-

Growth in national house prices will be slower this year as price growth slows in major markets like Sydney and Melbourne.

We expect capital city housing prices to rise 6-7 per cent this year, slowing to 5-6 per cent in 2025 as population growth slows alongside an increase in available housing.

"Demand is still outpacing supply nationally. Residential construction activity is at very low levels despite strong demand, with population growth remaining elevated.”

We expect a further increase of about 5 per cent in 2026.

{CF_IMAGE}

Property market indicators are mixed, nationally. Total listings and vendor discounts are declining but the median time on the market has picked up alongside a pick-up in monthly price increases. Auction clearance rates have dropped so far in 2024, which suggests weaker near-term price growth.

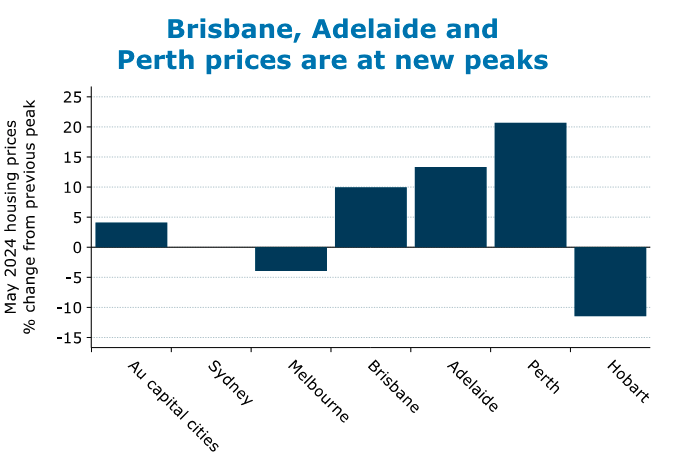

Brisbane, Perth and Adelaide are likely to outperform other cities due to the possibility of a longer-running shortage of available homes. Housing prices continue to reach new peaks in these cities, with strong growth in lending to investors in these cities supporting price growth.

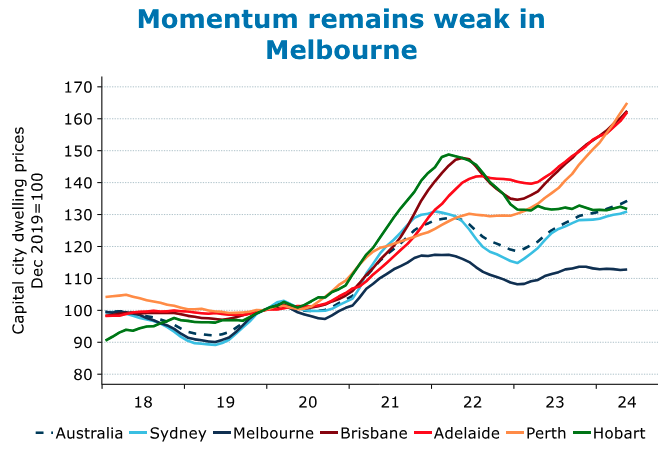

Price momentum is weaker in Melbourne, where housing construction relative to population growth appears to have been the strongest since the onset of COVID.

An expected lift in household disposable incomes (helped first by fiscal policy) will support prices from late 2024 onwards.

Demand and supply imbalances

Demand is still outpacing supply nationally. Residential construction activity is at very low levels despite strong demand, with population growth remaining elevated. Although this varies across the country.

Since the beginning of the COVID-19 pandemic the growth in the population of Western Australia and Queensland has been faster than the growth in the estimated dwelling stock, increasing any relative supply and demand imbalance that existed in 2020 and putting upwards pressure on housing prices.

Victoria’s dwelling stock has, we estimate, grown faster than the state’s population since early 2020 and faster than other state/territory, except the Australian Capital Territory.

This is putting less pressure on housing prices to increase in Victoria. The growth in New South Wales’s estimated dwelling stock has also outpaced population growth but to a lesser extent.

A decline in the average size of households, relative to pre-COVID, is adding to the demand and supply imbalance. The average size of households across Australia barely changed in 2023, at 2.49 people per household, 0.03 people below the level in 2019.

With Australia’s population around 27 million, this difference in household size roughly equals demand for an additional 130,000 dwellings.

Market listings and clearance rates

Total listings are at their lowest since 2009, despite a pick-up in new listings and an increase in median time on the market. Median time on the market remains below levels seen in the decade before COVID.

