-

Customer experience and advocacy are key deciding factors when it comes to success in today’s banking environment. Getting them right can be a huge competitive advantage.

But what is it that really drives a positive experience? And what leads to advocacy?

“Mobile is the ascendent channel through which consumers conduct their day-to-day banking.”

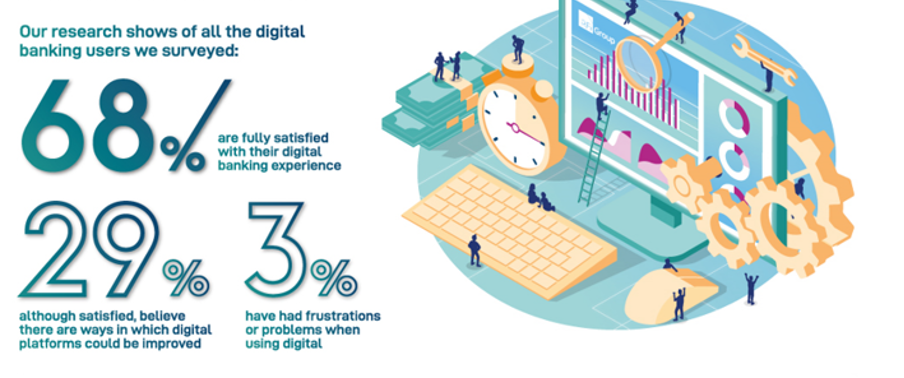

For a long time, we’ve watched usage of internet banking rise to the point where, globally, 91 per cent of consumers are now on board with it. As digital banking has matured it has reached high levels of satisfaction.

{CF_IMAGE}

According to the latest RFi Global Digital Banking Council survey however, when it comes to growth and frequency of usage, it is mobile that wins.

More than 50 per cent of respondents use mobile banking on a weekly basis and a further 25 per cent are using it daily, compared with 49 per cent and 21 per cent for internet banking. Essentially, internet banking is increasingly for the occasional user. For a heavier user, mobile prevails.

If this wasn’t clear prior to the beginning of 2020, then it’s become evident during the pandemic. Mobile is the ascendent channel through which consumers conduct their day-to-day banking.

In fact 41 per cent of consumers call their mobile device their most preferred channel for banking, compared with 33 per cent for desktop banking - however this is still way ahead of branches which take just 9 per cent of the vote.

Getting mobile banking right

This shift in preferred channels means the overall banking experience is likely to be more and more heavily influenced by mobile experience.

So how do you deliver the optimal mobile banking experience to customers? Where do app features fit into the equation? Should you prioritise number of features or simplicity of design? Where is the balance?

RFi Group had a look at the Australian market in more detail to see what we could find. We catalogued all the features that were available through mobile banking apps in the market and came up with a list of 42 features across categories ranging from account management to security and travel.

We recorded how many features each banking app had and overlaid it with customer Net Promoter Scores (NPS) taken from our XPRT annual survey of 63,000 consumers. The top 12 banks had between 32 and 15 features available in their apps (with an average of 23) while NPS rankings ranged from +59 to +16.

{CF_INFOGRAM}

There was very little correlation between number of features available and the NPS score. In other words, more features do not necessarily equate to a higher NPS.

Keeping it simple

So the fundamental question is how do you deliver the right amount of in-app features and information without overcomplicating the user experience? We call this “over-featuring”.

Globally, the top three mobile banking attributes correlated with app satisfaction are:

- ease of use

- reliability, and

- ease of login

When we looked at what might be causing friction for customers, we also found two main pain points: range of tasks and access to information. This suggests banks would do well to prioritise the basics and accessibility.

It sounds simple, provided we resist a common temptation and misconception: the more functions, the better the user satisfaction. Our data indicate quite the opposite.

Let’s not reinvent the wheel. The best experience is the one that can take customer value to the next level. Organisations that do it well make sure their mobile app works: customers can log in and can easily do what they need to do. And they watch their NPS go up.

Alan Shields is Chief Data Officer at RFi Group

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

-

anzcomau:Bluenotes/Banking,anzcomau:Bluenotes/Digital

User experience: ease to please

2021-09-21

/content/dam/anzcomau/bluenotes/images/articles/2021/September/Shields_CX.jpg

EDITOR'S PICKS

-

Western, educated, industrialised, rich and democratic economies are leading the push for digital banking trends to stick around in the future.

9 July 2021 -

The move away from cash emerged as one of the biggest digital shifts from the pandemic as consumers seemed to fully embrace mobile wallets.

20 October 2020