-

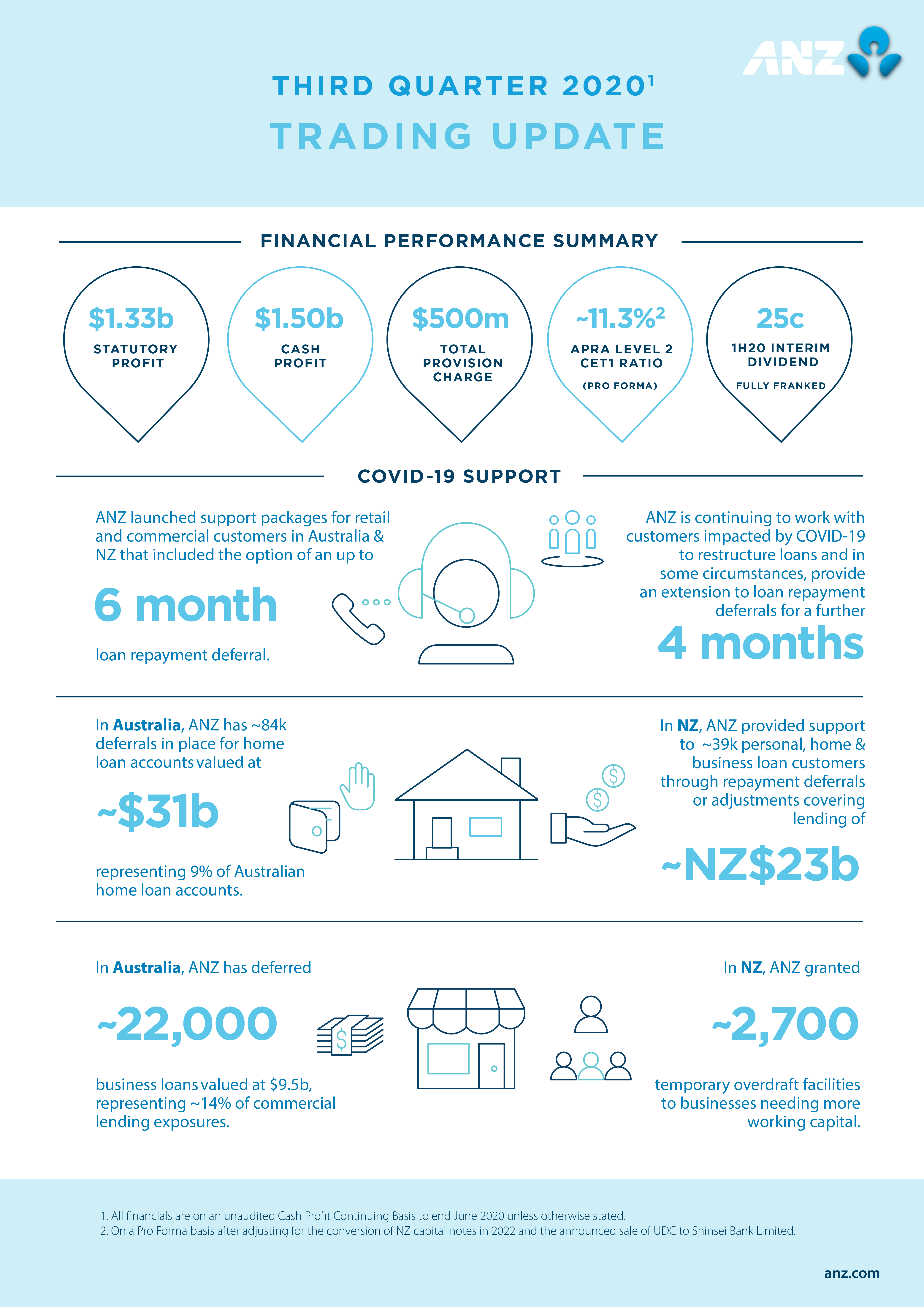

As the COVID-19 pandemic continues to weigh heavily on the global economy, ANZ posted an unaudited statutory profit for the third quarter to 30 June 2020 of $A1.33 billion with an unaudited cash profit on its continuing operations of $A1.5 billion.

Following the deferral of a decision on the interim dividend in April 2020, ANZ’s Board also determined an interim dividend of A25 cents per-share, fully franked.

ANZ Chief Executive Shayne Elliott said the bank’s performance during these difficult times demonstrates the strength of the business as it balances the need to support customers and staff through a one-in-100 year global pandemic while providing a fair return for shareholders.

Elliott said ANZ’s purpose of shaping a world where people and communities thrive had guided the bank’s response.

“Challenges clearly still remain, however moving quickly to protect the things that matter, engage with key stakeholders, adapt for a new world, while also preparing for the future has us well placed,” he said.

You can see highlights of the trading update in the infographic below.

{CF_IMAGE}

Click here for full screen

Melissa Currie is Creative Content Producer at ANZ

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

anzcomau:Bluenotes/anz-results,anzcomau:Bluenotes/global-economy,anzcomau:Bluenotes/Banking,anzcomau:Bluenotes/COVID-19

INFOGRAPHIC: ANZ’s Q3 trading update

2020-08-19

/content/dam/anzcomau/bluenotes/images/articles/2020/August/Infog_thumb.jpg

EDITOR'S PICKS

-

ANZ CEO Shayne Elliott says the bank is focusing on its purpose to guide customers, community and shareholders through this stressful period.

19 August 2020 -

According to the experts, capital is the cornerstone of financial strength. But what does that actually mean?

4 August 2020