-

Making money quickly can’t be that easy right? But being scammed is becoming increasingly common. So, despite what the headline here suggests, this isn’t a story with tips to help you get rich.

Over the past year alone ANZ has seen a 22 per cent increase in scam volumes and this is likely to rise over the Christmas and holiday period.

" While many people start to wind down for the festive season scammers will be working around the clock, taking advantage of busy schedules, increased online shopping and travel plans."

{CF_VIDEO}

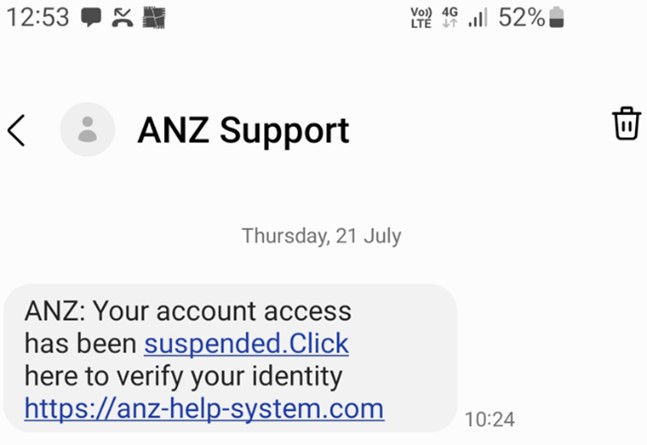

Here are three common scams we’re seeing right now and what to watch out for.1. The bank impersonation scam

This type of scam is becoming more prevalent and starts as a call or text from someone from a bank, say ‘ANZ’.

- You receive a cold call from an individual claiming to be from the bank’s fraud prevention team.

- The caller will panic you by saying your accounts are at risk and you urgently need to transfer funds to a different account.

- They may appear professional and confident and will ask to identify you using bank procedures which appear completely legitimate.

- They will then convince you to share your card number, PIN, password, registration numbers or a one-time password (OTP).

- Often the caller will have sourced personal information about you beforehand through a malicious message sent in the days or weeks leading up to the call.

{CF_IMAGE}

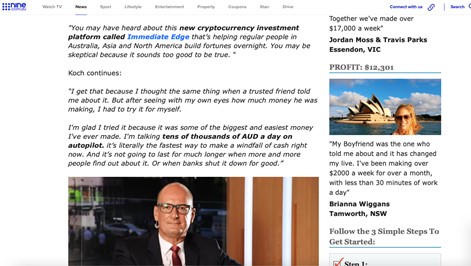

2. The cryptocurrency investment scamThis is the most common scam type we’re seeing at the moment in terms of volume and value.

- You’re contacted out if the blue by someone guaranteeing fast, high returns on investment.

- The connection could come through social media, a cold call or it might even start off as a romance scam you believe to be genuine.

- Sometimes the opportunity appears in a Google search. Scammers can create what appears to be a legitimate investment website claiming to have celebrity endorsement.

- The scam will encourage you to click on a link and enter contact details for a call-back from a professional sounding ‘investment consultant’ who is full of advice and offers.

- The consultant will then guide you through the steps for making an investment, going on to steal personal information and payment information resulting in lost funds and stolen identity.

{CF_IMAGE}

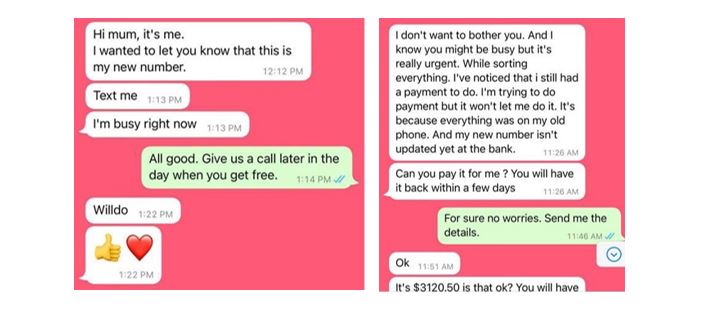

3. The Hey Mum or Hey Dad scamThese scams have become increasingly common in the past six months with Mums and Dads each losing thousands of dollars.

- A WhatsApp or text message will come from someone claiming to be a family member.

- They’ll say they’ve damaged or lost their phone and they’ll ask you to save their ‘new’ number.

- Once they’ve built a rapport with you, the scammer will ask to borrow money, ask you to pay a bill on their behalf or help with a payment to replace their phone.

- Once the scammer has convinced you to send money, they’ll then come back and ask for more.

{CF_IMAGE}

The best way to protect yourself from being caught out by a scam is knowing the warning signs and thinking before you act.

Stay cyber-safe this festive season

- Stop and think twice if you’re being asked to act urgently or respond to an offer sounding too good to be true.

- Do your research by finding out more about a company you’re looking to invest in or of anyone contacting you asking for money.

- Be suspicious of anyone asking you for personal information or a payment. Even if they say they’re from your bank or a known service provider, or if they claim to be a family member who has recently changed their phone number.

- Never provide your password, PIN, registration number or one-time password (OTP) to anyone, even if they claim to work for your bank.

- Contact your bank immediately on a number you know if you receive a message from someone saying your account is at risk or if you enter personal details into a link you suspect is a scam.

More tips on staying cyber safe over the holidays

Marc Broome and Ruth Talalla are from ANZ’s Fraud Prevention team

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

-

-

-

anzcomau:Bluenotes/Banking

Get rich in three simple steps. Act now!

2022-12-14

/content/dam/anzcomau/bluenotes/images/articles/2022/December/shutterstock_hero image.jpg

EDITOR'S PICKS

-

Digital IDs are all about creating a secure way to provide digital identification, where data is not shared directly but rather stored by a secure provider.

-

The average lifecycle of a data breach is 287 days with many attacks going unnoticed for months before it’s too late.

12 October 2022