-

In 2011, when an earthquake, tsunami and nuclear meltdown devastated the north east coast of Japan’s main island, the catastrophe played out in several phases.

The ninth anniversary of that disaster is next week and still some people are without permanent shelter, some towns have never reappeared and thousands of businesses have failed, driving up local unemployment. Tens of thousands of people left the region.

"The go-to cliché of Chinese significance to the global economy is now going to be literally tested: what does happen when China sneezes?”

With the novel coronavirus (COVID-19), we will see that pattern of overlapping phases play out – as it does for all calamities of such scale.

Being Japan - a modern, earthquake prone economy - the actual quake, while the largest on record, did relatively minor damage. But the tsunami it triggered razed the coast and killed more than 20,000 people.

It also wrecked a nuclear power plant in Fukushima, testing the brink of a nuclear meltdown.

In the weeks and months which followed, other impacts played out. The world’s luxury car brands realised the sole manufacturer of the exotic metallic paints they used was in the devastated region of Tohoku.

In the months and years after, produce from the region, especially seafood, was avoided by consumers, even when it was demonstrably safe.

While the initial rebuilding generated work, for many businesses, large and small, an economic malaise descended on the region which persists to this day.

According to the Japanese government, almost 50,000 people still live as evacuees. Sales in the marine product processing industry are still down. The contaminated water management and decommissioning process at Fukushima Daiichi Nuclear Power Station is still an issue.

Indeed, the decommissioning of the nuclear plant and the radiation threat will span decades if not centuries.

Immediate phase

With COVID-19, the immediate phase of the epidemic, although delayed by the initial opacity around the outbreak, has been swift.

Approaching 100,000 people have been infected although that number is likely to be understated (given the nature of medical data in some countries and also the likelihood of non-reporting of minor cases). The mortality rate is estimated at between 0.05 and 4 per cent (again, if minor cases are unreported, the death rate looks higher). In China today it is 3.7 per cent.

Beyond this human cost, quarantine and preventative measures have caused profound, widely documented disruption.

Yet as ANZ Chief Risk Officer for Institutional, Tim Bezencon, says, we are really still at the stage of the sea receding before the tsunami hits. The infection curve is still “immature” – while new infections are falling in China, they are rising exponentially in South Korea, Italy and Iran.

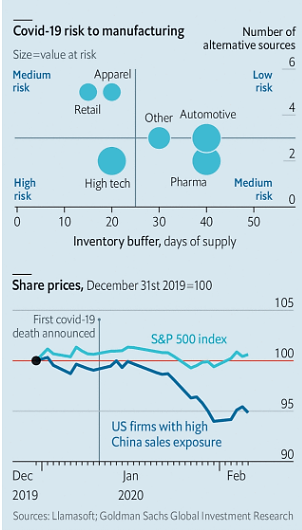

The latest, most significant economic data from China show a collapse in manufacturing and consequent hit to growth. Manufacturing activity plumbed a record low of 35.7 on the most widely watched index, from 50 in January and against forecasts of 46.

Economic forecasts for China’s March quarter are dire: from 6.1 per cent growth in the December quarter to as low as 2 per cent. As Bezencon says, lost profit isn’t recoverable: net present values are already hit, supply chains can’t ramp up to 150 per cent, consumer confidence takes time to even recover.

The go-to cliché of Chinese significance to the global economy is now going to be literally tested: what does happen when China sneezes?

{CF_IMAGE}

Phase two

Belatedly, securities markets around the world have put their money on a serious infection for the global economy. Interests rates are back to historic lows – presaging weaker growth – while major equity markets are in correction territory and heading for the bears.

ANZ’s chief economist Richard Yetsenga notes during the first phase of the outbreak the focus was very much on domestic demand in China and the supply chain effects through the rest of the Asia Pacific region and the world.

“This phase still has quite some way to run,” he says. But the next phase is domestic demand.

