-

Australia’s national sheep flock is about 69 million - down from around 180 million in 1970. It’s a dramatic fall and due to a range of factors, including low sheep and wool prices and a shift from sheep to grain and cattle farming. (For a time cattle seemed to promise more attractive export options and were viewed as less ‘hands-on’ to run.)

But it’s time we thought closely about the considerable change the sheep industry has undergone over the last five decades.

"Although we’ve got bad seasonal conditions, we’ve got these historical highs in all our commodity prices.” – McGuiness

ANZ has just taken 22 Australian farmers to Singapore and China with a clear purpose to help the industry understand the challenges and opportunities ahead for one of Australia’s most iconic commodities.

{CF_VIDEO}

{CF_IMAGE}

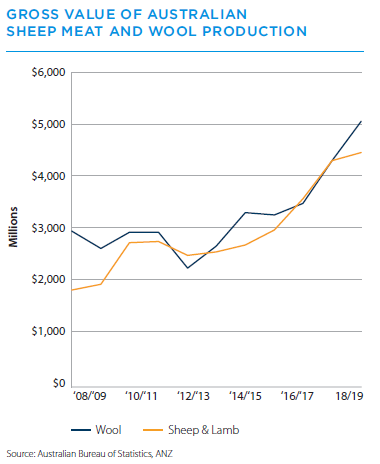

As domestic supply has declined and demand has increased, today’s 31,000 Australian sheep farmers are enjoying some of the best financial conditions in years, conditions which might just continue despite significantly tough times in many parts of Australia due to drought.

As Tom McGuiness, a New South Wales sheep farmer, told me “although we’ve got bad seasonal conditions, we’ve got these historical highs in all our commodity prices”.

Normally in a drought you are selling stock for nothing, he says, “and you can’t get rid of them, where as in the last couple of years we’ve been selling stock for record prices”.

As our research team highlights in our latest agricultural insight report, Shear Brilliance, prices are high for sheep meat and wool and both are expected to remain so due to low Australian sheep numbers.

The national flock is estimated to grow by just around 1 per cent per year from 2020. A lack of near competition, with the exception of New Zealand, also reduces the chance of major oversupply.

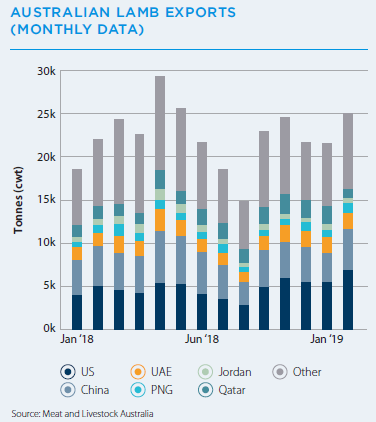

Sheep meat exports continue to grow with China now the largest market for Australian sheep meat, while the Middle East and the US provide ongoing strong demand.

For Australian wool, the outlook is also promising. While the world’s flock is increasing, its focus is on sheep meat, limiting wool supply. This has led to export opportunities including in China where wool imports have risen from around 200,000 tonnes in the early 2000s to more than 350,000 tonnes in recent years.

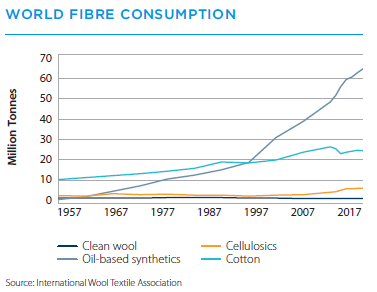

Growing interest in natural fibres over synthetics among Asia’s middle-class is also expected to maintain strong demand for Australian wool - particularly for fine apparel sub 24.5 micron wool.

However, there a number of challenges ahead for the industry however, despite the rosy outlook. Changing consumer trends, including a potential preference for grain finished meat, health concerns regarding red meat consumption and the wider availability of alternative proteins in major export markets, could pose some risk.

Wider political and economic factors such as trade regulations as well as climate variability and biosecurity risks are also issues the industry must monitor and prepare for.

Farmers relying on live export may also face some challenges with ongoing calls from some quarters for a cessation of the trade.

But Western Australian farmer Craig Lubcke reminds us “live export with the merino wether is very important to us because it’s harder to get a merino wether to a cross bred standard, so that market suits us very well”.

{CF_IMAGE}

The general sentiment however across industry, and certainly what we’ve experienced with our delegation to Asia, is one of optimism.

South Australian farmer Andrew Michael summed it up well: “With every country in the world having reduced numbers of sheep and our main export competitor New Zealand there lowest numbers for I think 60 years, to me there really is no downside as long as we maintain that quality of product, both meat and wool.”

Mark Bennett is Head of Australian Agribusiness at ANZ

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

-

-

anzcomau:Bluenotes/Agriculture,anzcomau:Bluenotes/business-finance

Australian sheep: shear opportunities ahead

2019-03-26

/content/dam/anzcomau/bluenotes/images/articles/2019/March/OppAsia_sheep_banner.jpeg

EDITOR'S PICKS

-

It would be an understatement to say the Australian sheep industry has been through some tough times since the 1990s. Today, the sector is back on its feet and times ahead look even better, with a new report forecasting a surge in demand for lamb over the coming decades.

2016-09-27 17:08 -

Australia is working hard to set global benchmarks with livestock exports and the animal welfare obligations which come with being one of the world’s largest exporters of live cattle and sheep.

2017-03-20 14:40