Vendor discounting, which increased between October and December, has started declining again.

Nationally, auction clearance rates have eased a little in recent months. Clearance rates have dropped in Sydney and Melbourne over 2024 so far but have continued increasing from their 2023 lows in Perth, Brisbane and Adelaide.

The relationship between clearance rates and annual price growth suggests price growth in Melbourne may slow in the near term but continue accelerating in the smaller capitals. Total listings continue to trend down in Brisbane, Perth and Adelaide.

{CF_IMAGE}

This is consistent with our forecasts for stronger price growth in these cities due to the relative lack of availability of homes for sale.

The subdued level of building approvals and dwelling construction is unlikely to boost new listings in the near term.

Lending rates

The average first-home-buyer loan size, which had been increasing since a COVID-related dip, has changed little this year. Although, the average first-home-buyer loan is now 6.7 per cent higher than in January 2022.

Other owner-occupier and investor loan sizes have grown over the second half of 2023 and early 2024 following earlier declines driven by increases in interest rates.

Total lending is still growing, with average loan sizes increasing; but subdued sales volumes growth is likely to limit lending growth in the near term.

Persistently low vacancy rates are likely to see rents continue to grow quickly for some time, but the pace of growth has eased over the past year. Higher rents are likely to continue attracting investors.

As with prices, momentum in lending has been strongest in Western Australia and Queensland. Although, lending in New South Wales has grown quickly in 2024 so far.

{CF_IMAGE}

{CF_IMAGE}

This has been driven more by investors than owner occupiers over the last year. Only Victoria has seen faster growth in owner occupier lending than investors, perhaps due to higher vacancy rates and new investor taxes.

Refinancings and building approvals

External refinancing has declined notably since peaking in 2023. This reflects reduced competition amongst banks to win new customers. It is also likely there are fewer borrowers seeking to refinance to lower rates, with rates little changed over the last six months.

Smaller numbers of borrowers are now also rolling off fixed-term loans, seeking to find the lowest variable rate, with expiring fixed-rate loans peaking in 2023.

Construction activity needs to increase to ease pressures in the housing market. Construction costs should grow slower than house prices this year, which should encourage more building.

Dwelling supply is unlikely to grow quickly over the next few years, with building approvals around 12-year lows and dwelling completions well below their peak in most states.

New building starts are also around their lowest levels since 2012, with completions low relative to the previous decade. Dwellings under construction are coming down from high levels, as new starts fail to keep up with completions.

{CF_IMAGE}

Slowing growth in the price of materials and construction outputs should help increase construction activity and spur more housing starts, particularly as recruitment difficulties ease.

Strong wage growth in construction could limit the slowdown in construction costs, though wage growth looks to have peaked.

After slowing in late 2023, insolvencies in the construction sector are trending up again.

Construction job advertisements remain elevated but have eased notably. While skilled labour shortages may keep output prices elevated, overall price pressures from labour should cool from here.

