Buying your next home?

See our home loan tools, articles and resources to help you explore your home loan options. We'll help you get to a good place.

Buying your next home?

See our home loan tools, articles and resources to help you explore your home loan options. We'll help you get to a good place.

Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.

Enjoy 0% p.a. interestSuperscript: 1 on your credit card purchasesSuperscript: 2 over 3, 6 or 12 monthsSuperscript: 3

Achieve greater repayment flexibility with ANZ Instalment Plans. You can choose to repay your ANZ credit card purchasesSuperscript: 2 over 3, 6 or 12 months at 0% p.a. interest.Superscript: 1 Setup fee applies.

Approval, eligibility criteria and T&Cs apply.

ANZ Instalment Plans are available on eligible ANZ credit cards. Buy what you need now on your credit card and apply for an ANZ Instalment Plan on that purchase to get 0% p.a. interestSuperscript: 1 on your repayments over 3, 6 or 12 months.Superscript: 3 Bet that got your interest?

Approval, eligibility criteria, setup fee and T&Cs apply.

Just pay a one-time setup fee for an Instalment Plan on your purchase, which is payable over the period of your Instalment Plan.Superscript: 4

And keep winning! You’ll continue to earn ANZ Reward or Qantas Points on your existing credit card the same way you do now.Superscript: 5Superscript: 6

You can cancel your ANZ Instalment Plan at any time in the ANZ App and there are no cancellation fees.Superscript: 4

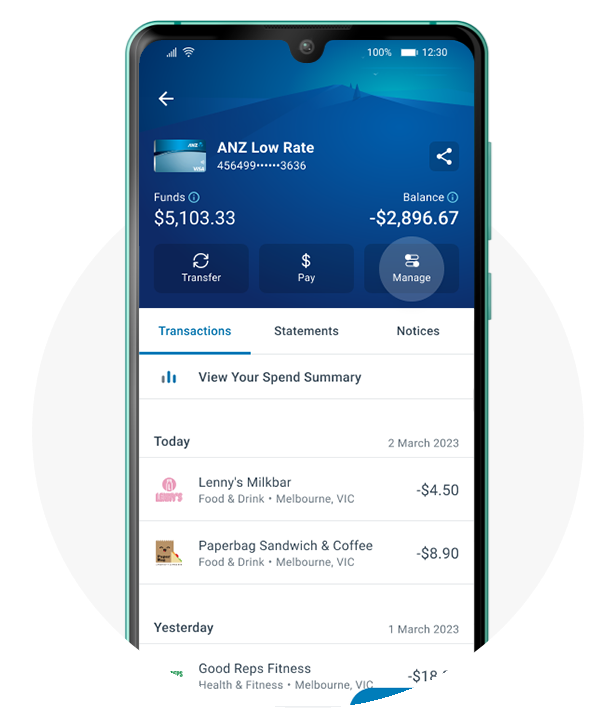

Select your credit card account,Superscript: 7 tap Manage and ANZ Instalment Plans, then follow the prompts.

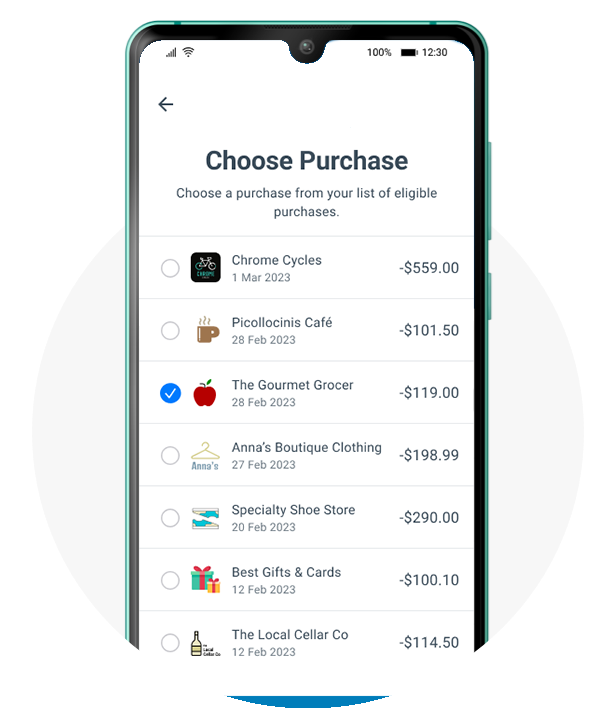

Choose an eligible purchase to put on an ANZ Instalment Plan.

