-

Estimated reading time

5 minLearn all about

- How investing in bonds work

- Three types of bonds you can buy

- The pros and cons of buying bonds

- Sunk cost fallacy and how it affects your decisions

Want a relatively stable method for growing your wealth? Then it’s worth considering investing in bonds.

In a nutshell, a bond is when you lend money to a company or government body, and you receive regular interest payments in return. Bonds are generally considered a lower-risk investment option as they provide financial security with interest payments typically made every six months. You also get the principal amount (the initial investment amount) back when the bond matures.Superscript: 1

Bonds can also be purchased from insurance providers, which acts more like a term deposit. You put in a lump sum that your insurance provider invests, and any earnings are added to your initial investment. If you leave your funds in the bond for a specified period (usually at least ten years), you may be able to cash out your investment without paying additional tax on your earnings.

With three different bonds to choose from, investing in the right one can help you grow your wealth steadily and put you on the path to being a savvy investor. If you’re ready to learn about all things bonds, then hop right in.

Remember, always do research before investing. Read the T&Cs and product information, find out more about the risks and benefits and consider any fees and charges. You might also want to consult an advisor and get independent financial and tax advice for your circumstances.

How does investing in bonds work?

When you buy a bond from a government body or corporation, you’ve got the option to pay either the:

- ‘offer price’, which is the lowest price the seller (a government body or corporation) is willing to accept from a buyer (you).

- ‘bid price’, which is the highest price you’re willing to buy the bond for.

Both prices will be determined by the market and things like interest rates and maturity (the end date of the bond set by the seller). All bonds also come with a ‘face value’, which is the amount you’ll get back from the seller when the bond reaches maturity.

If you decide to sell the bond before maturity, you’ll be paid the ‘market value’ – the value of the bond in the current market which is influenced by interest rates, the issuer’s credit risk, and when the bond was meant to be paid to you originally.

On top of this, all bonds will come with an interest rate (the ‘coupon rate’). This rate will either be fixed (it doesn’t change) or floating (it can change based on the economic climate) and will be paid to you every six months.

Types of bonds

In Australia, there are three types of bonds you can purchase: government, corporate and insurance.

1. Government bonds

- Exchange-traded Treasury Bonds (eTBs), which are fixed rate bonds.

- Exchange-traded Treasury Indexed Bonds (eTIBs), which is when the rate reflects inflation (also called the floating rate) and the consumer price index (a measurement of the change in price for goods and services).Superscript: 2

Governments in Australia – such as federal, state and territory – can sell bonds to investors.

If you buy a bond from the Australian Government, you’ll be purchasing an Australian Government Bond (AGB) and have a guaranteed rate of return if you hold the bond until maturity. There are two types of AGBs you can buy on the Australian Securities Exchange (ASX):

You can also purchase bonds from state or territory governments, but these are called Semi Government Bonds or ‘semis’. You’ll have to buy and sell these bonds through specific state and territory treasury corporations, rather than the ASX. A quick online search will point you in the right direction for your future investments.

2. Corporate bonds

You can buy a corporate bond from a business or organisation to support that company financially. Unlike government bonds, you’ll have the option to buy and sell your corporate bonds on the ASX or the over the counter (OTC) market. The OTC market is a platform where you can buy or sell bonds directly from the issuer, rather than through a centralised exchange like the ASX.

3. Insurance bonds

An insurance bond is a long-term investment option that is offered by insurance companies. This type of bond is where you pool your money with other investors and the money is invested based on the investment strategy that you choose. You can also top up your insurance bond to a certain amount each year (usually up to 125% of the previous year’s contribution amount) to help grow your wealth.

There are some tax benefits if you earn a high income, hold the investment for at least ten years, or meet certain conditions. It’s always worth investigating your options with the insurance bond provider.Superscript: 3

