflation is on a more sustainable path back to target before any easing commences. Minutes from the November FOMC seem to corroborate this view.

While we have likely reached the peak level for yields this cycle, should inflation prove stubborn over the coming months there remains scope for yields to lift once more.

While any recession is expected to be shallow, weighing up current yield levels versus equity fundamentals and the broader macroeconomic backdrop we continue to favour the outlook for fixed income relative to equities over the medium-term.

Should the Fed hold rates too high for too long then risks for a deeper recession naturally increase. If this occurs, we expect duration to prove a good diversifier across multi-asset portfolios once more.

With the equity risk premium challenged, yields remaining at compelling levels, and the outlook unclear, we remain overweight global bonds this month.10-yr Australian Government vs. US Treasury 10-yr (%)

Source: Bloomberg, ANZ CIO as at 30 November 2023

Info-09Sentiment for the USD is expected to remain weak over the remainder of the year. The Fed appears finished with its hiking cycle, labour market data is softening and ISM gauges deteriorating. As we argued last month, this is likely to be the most important factor in the AUD making further ground on the USD before year-end.

And although October CPI and retail sales data also suggest the RBA is likely to remain on hold for the foreseeable future, there remains scope for further rate rises with recent rhetoric from Governor Bullock remaining hawkish, noting the issue of ‘home-grown inflation’.

The key factor weighing on the AUD continues to be the slowing growth in China. Recent PMIs suggest there could still be some further room for contraction.

Despite the potential for the AUD to move higher into year-end, with the global macro-outlook remaining uncertain we maintain a mild underweight to the AUD given the potential for it to provide effective insurance to global equity positioning in the event of a sudden shift in risk sentiment.The market has downgraded expectations for the cash rate target

Source: Bloomberg, Macrobond, ANZ Research as at 1 December 2023

-

-

Equity markets rose strongly over November as yields fell appreciably alongside expectations that central banks have reached the end of this tightening cycle. Although we noted the potential for this increase last month, owing primarily to seasonality and the solid sell-off from mid-July, the magnitude of the gains caught us somewhat by surprise.

We continue to see scope for shares to rally further into year-end with seasonality continuing to be a strong positive factor. Furthermore, while broader market positioning in equities has increased it remains relatively light (typically a contrarian indicator) and with central banks now likely on hold the backdrop for equities could be constructive in the months ahead.

However, while valuations had improved at the margin prior to the November rally, that was washed away over the course of only a few weeks as the S&P 500 rose by almost 10 per cent. Although the risk-free rate (10-year US Treasury yield) has declined over that period also, the required return hurdle for equities remains significant – particularly in the context of a deteriorating economic growth and softer labour markets. And with valuations high, prevailing recession risks and a belief that central banks may be over cautious in keeping monetary policy restrictive, the attractiveness of equities is diminished over the medium-term – particularly when considering the yields available on high quality fixed income assets.

Weighing up these factors we remain at benchmark to global developed market shares this month. -

Official Chinese PMIs declined for a second month in November, albeit modestly, with non-manufacturing weakening to 50.2 in November from 50.6 in October and manufacturing contracting further to 49.4 from 49.5 the month prior. This stood in contrast to the Caixin manufacturing purchasing managers' index released a day later that unexpectedly rose to 50.7 in November from a 49.5 reading in October.

Despite the disparity, and Q3 GDP that printed above expectations, the downward trend in PMIs suggests there may be further pressure and stimulus required for the Chinese economy – one that has failed to recover from the period of ‘zero-covid’ as quickly as some investors had hoped.

Countering this is the recent thawing in geopolitical tensions that can be viewed as positive – how long this will last will be a key question in the year ahead. Moreover, valuations remain relatively cheap with Chinese shares having endured significant underperformance to the broader equity market on a year-to-date basis.

We hold our benchmark position to emerging markets this month. With sentiment remaining downtrodden and performance underwhelming, seasonality and economic surprises could assist this segment of the market over the short-term. Moreover, broader emerging markets could also be a beneficiary of fading US dollar exceptionalism into year-end. -

The Australian market is at an interesting juncture. On the one hand the outlook for global growth remains weak and concerns surrounding China continue to simmer. On this basis and given the Australian market’s heavy reliance on Materials and Banks, there is an argument that the Australian market will continue to underperform over the short-to-medium term.

On the other hand, at the end of November, the Australian market sat more than 12 per cent behind the MSCI World Index (Hedged) over the year to date. On both a price-to-earnings and price-to-book basis, the market is cheap by historical standards versus the MSCI All Country World Index. Moreover, domestic EPS estimates for 2024 have been falling as opposed to rising across many other developed markets.

Within the domestic market, positioning in Materials is incredibly light and could benefit from upside surprises. Although the global growth outlook remains weak and demand for iron ore tepid, supply constraints should see the commodity price remain well supported throughout 2024.