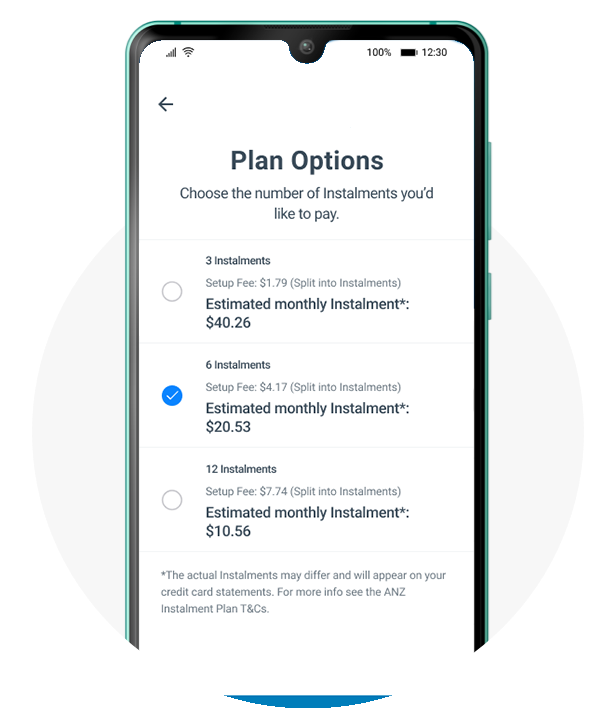

Choose from a 3, 6 or 12 month Instalment Plan. Review the Plan details and submit. Hey presto!

Applications are usually processed within two business days, and we’ll let you know if your Instalment Plan is approved. The Instalments will then form part of your Minimum Monthly Payments due on your credit card account, as indicated on your credit card statements.

For more information on ANZ Instalment Plans for a purchase, see the ANZ Instalment Plan Terms and Conditions (PDF). Approval, eligibility criteria and T&Cs apply.

3 month Instalment Plan |

1.5% of amount enrolled |

6 month Instalment Plan |

3.5% of amount enrolled |

12 month Instalment Plan |

6.5% of amount enrolled |

For example, if you bought a TV for $1,000 (incl GST) and enrolled it into a 3 month Instalment Plan for a purchase, you’d be charged a $15 Setup Fee payable over the term of the Plan, while enjoying 0% p.a. interest for the duration of the Plan.

That’s also possible. Apply for a 3, 6 or 12 month Instalment Plan on part of your balance and you could enjoy a lower interest rateSuperscript: 1 compared to the standard interest rate on purchases.Superscript: 8

Approval, eligibility criteria, T&Cs and charges apply.

ANZ Instalment Plans are a tool that eligible ANZ credit card customers can apply for in the ANZ App.

They can be used to pay off eligible purchases or some of your balance on an eligible ANZ Credit CardSuperscript: 7 via monthly Instalments.Superscript: 3 You can pay bit by bit.

If you are eligible to apply for a Plan you will see the option “ANZ Instalment Plans” in the “Manage” section of your credit card in the ANZ App.

From there, the steps to apply for a Plan are simple:Superscript: 9

While we’d love to make this promotion available for all customers, not everyone meets eligibility criteria all the time. If you can’t see “ANZ Instalment Plans” in the ANZ App this may be because your account currently doesn’t meet the applicable eligibility criteria to apply for a Plan or because you may not be on the latest version of the ANZ App.

