Fraud protection.

Now it's personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Issac Corporation.

Fraud protection.

Now it's personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Issac Corporation.

Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.

Is managing cash flow keeping you up at night? Do you have an opportunity to purchase more stock or hire more staff right now?

We have short term, flexible and fast cash flow options for you.

Get the flexibility to easily draw money as you need it, up to your agreed limit.

Apply online in 20 minutes through an encrypted, one-time connection to your accounting software. No application paperwork or need to visit a branch.

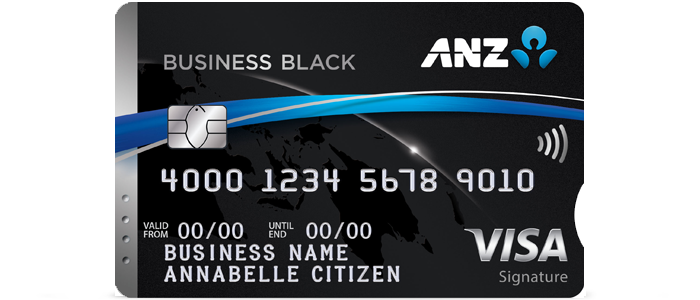

Waiting for your customers to pay you? Enjoy up to 55 interest free days on eligible purchasesdisclaimerwith our ANZ Qantas Business Rewards, ANZ Business Black and ANZ Business 55 Interest Free Days cards.

Need to pay suppliers on the spot? Pay instantly with contactless payments.

Watch the video and learn how Vanessa the café owner gets on top of her cash flow and business admin using her ANZ business credit card.

Earn 100,000 bonus Qantas Points when you spend $6,000 on eligible purchases in the first 3 months from approval of your new card.

Plus earn 50,000 bonus Qantas Points when you keep the card for over 15 months.disclaimer

Earn 100,000 extra Business Reward Points when you spend $6,000 on eligible purchases in the first 3 months from approval.

Plus earn 50,000 extra Business Reward Points when you keep the card for over 15 months.disclaimer

Save $150 with no Annual Feedisclaimer for the first year on a new card.

ANZ Vehicle and Equipment Finance offers flexible repayment options and can help reduce the impact on your day-to-day cash flow.

Effectively manage your cash flow and feel in control with our handy forecast template.

Cash flow forecast template (xlsx)

Improve your cash flow and draw up an action plan with our comprehensive tips.

Cash flow improvement checklist (PDF 1.5MB)

This checklist will help you understand the current cash flow position of your business and prepare for the 'new normal'.

Business cash flow checklist (PDF)

Running a business smoothly means managing cash flow effectively. Cash flow simply means a change in your business cash balance (cash balance being the closing balance in your business for a given period of time). Cash flow lets you understand and assess cash that comes into your business and flows out in a period of time.

Positive cash flow means that at a given time period there's more money going into your business than what's coming out. Imagine there's $20,000 in your business account at the start of a month. If your account ends with $30,000 for the same month, your cash flow is positive $10,000.

Negative cash flow, on the other hand, is the reverse - when there's more money coming out of your account than what's going in for a given time period.

Cash flow forecasting can help in protecting your business before any cash emergency happens. There are many ways in which you could do a cash flow plan. Download and use our handy cash flow forecast template to effectively manage, improve and feel in control of your cash flow.

A cash flow statement can help you see all the cash inflows and outflows for your business over a period of time. A cash flow statement can let you reconcile your business balance sheet with your income statement.

As a small business owner, it's imperative to be on top of your cash flow. Follow these golden rules for good cash flow management:

You can also download our cash flow improvements checklist to draw up your cash flow action plan.

Yes, you do. But don't worry as you can open one when you apply for a business overdraft. You can then use your transaction account to access money via ANZ Internet Banking, ANZ Phone Banking, ANZ ATMs, the ANZ app and our branches.

While both business overdrafts and loans involve borrowing money, they’re set up differently to meet different needs. A business loan is a long-term liability and can suit capital purchases like property or system upgrades. See more about business loans. Overdrafts, on the other hand, are flexible short-term cash flow solutions that can help with the ups and downs of business like paying an unexpected bill.

Want to discuss new or existing ANZ business banking or need help with general enquiries?

Mon-Fri 8am to 6pm (AEST)

Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider whether it is appropriate for you.

ANZ recommends you read the applicable Terms and Conditions and the ANZ Financial Services Guide (PDF) before acquiring the product.

Interest free days do not apply if you do not pay your Closing Balance in full by the due date each month. Payments to your account are applied in the order set out in the ANZ Commercial Card (ANZ Business One) Terms and Conditions (PDF).