“Through this next phase, which has emerged over the past week, the condition of domestic demand in affected countries will be increasingly the focus. In the most affected countries, large gatherings are being discouraged and schools delayed, and discretionary consumption is likely to be heavily impacted.”

How this plays out will depend on the strategies – and the execution of those strategies - in other countries, underpinned by the confidence of the community in their governments.

In the region, ANZ’s head of Asia research, Khoon Goh, sees four channels of negative economic impact: reduced trade activity, fewer Chinese tourists, epidemic response and restrictions, and the confidence affect with spill-overs from other issues.

{CF_IMAGE}

Third phase

Third order impacts are emerging. In Australia, for example, the tourism, education and major resources sectors are all directly hit by China’s downturn and Australian policy responses.

If we were to compare this with the Tohoku disaster, the tsunami waves are still coming, the Fukushima plant has been quarantined but it is too early for recovery operations. And with tsunamis, the greater damage is inflicted as the water recedes, dragging with it everything which has been torn loose.

There will be long term impacts. Both the physical restraints on trade and manufacturing and confidence (in already frail economies) will play out over months and at least into 2021.

Just how deeply China is entwined in global supply chains, be that iPhones, medical quality glass for drug containers or pressure pumps for hand sanitiser bottles, is coming into focus. Like the Japanese metallic paint firm, these are chains invisible until they break.

The collateral damage to labour demand damages household spending and debt management. Falling labour demand is because business can’t or won’t hire or pay overtime because operations are either directly affected or suffering a fall in demand.

That means credit risk in the personal and corporate sectors will rise. The financial sector, already suffering from anaemic demand despite historically low interest rates, is already facing very low revenue growth. It may face higher delinquencies.

Bezencon says the most at risk companies – as always – are those with high debt and operating leverage and low liquidity. The American high yield debt market, where the riskiest credits raise money, will be an early warning. And it is already in bubble territory – while liquidity support may actually exacerbate bubbles.

Contingent phase

In its most recent meeting, the Basel Committee on Banking Supervision warned of risks to the banking system, including the financial stability implications.

But just as the coronavirus situation is changing daily, the calculus of risk for financial institutions shifts too. If the crisis is relatively acute, emerging but shorter term liquidity issues will demand support for businesses with cash flow but not solvency problems.

Unfortunately, there are already signs some businesses may not recover, given the gravity of the acute shock. (One positive: businesses will be forced to think more deeply about resilience, taking risk out of their operations, business continuity planning.)

Regulators are alert. In Australia, the Australian Prudential Regulation Authority (APRA) has required major financial institutions to prove they have adequate contingency plans in place to continue to operate in the face of the pandemic.

APRA’s practice guide “CPG 233 — Pandemic Planning” was updated in 2013. The insurance sector too faces much more intense scrutiny.

The coronavirus epidemic is already a massive shock. It will have medical, social, economic and psychological consequences, which will play out over the short, medium and longer term.

Even more than a decade after the financial crisis, global interest rates are at record lows and the European banking system remains challenged. In Japan, despite the Tohoku catastrophe being very localised, economy-wide and even global ripples continue to play out, whether that be in society, energy policy or global supply chains.

The coronavirus has already permanently shifted the global economy.

Andrew Cornell is Managing Editor of bluenotes

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

-

anzcomau:Bluenotes/asia-pacific-region,anzcomau:Bluenotes/Banking,anzcomau:Bluenotes/Economics,anzcomau:Bluenotes/COVID-19

A viral tsunami

2020-03-04

/content/dam/anzcomau/bluenotes/images/articles/2020/March/CornellCoronavirus_banner.jpg

EDITOR'S PICKS

-

Growing uncertainty surrounding the coronavirus will have a large impact on near-term GDP growth in Australia.

2020-02-10 13:11 -

As the frenzy surrounding Coronavirus continues, economic shockwaves are starting to radiate.

2020-02-04 09:36