You will be prompted to enter an eligible amount from your Purchases balance or an eligible purchase which you can apply to enrol in an ANZ Instalment Plan in the ANZ App and then select the number of Instalments that best suits you.Superscript: 3

It is possible to have more than one ANZ Instalment Plan on an account at a time. A separate Plan is created each time we accept your request to enrol some of your balance or a selected purchase in an ANZ Instalment Plan. You can have up to 99 active ANZ Instalment Plans at any one time.

ANZ Instalment Plans are like Buy Now Pay Later services in that they allow you to buy now, repay later. The key difference between BNPL and Instalment Plans is that full amount of the purchase plus the setup fee is deducted from your ANZ credit card upfront, which you can repay over 3, 6 or 12 months.

Here are some other differences:

We’d be happy to discuss why you couldn’t set up an ANZ Instalment Plan on this occasion. Give us a call on 1800 269 484.

If your application to set up an ANZ Instalment Plan is approved, we may send you a confirmation document with information about your Plan. Please ensure that your contact details (including your email address) is valid and up to date. Once your Plan is active, it will display in your ANZ App. Information about your Plan will also be displayed on your credit card statement.

You can cancel the Plan at any time via the ANZ App or just give us a call on 1800 269 484 – we’re here to help.

Please note that if an Instalment Plan ends or expires early,Superscript: 6 the remaining unpaid balance for that Plan will be transferred back to the Purchases balance of your Credit Card Account. You may be charged interest on the outstanding ANZ Instalment Plan balance at the standard purchases interest rateSuperscript: 8 once it has been transferred to your Purchases balance.

You can cancel the Plan at any time via the ANZ App or just give us a call on 1800 269 484 – we’re here to help.

ANZ will refund the Setup Fee in the form of a credit to your Credit Card Account if we receive your request to cancel the Plan within 7 days of your ANZ Instalment Plan becoming active (being when the Plan is accepted by ANZ). The Setup Fee will be credited to your Credit Card Account within two ANZ Business Days of receiving your cancellation request.

Please note that if an Instalment Plan ends or expires early,Superscript: 6 the remaining unpaid balance for that Plan will be transferred back to the Purchases balance of your Credit Card Account. You may be charged interest on the outstanding ANZ Instalment Plan balance at the standard purchases interest rateSuperscript: 8 once it has been transferred to your Purchases balance.

To be eligible for an ANZ Instalment Plan, some of the criteria you need to meet includes:

If you have questions about your eligibility, you can give us a call on 1800 269 484.

A Setup Fee applies when you enrol an eligible purchase into an ANZ Instalment Plan. However, a Setup Fee will not apply when you enrol some or all of your Purchases balance into an ANZ Instalment Plan.

You can find information about the rates, fees, and charges that would relate to a particular Plan (if approved) on the “Confirm details” screen in the ANZ App. Once a Plan is approved by ANZ you’ll also be sent a confirmation email with details and can refer to your statements of account.

A Setup FeeSuperscript: 11 applies when you enrol an eligible purchase onto an ANZ Instalment Plan and is an Instalment Plan Fee which is calculated as a percentage of the eligible purchase amount.

The Setup Fee is added to the amount that’s enrolled in the Plan which is payable over the number of Instalments you select and forms part of your Minimum Monthly Payments.

If a Setup Fee applies to your Plan, you can see details of the amount of this Fee in the "Confirm details" section of the ANZ App, and once a Plan is approved by ANZ the amount of any Setup Fee that applies will be shown on your statements of account.

A Plan interest rateSuperscript: 1 is the discounted variable purchases interest rate that applies to your ANZ Instalment Plan balance when you enrol some or all of your Purchases balance onto a Plan.

You can see the Plan interest rate that would apply to a particular Plan (if approved) in the “Confirm details” section of the ANZ App.

The Instalments you choose will form part of the Minimum Monthly Payments due on your credit card, which you pay off monthly as part of your credit card payments.