We are far from bullish on the outlook and on a relative basis the segment remains our least preferred exposure across portfolios. However, based on cheap valuations, positive seasonality factors and the potential that a peak in policy rates has been reached we look for opportunities to modestly add to our position this month, with a view to taking the position to neutral, albeit modestly below benchmark across portfolios. -

The underperformance of listed real assets has been pronounced over 2023. This has been particularly acute within global real estate investment trusts (GREITs). On a 12-month basis, GREITs and listed infrastructure trail global share markets by more than 15 per cent.

We have held an underweight to listed infrastructure for most of 2023 and have been positioned between benchmark and mildly underweight GREITs over the same period. Both segments have suffered against the spectre of rising interest rates. As witnessed over November, a steep fall in yields has seen both segments stabilise, and with an expectation that the terminal level for interest rates has been reached across most of the globe we believe there is better scope for each to perform more positively over the coming period.

With valuations remaining relatively attractive, sentiment weak and a likely peak in the rate cycle being reached we have elected to take both positions back to benchmark this month.

Both strategies continue to provide a hedge to inflationary pressures, diversification characteristics and valuable income benefits for portfolios. -

The Q3 US earnings season provided the first quarter of year-over-year earnings growth in 12-months, and while earnings could remain supported over the next couple of quarters, with growth expected to slow we do look to the potential for some form of earnings slump over the first half of next year.

We continue to believe the Fed will keep rates elevated through the first half of next year and possibly beyond. If this coincides with disinflation, softer labour markets, deteriorating economic growth and a US consumer that comes under further duress, then we would expect pressure on corporates to build also.

With a significant amount of debt needing to be reissued out of the high yield market over the coming year there also remains a reasonable refinancing risk given the generally shorter duration of high yield versus investment grade credit.

In our view, spreads are likely to widen from here, even without pricing for a deeper recession. And while we continue to point to the likelihood of a relatively shallow recession, if the Fed and other central banks hold rates at these levels deep into next year then recession risks will rise accordingly.

Given these factors, we remain underweight global high yield this month, maintaining our preference for higher quality assets across portfolios in this late-cycle environment. -

Last month we upgraded our preference for duration, making further purchases of Australian bonds. The change came just prior to the sharp decline in yields and has so far assisted absolute returns across portfolios.

The outlook for the Australian economy continues to look reasonable and we expect the RBA to be finished tightening policy this cycle. The downward surprises in the October monthly CPI (+4.9 per cent y/y) and retail sales data (-0.2 per cent m/m) support the case for the RBA to hold rates steady for the time-being at least. That said, we note that risks remain skewed towards the next move in policy being an increase rather than decrease.

With Australia’s terminal point looking likely to remain below the US and with the economy remaining reasonable we would also expect any cutting cycle here to commence later and be shallower than the US. Although we expect to have seen a peak in yields this cycle, the recent falls have been steep and there remains scope for them to push higher once more, particularly if economic data surprises to the upside.

Nonetheless, with yields remaining elevated and comparable to those available on the ASX 200, on a risk/reward basis we continue to favour fixed income across portfolios. We hold our position this month and remain mildly overweight Australian fixed income as a result. -

Global bond yields fell sharply over November alongside easing expectations for global monetary policy rates when the Fed stood pat at its November meeting and the US Treasury indicated it will slow the pace of bond auctions this quarter.

The decline in yields has been incredibly steep and could potentially be overdone should data not continue to deteriorate over the period ahead. Markets have started to bring forward to prospect of rate cuts into the first half of next year and we are inclined to think the Fed will want to be certain that inflation is on a more sustainable path back to target before any easing commences. Minutes from the November FOMC seem to corroborate this view.

While we have likely reached the peak level for yields this cycle, should inflation prove stubborn over the coming months there remains scope for yields to lift once more.

While any recession is expected to be shallow, weighing up current yield levels versus equity fundamentals and the broader macroeconomic backdrop we continue to favour the outlook for fixed income relative to equities over the medium-term.

Should the Fed hold rates too high for too long then risks for a deeper recession naturally increase. If this occurs, we expect duration to prove a good diversifier across multi-asset portfolios once more.

With the equity risk premium challenged, yields remaining at compelling levels, and the outlook unclear, we remain overweight global bonds this month. -

Sentiment for the USD is expected to remain weak over the remainder of the year. The Fed appears finished with its hiking cycle, labour market data is softening and ISM gauges deteriorating. As we argued last month, this is likely to be the most important factor in the AUD making further ground on the USD before year-end.

And although October CPI and retail sales data also suggest the RBA is likely to remain on hold for the foreseeable future, there remains scope for further rate rises with recent rhetoric from Governor Bullock remaining hawkish, noting the issue of ‘home-grown inflation’.

The key factor weighing on the AUD continues to be the slowing growth in China. Recent PMIs suggest there could still be some further room for contraction.

Despite the potential for the AUD to move higher into year-end, with the global macro-outlook remaining uncertain we maintain a mild underweight to the AUD given the potential for it to provide effective insurance to global equity positioning in the event of a sudden shift in risk sentiment.

Buying your next home?

See our home loan tools, articles and resources to help you explore your home loan options. We'll help you get to a good place.