ReturnQantas Points and Bonus Qantas Points are earned in accordance with the ANZ Qantas Business Rewards Terms & Conditions. Certain transactions and other items are not eligible to earn Qantas Points, for details refer to the ANZ Qantas Business Rewards Terms & Conditions. The Principal must be a member of the Qantas Business Rewards Program to earn Qantas Points in connection with the ANZ Qantas Business Rewards Card. All Qantas Points earned on eligible Card spend will be awarded to the Principal. Points will not be awarded to individual Cardholders.

ReturnOffer available to new and approved applicants who apply for a new ANZ Qantas Business Rewards account. ANZ may terminate, withdraw or vary this offer at any time without prior notice. This offer applies only once per new ANZ Qantas Business Rewards account. Offer is not available when transferring from an existing ANZ Business credit card account and/or adding an additional account to an existing ANZ Business credit card contract. You are not eligible for this offer if you currently hold or have held an ANZ Qantas Business Rewards and/or ANZ Business Black account in the last 12 months. Your application must be approved, and you must activate your ANZ Qantas Business Rewards account and make $6,000 worth of eligible purchases within 3 months of approval to receive the 100,000 bonus Qantas Points. Eligible purchases means purchases which are eligible to earn Qantas Points. Certain transactions and other items are not eligible to earn Qantas Points. For details refer to the ANZ Qantas Business Rewards Terms & Conditions (PDF). The 100,000 bonus Qantas Points will be credited to the Qantas Business Rewards member account within 3 months of the eligible spend criteria being met. The 50,000 bonus Qantas Points for retaining the card over 15 months will be credited to the Qantas Business Rewards member account within 3 months of you retaining the card for over 15 months from card activation. If you transfer or cancel your new ANZ Qantas Business Rewards account before the bonus Qantas Points are processed to your Qantas Business Rewards member account, you may become ineligible for this offer. If any repayments are overdue before the bonus Qantas Points are processed to your membership, you will be ineligible for this offer until any overdue amount and amounts shown on your statement as being payable immediately have been paid.

ReturnReward Points and Bonus Reward Points accrue in accordance with the ANZ Business Rewards Program Terms and Conditions (PDF). Certain transactions and other items are not eligible to earn Reward Points. For details refer to the Business Rewards Program Terms and Conditions (PDF).

ReturnOffer available to new and approved applicants who apply for a new ANZ Business Black account. ANZ may terminate, withdraw or vary this offer at any time without prior notice. This offer applies only once per new ANZ Business Black account. Offer is not available when transferring from an existing ANZ Business credit card account and/or adding additional account to an existing ANZ Business credit card contract. You are not eligible for this offer if you currently hold or have held an ANZ Qantas Business Rewards and/or ANZ Business Black account in the last 12 months. Your application must be approved, and you must activate your ANZ Business Black account and make $6,000 worth of eligible purchases within 3 months of approval to receive the 100,000 extra Reward Points. Eligible purchases means purchases which are eligible to earn Reward Points. Certain transactions and other items are not eligible to earn Reward Points. For details refer to the ANZ Business Rewards Program Terms and Conditions (PDF). The 100,000 extra Reward Points will be credited to the Principal within 3 months of the eligible spend criteria being met. The 50,000 extra Rewards Points for retaining the card for over 15 months will be credited to the Principal within 3 months of you retaining the card for over 15 months from card activation. If you transfer or cancel your new ANZ Business Black account before the extra Reward Points are processed to your account, you may become ineligible for this offer. If any repayments are overdue before the relevant extra Reward points are processed to your account, you will be ineligible for this offer until any overdue amount and amounts shown on your statement as being payable immediately have been paid.

ReturnOffer available to new and approved applicants who apply for a new ANZ Business 55 Interest Free Days and/or ANZ Business Low Rate credit card account. ANZ may terminate or withdraw this offer at any time without prior notice. The Annual Fee offer applies only once per new ANZ Business 55 Interest Free Days and/or ANZ Business Low Rate credit card account. Offer is not available when transferring from an existing ANZ Business credit card account. The Annual Fee waiver is applicable for one year subsequent to the date you accept the ANZ Commercial Card (ANZ Business One) Terms and Conditions (PDF) in respect of the new ANZ Business 55 Interest Free Days and/or ANZ Business Low Rate credit card account. In subsequent years the Annual Fee (currently $150 for an ANZ Business 55 Interest Free Days account and $100 for an ANZ Business Low Rate account but is subject to change) will apply.

Return