Just a heads up though:

Your monthly Instalments form part of the ‘Minimum Monthly Payment’ amount which you’ll see on your credit card statements whilst the Plan is active. You’ll need to pay at least this amount to meet your Plan payments (plus any 'Payable Immediately’ amounts) shown on your statements. Of course, you can also choose to pay more.

You’ll find details of the Instalments, Minimum Monthly Payments, amounts owing and Due Dates in your statements of account. You can also check details of your active Plans in the ANZ App.

An important thing to be aware of is that your Minimum Monthly Payments will be higher while an ANZ Instalment Plan applies to your account. That's because the Instalments form part of the Minimum Monthly Payments that are due.

At the bottom of your statements you’ll find a section called ‘Accepted Promotions’. That’s where you’ll see your Instalment Plan details.

You’ll need to check your statement for the Adjusted Closing Balance first. Then select ‘Pay Other Amount’ in the ANZ App and input your Adjusted Closing Balance as the amount to be paid.

Instalments will form part of the ‘Minimum Monthly Payment’ that’s due on your credit card account.

You’ll need to continue to pay at least this amount (plus any 'Payable Immediately’ amounts) shown on your statements.

Your Minimum Monthly Payments will be higher while you have an ANZ Instalment Plan applied to your account. That's because your Minimum Monthly Payments will include any Instalments that are due.

The first Instalment for a particular Plan will be due on the Due Date of the first statement you receive after an amount is successfully enrolled in that Plan.

The remaining Instalments are due on each of the following statement period Due Dates.

You can find information about your Instalments and when payments are due on an Instalment Plan on your statements of account.

Yes. The payments you make to your credit card account whilst you have an ANZ Instalment Plan will be applied differently.

You can learn more about how your payments are applied by reading the ANZ Instalment Plan Terms and Conditions (PDF). Something to note is that when a payment is processed to your account whilst an ANZ Instalment Plan applies to your account, the payment will be applied to pay off your ANZ Instalment Plan Instalments which are due first, and not the balance with the highest interest rate. That means you might pay more interest than if your payments did go to the balance with the highest interest rate. You could end up paying more interest by applying payments in this way, than you would have if the payments had been applied to the highest balance first.

You can withdraw your request to apply payments in this way at any time by calling us on 1800 269 484 and requesting this.Superscript: 9 If you do, ANZ will cancel your ANZ Instalment Plan and interest may apply to any remaining ANZ Instalment Plan balance at the standard purchases interest rateSuperscript: 8 that applies to your account.Superscript: 6

So that’s an easy answer. You’ll see an ‘Adjusted Closing Balance’ on your statement. If you are currently eligible for Interest Free Days on your purchases balance, make sure you pay at least the ‘Adjusted Closing Balance’ on each statement if you want to keep enjoying your Interest Free Days.

It’s important to note, Interest Free Days do not apply to Instalment Plan amounts.

If you don’t currently have the benefit of Interest Free Days on purchases applying to your account, and your account is eligible for this benefit, you can regain the benefit:

See the ANZ Credit Card Conditions of Use (PDF) for more information.

If you have CardPay Direct set up on your account, it continues to operate whilst you have Instalments due.

Here’s how it works depending on how you have CardPay Direct set up:

If CardPay Direct is set up to pay the full Closing BalanceSuperscript: 12 each month: CardPay Direct will debit the ‘Adjusted Closing Balance’ (rather than the full ‘Closing Balance’) in accordance with the CardPay Direct terms.

If CardPay Direct is set up to pay the Minimum Monthly Payment: CardPay Direct will continue to debit this amount plus any 'Payable Immediately’ amounts in accordance with the CardPay Direct terms. If an Instalment is due under the Plan it will form part of the ‘Minimum Monthly Payment’ amount.

