-

The work Payments NZ has been doing with the industry as part of our modernisation plan has confirmed real-time payments capability is a key cornerstone of modernising the country’s payments system.

" This work being led by Payments NZ is a long-term project that will have wide-ranging implications across many industries and our economy."

We’ll now be leading further industry discussions around how best to progress real-time payments capability for our domestic market. Our real-time payments workstream started with an information gathering exercise which showed real-time payments infrastructure can deliver a range of long-term benefits for the country.

We collected input from organisations who have delivered real-time capabilities around the world. Analysis showed the immediate transfer of funds between bank accounts speeds up the flow of money around the economy and can improve access for innovators while the ability to have richer payment information flows will deliver improved choice and efficiency for consumers.

{CF_IMAGE}

Another key insight was inclusive, real-time infrastructure is a strategic and enduring investment in the future of a country. This work will have wide-ranging implications across many industries. To realise this capability for Aotearoa, we’ll require input from a broad range of stakeholders.

In the coming months Payments NZ will start to engage with the wider Aotearoa payments ecosystem. This will start with the release of a discussion document that explores in more detail the work we have done so far.

We’ll invite feedback and comments on the document and welcome input on demand, features and the configuration options of a potential real-time payments system in Aotearoa.

We’ll also start to consider the structures required to govern and manage real-time infrastructure – including key areas such as privacy, security, access, interoperability, efficiency and cost-effectiveness. Interested parties can register online now to receive a copy of the discussion document.

In the meantime we’ll continue to work with participants of our clearing systems and share global real-time use cases and best practise to help inform what we do here in Aotearoa.

Payments NZ:

Payments NZ was formed in 2010 by the industry with the support of the Reserve Bank of New Zealand. It governs New Zealand’s core payment systems and manages the API Centre which is leading opening banking in Aotearoa New Zealand. Payments NZ is committed to a world-class payments network and empowering Aotearoa New Zealand’s payments future.

If you’re interested in finding out more about real-time payments, Payments NZ will be running an online session on day two of our conference, “The Point 2022 – Reframing the Future”. The conference is on 9-10 November. Registrations are open now.

What is Payments Direction?

Payments Direction is Payments NZ’s cornerstone initiative to understand the evolving future of payments. Through this program we work collaboratively with the industry to identify what needs to be done to contribute to and prepare for that future.

Our vision is to ensure New Zealand has the world’s most progressive payments system while making sure payments are simple and secure for Aotearoa. Ultimately, we want Kiwi to be able to pay who they want, when they want and how they want.

What are we working on?

Our focus this year is to finalise work on our long-term strategic roadmap for payments systems to 2030. This work is based on the Payments Modernisation Plan (PMP) discussion document we released in 2020.

The PMP is based on five guiding principles that put Kiwi at the heart of everything we do.

The principles that guide our modernisation activities are to:

- help Kiwi achieve their financial goals

- improve financial inclusion

- build a more productive New Zealand

- improve the financial resilience of Kiwi businesses and consumers

- support competition and innovation to give Kiwi more choice in payments.

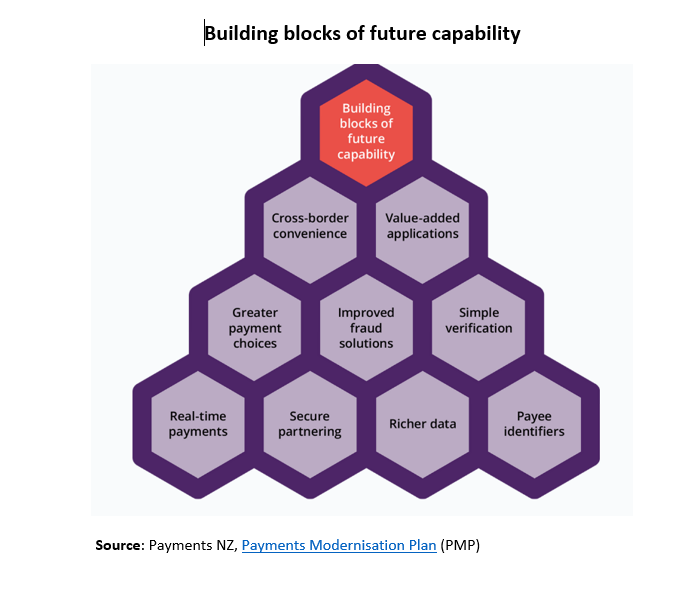

The PMP also identifies a range of building blocks required to modernise New Zealand’s payments ecosystem. Each of these blocks will help address current and emerging limitations in the payments ecosystem.

Steve Wiggins in Chief Executive Officer of Payments NZ.

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

anzcomau:Bluenotes/Banking,anzcomau:Bluenotes/Payments,anzcomau:Bluenotes/technology-innovation

Payments NZ lays out ambition for real time payments

2022-09-21

/content/dam/anzcomau/bluenotes/images/articles/2022/September/Screen Shot 2022-09-21 at 9.29.10 am.png

EDITOR'S PICKS

-

The new ANZ Worldline Payment Solutions joint venture launched this week into a rapidly evolving world of payments.

5 April 2022 -

Payments platforms must keep up with demand as consumers increasingly move away from physical cash and cards.

4 April 2022