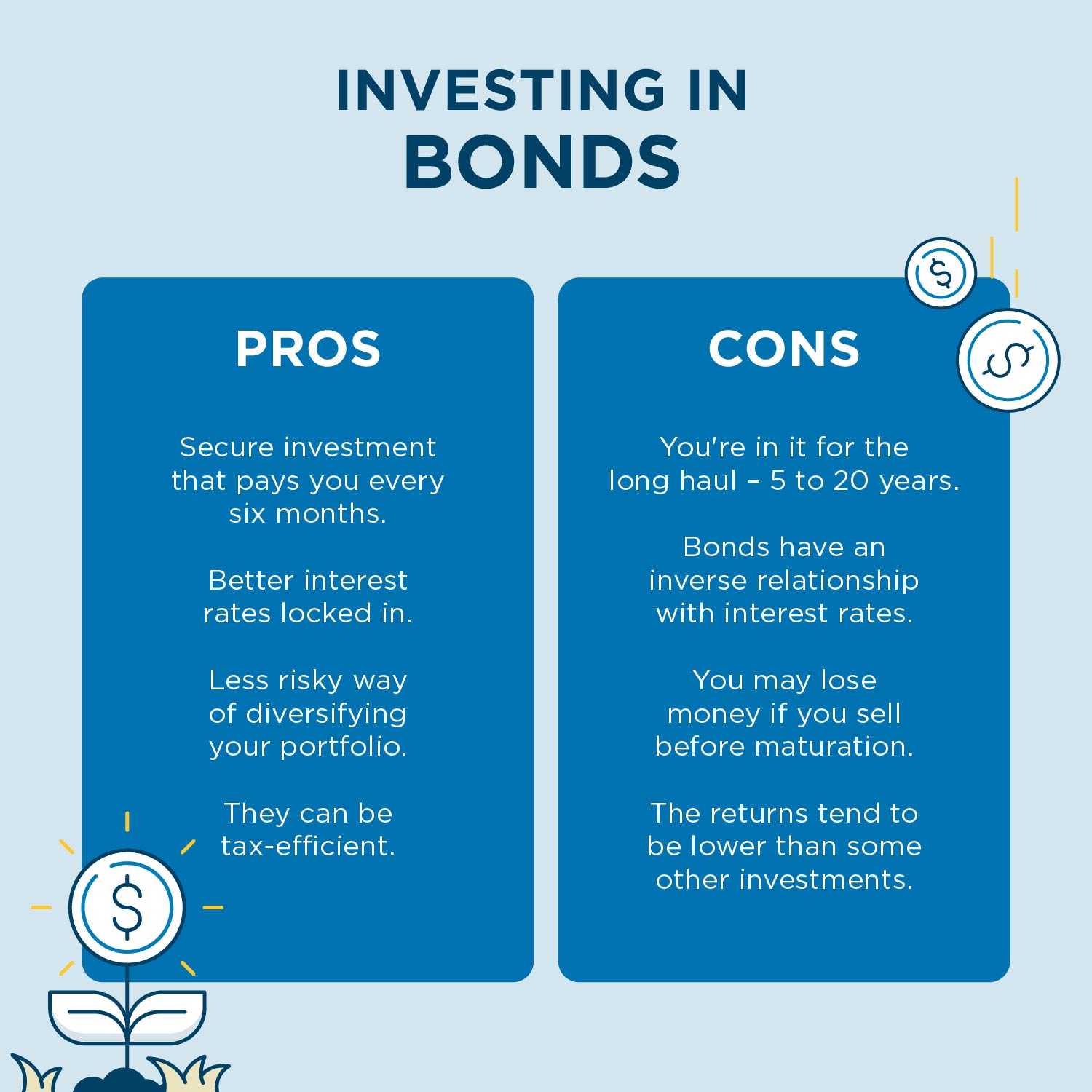

What are some of the pros and cons of investing in bonds?

- Pro: You’ll have a fairly secure investment that pays you every six months up until the bond’s maturity date.

- Con: When you buy a bond, you’re in it for the long haul. The maturity of a bond can start from as little as five years and go well beyond twenty years. This means you won’t be able to access the face value of your bond for a long time.

- Pro: If you get a better interest rate on your bond (which is locked in by the seller), this can help improve its overall performance in the long term.

- Con: Bonds have an inverse relationship with interest rates. So, if interest rates increase and you have a fixed-rate bond, your bond’s value will go down. This may cause you to lose money if you sell your fixed-rate bond before maturity.

- Pro: Bonds are a smart and less risky way of diversifying your investment portfolio.

- Con: The 125% rule mentioned above can limit your ability to add more to your bond. For example, if you add $1000 in one year and then nothing the next year, you’re no longer able to add money to that bond (because 125% of nothing is still nothing). This means it is often better for lump sums or consistent contributions.

Understanding sunk cost fallacy

After several years holding a government bond, you’ve had a light bulb moment – the returns aren’t nearly as high as you expected. But you’ve come this far on your bond investment journey and the maturity date of your bond isn’t far away. So, you might as well keep at it even if it’s not going to benefit you.

This pattern of thinking is what we call sunk cost fallacy, which is our tendency to keep investing time, money and effort into something after we’ve made the initial investment even if it won’t give us a good outcome.

If this feeling sneaks up on you when you’re considering your investment in bonds, focus on your current and future situation. Sure, you might not earn millions of dollars once your bond has reached maturity, but you will earn something, even if it’s not what you hoped it would be. If you’re still not satisfied with that possibility, consider what you can do now to put yourself in the best financial and investment position possible – like selling the bond if that’s the right move for you or diversifying your portfolio with other investments to spread the level of risk across multiple assets.

-

Buying your next home?

See our home loan tools, articles and resources to help you explore your home loan options. We'll help you get to a good place.