If you’ve selected the ‘set monthly amount’ option when you set up CardPay Direct:

If you have selected the ‘set monthly amount’ option and you only have a Promotional Plan balance (like an ANZ Instalment Plan balance) owing on your account at the time the CardPay Direct Payment is processed, CardPay Direct may only debit the Minimum Monthly Payment (plus any 'Payable Immediately’ amounts) due rather than the set amount.

If you wish to make an extra payment you can do so by making a manual payment to your account after the Due Date when that CardPay Direct Payment is credited to your account and before the end of the relevant statement period.

If you have selected the ‘set monthly amount’ option and you have more than a Promotional Plan balance owing on your account, CardPay Direct may debit the greater of the set amount or the Minimum Monthly Payment as shown on your relevant statement, (plus any 'Payable Immediately’ amounts).

Well, the Instalment will become a 'Payable Immediately’ amount and you may be charged a Late Payment Fee, as explained in your Credit Card Contract.

If you don’t meet your Credit Card Contract obligations, such as not paying the Minimum Monthly Payments shown on a statement, the ANZ Instalment Plan(s) on the account at that time may be cancelled by ANZ.

No, you need to pay the difference between the Closing Balance and the amount you enrolled into an ANZ Instalment Plan by the Due Date on your recent statement. Otherwise, you may pay off your Instalment Plan early.

Yes, you may be charged interest on that balance at the standard purchases interest rateSuperscript: 8 that applies to your account if an ANZ Instalment Plan expires or is ended early.Superscript: 6 You can learn more about what happens when your Plan ends early in the ANZ Instalment Plan Terms and Conditions (PDF). The date it is effective will be reflected on your statement of account in the statement period in which the cancellation or end is processed by ANZ.

Quick tip: You can generally avoid paying interest on your Purchases balance if you pay the ‘Closing Balance’ or ‘Adjusted Closing Balance’ (as applicable) in full by the Due Date shown on each statement of account.

You can cancel your ANZ Instalment Plan at any time in the ANZ App or by giving us a call on 1800 269 484.

When a cancellation is processed, the outstanding ANZ Instalment Plan balance will be moved to your Purchases balance and may start to attract interest at the standard purchases interest rateSuperscript: 8 applicable to that account.Superscript: 6

The cancellation or ending of a Plan may not be effective immediately and will depend on factors including the day or time when the event triggering the early end of the Plan or when the cancellation request is made and how it is made.Superscript: 6 The date it is effective will be reflected on your statement of account in the statement period in which the cancellation or end is processed by ANZ.

You can learn more about this in the ANZ Instalment Plan Terms and Conditions (PDF).

ANZ does not charge a fee for cancelling a Plan. However, if interest has accrued on the balance enrolled on the Plan, it will not be refunded and will transfer to the Purchases balance on the relevant Credit Card Account.

This means that you may be charged interest at the standard purchases interest rateSuperscript: 8 that applies to your account on any unpaid amount that has been part of an ANZ Instalment Plan balance if that Plan ends or expires early.Superscript: 6

For more info see the ANZ Instalment Plan Terms and Conditions (PDF).

When a Setup Fee applies to your ANZ Instalment Plan, we will refund the Setup Fee in the form of a credit to your Credit Card Account if we receive your request to cancel the Plan within 7 days of your ANZ Instalment Plan becoming active (being when the Plan is accepted by ANZ). The Setup Fee will be credited to your Credit Card Account within two ANZ Business Days of receiving your cancellation request.

Applications for credit are subject to ANZ’s credit approval criteria. Terms and conditions, and fees and charges apply to your credit card.

Terms and Conditions and eligibility criteria apply to ANZ Instalment Plans. Read the ANZ Instalment Plan Terms and Conditions (PDF) and if approved, your confirmation communication for details. You can refer to your statements of account for information about the interest rate, fees, and/or charges that relate to a particular ANZ Instalment Plan.

