-

Farmland prices in Australia are surging, interest rates are low, commodity prices are going from strength-to-strength. Profitability in farming is extremely strong which is leading to an increase in investment and support for land values.

From a banking perspective, it’s important for us to keep an eye on each customer’s circumstances to ensure they aren’t inadvertently faced with tough circumstances if any of those variables start to drop away.

"We are seeing second and third generations of farmers with a long-term view of staying in the game and doing whatever it takes to succeed.”

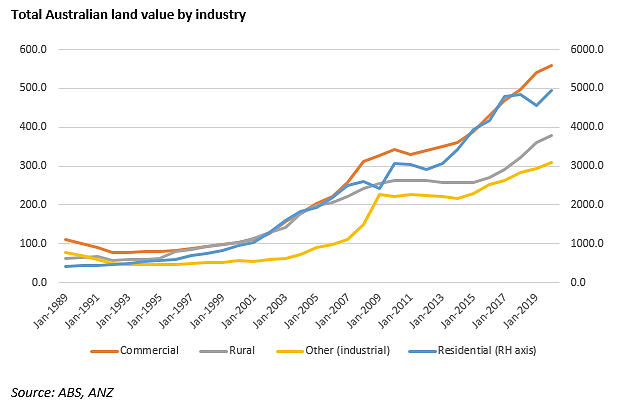

On the whole, farmland prices have followed the general patterns of Australia’s real estate market. Even when we’ve had a run of droughts and before some commodity prices rose, land prices were already appreciating.

{CF_IMAGE}

Medium to large-scale farms were buying and expanding their operations as they tried to build up economies of scale and this has allowed people to sell and exit with good money which is just one of the drivers underpinning the market.

Over the last 20 or so years, farmers have been looking to grow larger to drive down the unit cost of production and maintain enough cash earnings to continue reinvesting and expanding their businesses and keep up with new technologies.

On top of this, we are now seeing second and third generations of farmers with a long-term view of staying in the game and doing whatever it takes to succeed. This has led to Australia seeing fewer, larger farm businesses today than there were 10, 15 or 25 years ago.

{CF_IMAGE}

Supply and demand

Some of Australia’s major commodity prices are now trading at historic highs. Most notably, beef the nation’s biggest single commodity subsector. However, both beef and sheep are undersupplied and have really strong demand characteristics which is driving prices up.

That means today's price points will likely stay in the high range over time. And while that attracts a lot of confidence, some farmers are facing issues as they try and restock at high prices and it can be a long road to rebuild herd and flock.

Anecdotally, we’ve seen land prices starting to outstrip some of the yield but there are still really healthy margins and strong levels of profitability. As long as that remains and there’s an appetite for investing in Australian farmland, it makes for a pretty positive sector.

If we think in financial markets, long-term often refers to three, five or seven years. However in farming, long-term is generational or more than 10 years when considering investment horizons. It’s a uniquely long-term driven industry which makes it dangerous to consider land in short-term cycles because it's very hard to predict.

In that context, benchmarking becomes even more important to get a feel for where the midpoints might be or what is reasonable to expect from a farm over time.

As farming becomes more specialised farmers need to be great producers as well as great at managing marketing, finance, relationships and strategy. And as bankers we need to have high levels of understanding of all of these things to be able to make good decisions with our customers.

Mark Bennett is Head of Australian Agribusiness at ANZ

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

-

anzcomau:Bluenotes/Agriculture,anzcomau:Bluenotes/global-economy,anzcomau:Bluenotes/Commodities

Aus farmland brimming at the highs

2021-07-20

/content/dam/anzcomau/bluenotes/images/articles/2021/July/BennettFarmLand_banner.jpg

EDITOR'S PICKS

-

There’s good news for Australia’s cattle industry, even after a difficult year for some in the sector.

18 May 2021 -

Australia’s agricultural sector emerged from 2020 relatively unscathed and is looking to build on that confidence in the new year.

1 March 2021