-

In the mortgage sector, 2019 is best described as a year of taking stock – for consumers, distributors (brokers) and lenders. It was the first year following the Hayne Royal Commission report. And a year where the market had to consider the significant issues identified and work through the appropriate responses and changes to ensure cases of poor outcomes for consumers were not repeated.

For many lenders, this led to material changes in the way they assessed customer suitability and loan servicing criteria. This impacted both the process time and information requirements placed on brokers and the customer. Many lenders also made conscious decisions to reduce exposure to certain segments of the market in line with revised risk appetite.

"It’s how you provide the right offering and experience in your various channels… Clearly when customers are choosing to use a specific channel, they are telling us there is something they find easier, or simpler or faster.” – John Campbell

The economic conditions of continued low inflation and wage growth also resulted in several official interest rate reductions by the Reserve Bank of Australia.

However, rather than stimulate consumer confidence in lending, it seemed that at least initially borrowers increased their savings (or mortgage prepayments), rather than spending or making property purchase decisions. In the capital cities of Sydney and Melbourne such conditions resulted in low or negative price growth through many suburbs over 2019.

And, not least, there was a Federal Election in May 2019 which generated uncertainty as it promised a wide range of impacts depending on which party was re-elected.

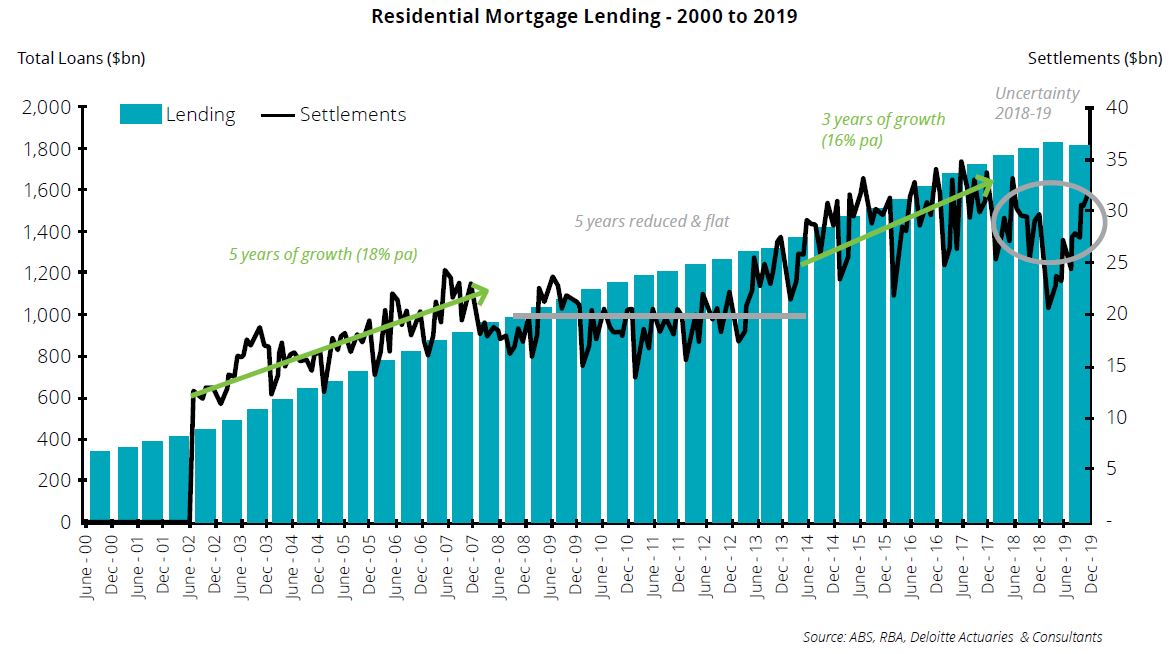

All these events give useful context to what may have caused a modest 3.7 per cent growth in overall residential mortgage lending and a 7.5 per cent fall in mortgage settlement volumes.

{CF_IMAGE}

As at 31 December 2019, this was the lowest rate of mortgage lending growth in Australia in the past decade.

In terms of new mortgage financing, or settlements, this totalled $A316 billion over 2019 (an average of $A26.4 billion per calendar month). This was a reduction of 7.5 per cent compared with the prior period in 2018. However, this overall fall in 2019 was largely a story of two halves.

In the first six months to June 2019 settlement volumes were up to 20 per cent lower than corresponding periods in 2018.

But in the second six months of 2019, settlement volumes returned to levels that were consistent with and slightly higher than comparable months in 2018.

Offering and experience

ANZ General Manager Home Loans, John Campbell, says the bank is forecasting 2 - 3 per cent growth in settlements in 2020 but would ideally like this to be higher.

“As we work our way through what it means to be a responsible lender, there are different interpretations of the regulations and rules. Lenders do tend to interpret it differently,” he says. “The interpretation plays out predominantly in policy setting, which then impacts assessment and operations, ultimately influencing certainty and confidence for customers.”

Campbell says the questions to be answered are:

- How do you meet customer needs?

- Do you have an offering that customers want?

- When customers walk down the street, or search on the internet, how do you make sure they choose your bank?

“It’s how you provide the right offering and experience in your various channels,” he says. “We don’t have the luxury of focusing only on a single channel. We compete across a number of channels, whether it’s through the aggregator and broker channels, or via our own lenders, branches, or contact centres.”

According to Campbell, “clearly when customers are choosing to use a specific channel, they are telling us there is something they find easier, or simpler or faster”.

“Channels have to operate in an ‘omni-channel’ manner, so the customer can seamlessly move between different channels. They may start in the branch and finish on the phone,” he says. “Or maybe start with a broker, go into a branch to do something and then finish online.”

Campbell says the other big question is how banks offers their services in a responsible manner. “Therein lies the challenge – how do you do lend in a responsible manner while making sure you have a proposition that delivers simplicity, speed and ease.”

James Hickey is Partner, Consulting and Heather Baister is Partner, Audit & Assurance at Deloitte

For more an in-depth look at Deloitte’s Australian Mortgage Report and details from the roundtable click here.

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

anzcomau:Bluenotes/Housing,anzcomau:Bluenotes/global-economy

Deloitte: settling mortgages in 2020

2020-02-18

/content/dam/anzcomau/bluenotes/images/articles/2020/February/HickeyBaisterMortgages_banner.jpg

EDITOR'S PICKS

-

Have the last few months of low interest rates left a lasting impact on Aus housing affordability and stability?

12 February 2020 -

After prices rebounded in 2019, housing market confidence continues to trend upwards.

17 January 2020