Financial stability and affordability

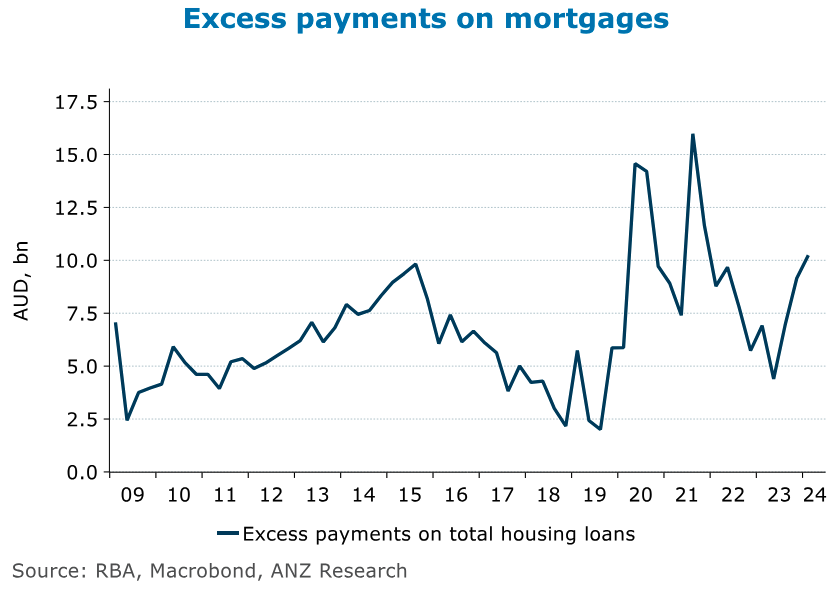

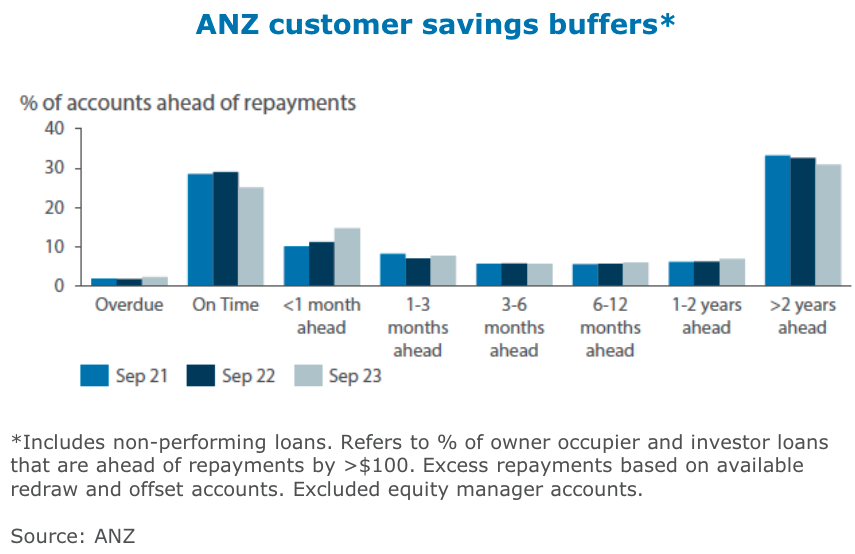

In aggregate, households are still ahead on mortgage payments. Excess mortgage payments have risen after falling in late 2022 and into 2023, with excess payments in the first quarter of this year 81 per cent higher than the 2015–19 average, despite pressure on budgets from inflation and rates.

Reserve Bank of Australia analysis suggests around half of all borrowers have enough savings to service debts and essential expenses for at least six months.

Although savings buffers have declined, especially sharply for those on the highest incomes who generally have the largest mortgages, they still have the largest buffers.

The RBA estimates over the past two years, the share of borrowers with cash flow shortfalls has increased to be over 4 per cent of borrowers. The expected interest rate cuts and growth in real wages will reduce the share of borrowers with a cash flow shortfall, the RBA estimates.

Home loan delinquencies have increased but remain below pre-COVID peaks. Those with high loan-to-value ratios (LVR) and higher loan-to-income ratios (LTI) are more likely to have fallen into arrears. Borrowers rolling off fixed rate loans have only been slightly more likely to fall into arrears than the aggregate.

Housing affordability has continued to deteriorate. The rapid increase in mortgage rates alongside the continued increase in housing prices has, over the past few years, seen the affordable purchase price for someone on the median income slip below the price of the median house and unit.

The share of the median income required to service a new loan on the median-priced dwelling has increased to 48.9 per cent, well above the decade average of 34.6 per cent.

The current imbalance between supply and demand for housing has seen rapid growth in rents over the past few years leading to an increase in the share of income required to service rents.

The share of median income required to service the median rent has increased more in the regions than the capital cities, with work from home and hybrid working allowing city dwellers to move to the regions, putting pressure on regional markets.

See ANZ-CoreLogic affordability report for details on housing affordability.

Blair Chapman is a Senior Economist at ANZ

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

-

-

-

-

anzcomau:Bluenotes/global-economy,anzcomau:Bluenotes/Housing,anzcomau:Bluenotes/Economics

Australian housing: signs of slowdown

2024-06-17

/content/dam/anzcomau/bluenotes/images/articles/article-listing-images/econonomy-housing-blair-chapman-1200-627.jpg

EDITOR'S PICKS

-

Most focus falls on supply issues in the housing affordability debate – but a broader view on the use of existing stock has the potential to be more effective.

22 April 2024 -

How does Australia unravel the rental crisis? ANZ’s expert panel examined factors – such as supply, alleviating skills shortages and productivity – that could bring change.

24 April 2024