-

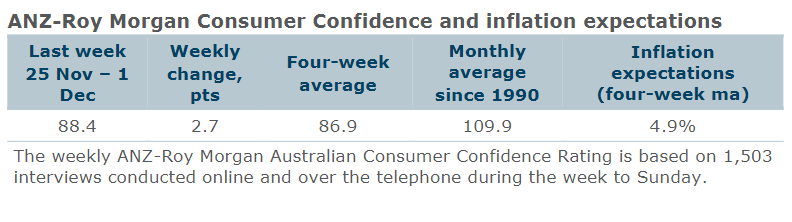

Consumer confidence rose 2.7 points last week to 88.4 points. The four-week moving average increased 0.5 points to 86.9 points.

‘Weekly inflation expectations’ fell 0.2 percentage point to 4.8 per cent, while the four-week moving average rose from 4.8 per cent to 4.9 per cent.

‘Current financial conditions’(over the last year) increased 0.9 points and ‘future financial conditions’ (next 12 months) jumped by 4.0 points.

‘Short-term economic confidence’ (next 12 months) declined 0.8 points, while ‘medium-term economic confidence’ (next five years) rose 1.8 points.

The ‘time to buy a major household item’ subindex increased 7.5 points.

“Consumer Confidence increased 2.7 points last week to 88.4 points, its highest level since May 2022,” ANZ Economist, Sophia Angala said.

“The rise in confidence was seen across most subindices. Households’ economic outlook over the next year declined 0.8 points but is still within the narrow range of 77-83 points since October.

“The ‘time to buy a major household item’ subindex ticked up 7.5 points as Black Friday related sales continued. This represented the subindex’s largest weekly rise since Black Friday sales in 2023, to its highest level since May 2022.

“Weekly inflation expectations dropped 0.2 percentage point to 4.8 per cent last week, a pullback from the rise to 5.0 per cent the week prior.

“This comes after the monthly Consumer Price Index (CPI) indicator showed headline inflation was 2.1 per cent in October, well within the Reserve Bank of Australia’s 2-3 per cent target band. Though we should note that the components measured in the October monthly CPI indicator are skewed away from the main categories causing inflation.”

Media contact

Judy Hang

+61 479 173 821

anzcomau:newsroom/mediacentre/ANZ-Roy-Morgan-Consumer-Confidence

Consumer confidence at a 30 month high

2024-12-03

/content/dam/anzcomau/mediacentre/images/consumerconfidence/ImagesTiles/colourful clothes.jpg