-

One of the phrases we hear more and more in the industry is “banking is a verb not a noun”. It neatly captures the essence of banking-as-a-service (BaaS) and the platform business.

The ANZ Banking Group is a noun – we are a “bank” – but we are also increasingly in the business of providing banking services to third parties. Those parties might be other banks, government, fintechs, neobanks or Institutional customers. That’s the business of banking as a verb.

"Providing platforms for other banks to use is a natural evolution of our Institutional business and something you will hear us talk more about in the future.”

We call this business “Powered by ANZ” and its mission is the provision of banking services to our clients for the benefit of their clients.

Traditionally this has been undertaken via agency or clearing mandates with financial institutions (FI) - where ANZ has a strong history, deep market share and relationship strength. That tradition is now shifting to encompass white labelling and open banking ecosystems.

Increasing numbers

The major service lines are clearing, domestic agency, client monies and in-house infrastructure with future opportunities in areas like digital currencies.

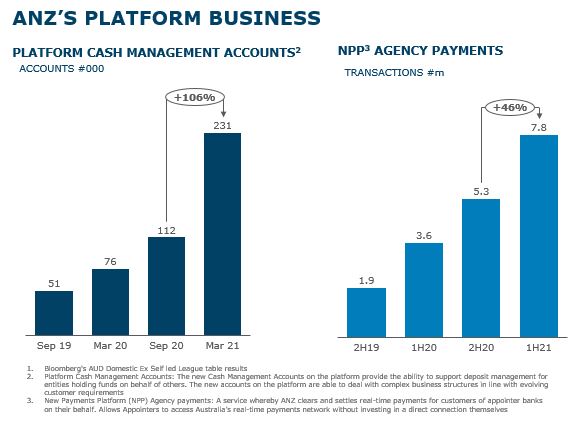

In the 2020 financial year, we increased the volume of payments and data processed through our digital channels to 1.3 billion transactions, up 19 per cent compared with the 2019 financial year. We have doubled the number of cash management accounts to 231,000 since the second half of the 2020 financial year, representing more than $A10 billion in deposits. And we have increased the number of NPP (New Payments Platform) payments for other banks by 115 per cent in the March 2021 half when compared with the March 2020 half.

These platform services provided allow our customers to safely, economically and more efficiently provide the products and services their own customers might want. By doing this, we not only provide a vital service to our financial institution customers, we become entrenched as a lead relationship bank providing a basis for much broader cross-sell and relationship development.

{CF_IMAGE}

For ANZ, these are services we already undertake and are market leaders in. We have the capacity and increasingly are growing that service as an opportunity with strong revenue potential and low capital intensity – and at very low marginal cost for extra volume.

Take the NPP, Australia’s real time payments network, for example, where we more than doubled payments undertaken for three other banks - within the same cost infrastructure.

We expect these transaction numbers to continue to grow and we will add more banks to this infrastructure this financial year and early next. These new customers represent a variety of different institutions from different regions.

The high cost of compliance, technology and complexity, together with reduced investment funds, is increasing the burden for both FIs and non-bank FIs, particularly those that lack scale or the desire to seek a banking licence. That’s why many FIs are choosing to buy access to ANZs NPP capability for their own customers rather than build their own.

Providing platforms for other banks to use is a natural evolution of our Institutional business and something you will hear us talk more about in the future.

Providing solutions

As it stands today, ANZ’s payments and cash management (PCM) business provides three propositions, of which “Powered by ANZ” has the highest growth potential.

Alongside this business, the primary ANZ proposition is the more traditional one of providing treasury and payment solutions to corporates, government and financial institutions. We will also enter into partnerships to expand the PCM ecosystem - our new relationship with global merchant payments specialist Worldline is a key example.

ANZ is building this business as a signficant element of our strategy. We have already seen a number of new, largely retail focused, partnerships announced across the industry, demonstrating the increasing demand for bank to non-financial institution partnerships that can reach a large number of customers at a low cost.

For ANZ, building this business offers the potential for high shareholder value creation as these services open up new, typically large, flow driven fee revenue lines which are high ROE. Offering these services can lead to the creation of long term and/or lead bank status customer relationships over the mid to long term.

As we build out this business, the key market drivers are the introduction of cloud computing, APIs and open banking, which have broken down barriers to entry. Providers are quickly realising they can leverage all aspects of the ‘Banking Stack’ to allow non-bank customers to provide banking services to their customers.

This in turn is driven by changing consumer behaviour and demographics which impel organisations to provide a much broader service – whether that be a credit union offering its customers real time payments or an ecommerce site offering payments and a deposit capability.

As ANZ expands its platform and BaaS services beyond the traditional Financial Institution segment, we are enhancing our cash management platform and shifting the focus to cloud-based services, API driven with scalable capacity.

The customer focus includes government, education and multi-national corporations, stockbrokers, wealth businesses, professional services, agency work and other financial institutions and technology companies - core segments of ANZ’s existing Institutional franchise.

According to Accenture, commercial banks that provide BaaS achieve two to three times the industry average return on assets. We have a strong foundaton from which to build upon and look forward to exciting times ahead for the ANZ PCM business.

Lisa Vasic is Managing Director Transaction Banking and Leigh Mahoney is Head of Wholesale Digital at ANZ

-

anzcomau:Bluenotes/anz-results,anzcomau:Bluenotes/Banking,anzcomau:Bluenotes/technology-innovation

BEHIND THE NUMBERS: platforms for future growth

2021-05-05

/content/dam/anzcomau/bluenotes/images/articles/2021/May/HY21_MahoneyVasic_banner.jpg

EDITOR'S PICKS

-

Everything you need to know about ANZ’s 2021 half-year result in one place.

5 May 2021 -

ANZ CEO says the bank delivered a very strong result after a challenging year but not all geographies are at the same stage of recovery.

5 May 2021