The ANZ App is provided by Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522. Super and Insurance (if available) are not provided by ANZ but entities which are not banks. ANZ does not guarantee them. This information is general in nature only and does not take into account your personal objectives, financial situation or needs. ANZ recommends that you read the ANZ App Terms and Conditions available here for iOS (PDF) and here for Android (PDF) and consider if this service is appropriate to you prior to making a decision to acquire or use the ANZ App.

ANZ App for Android is only available on Google Play™. ANZ App for iPhone is only available from the App Store.

Apple, Apple Pay, Apple Watch, Face ID, iPad, iPhone and Touch ID are trade marks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android, Google Play and the Google Play logo are trade marks of Google Inc.

1. A Plan interest rate is a discounted purchase interest rate that applies to an ANZ Instalment Plan balance if and while it’s enrolled in a Plan. For more information, see the ANZ Instalment Plan T&Cs (PDF).

Return2. Approval, eligibility criteria, T&Cs and Setup Fee applies.

Return3. T&Cs and eligibility criteria apply. Fees and charges may apply.

Return4. ANZ Reward Points are earned and redeemed in accordance with the ANZ Rewards – Rewards Program Terms and Conditions booklet (PDF). Certain transactions and other items are not eligible to earn Reward Points, for details refer to the ANZ Rewards – Rewards Program Terms and Conditions booklet (PDF).

Return5. Qantas Points and Bonus Qantas Points are earned and redeemed in accordance with the ANZ Frequent Flyer Reward Terms and Conditions booklet (PDF) (please call 13 13 14 for a copy). Certain transactions and other items are not eligible to earn Qantas Points, for details refer to the ANZ Frequent Flyer Reward Terms and Conditions booklet (PDF). Account Holder must be a member of the Qantas Frequent Flyer program to earn and redeem Qantas Points. A joining fee may apply. Membership of the Qantas Frequent Flyer program is subject to the Terms and Conditions of the Qantas Frequent Flyer program. Earn rates and earn rate bands are subject to change. Existing customers should call 13 13 14 for information regarding their account. For details on using your Qantas Points please refer to the Qantas website.

Return6. T&Cs apply to ANZ Instalment Plan cancellation. See the ANZ Instalment Plan T&Cs (PDF) for further info. When a cancellation is processed, the outstanding ANZ Instalment Plan balance will be moved to the Purchases balance on your Credit Card Account and may start to attract interest at the standard variable annual percentage interest rate on purchases applicable to that account. Refer to your Credit Card Contract and your statement of account for details of the rate(s) that apply to your Purchases balance. Interest rates are subject to change. If a Setup Fee applies to your ANZ Instalment Plan, ANZ will refund the Setup Fee within two ANZ Business Days of receiving your cancellation request, by crediting the Setup Fee to your Credit Card Account in accordance with the ANZ Credit Cards Conditions of Use (PDF), provided ANZ receives your request to cancel the Plan within 7 days of your ANZ Instalment Plan becoming active (being when the Plan is accepted by ANZ).

Return7. Not all ANZ credit card accounts are eligible to apply to enrol an Amount in an ANZ Instalment Plan. If you are eligible to apply for a Plan you will see the option “ANZ Instalment Plans” in the “Manage” section of your credit card in the ANZ App.

Return8. Standard variable annual percentage interest rate on purchases for ANZ Low Rate is , for ANZ Rewards Classic, for ANZ Rewards Platinum, for ANZ Rewards Black, for ANZ Frequent Flyer, for ANZ Frequent Flyer Platinum and for ANZ Frequent Flyer Black. Rates are subject to change. Refer to your statement of account for details of the rate(s) that apply to your account.

Return9. T&Cs apply. You can learn more about the ANZ Instalment Plan T&Cs (PDF) here.

Return10. ANZ Falcon is a trademark of Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522. Falcon is a trademark of Fair Isaac Corporation.

Return11. The Setup Fee (if applicable) is an Instalment Plan Fee and will be calculated as a percentage of the Amount that’s enrolled in the ANZ Instalment Plan at the time the balance is enrolled.

Return12. Excluding any repayments on Promotional Plans not yet due.

Return