-

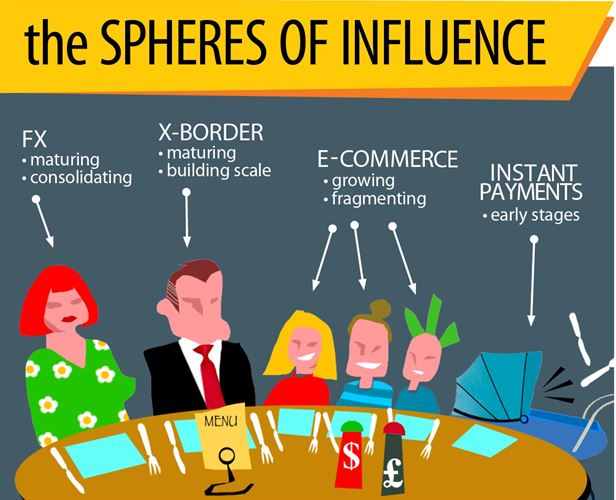

Nobody doubts the potential for further growth in payments technology in Asia. It is simply a matter of how fast it will grow.

We believe the rate of growth will be rapid and will continue to speed up given the size of Asia’s customer base, demographics and the kind of opportunities developing in the region.

"There are numerous drivers influencing the move to a cashless Asia.”

The adoption of technology is quite high. The younger population in Asia drives a lot of new-age solutions into play.

We’ve seen this in the phenomenal take-up around the newest payment tech like digital wallets. In fact, the Asia Pacific region leads the world when it comes to digital wallet usage via mobile and smart devices, according to a Mastercard Digital Payments study in 2017.

In China alone, online sales of retail goods reached RMB 7.1 trillion in calendar 2017, growing at approximately 30 per cent a year, according to government statistics and ANZ analysis.

The drivers for growth are there – and it may be happening faster than many people expect.

A good payments system is vital to any successful economy. Today many Asian nations are adopting new technologies, new platforms and even looking to go cashless as they drive toward creating a digital economy.

{CF_AUDIO}

Screen reader users press tab 3 times to reach the play button.

Cashless

There are numerous drivers influencing the move to a cashless Asia. One is actually government mandates, with nations and regulators pushing to get their economies into a digital mode.

{CF_IMAGE}

Such a push promotes efficiency in payments systems and more importantly allows for a common standard - and a customer experience - which can build consistency.

The second factor we should not forget is the demographics. There is a fairly young and youthful population across Asian markets which is quite tech savvy.

{CF_IMAGE}

More importantly their access to technology and purchasing power are both drivers which could see cashless capture the region.

Merchants

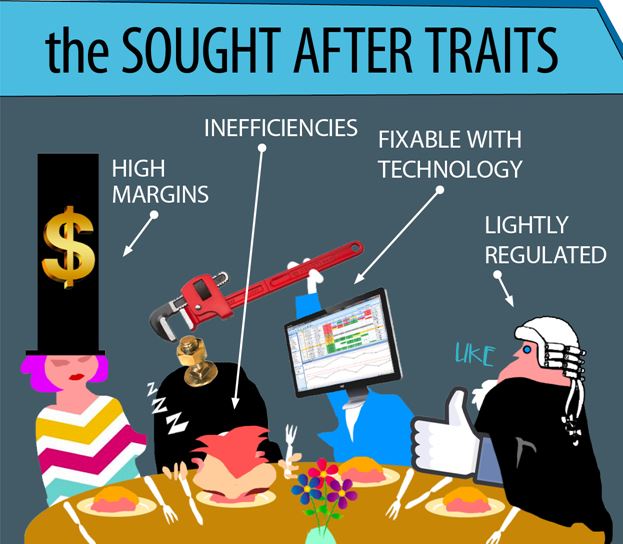

Not everyone is benefitting enormously from the transition – some merchants are struggling on many fronts.

The first is customer experience - what they can deliver? At the point of sale in many Asian countries you end up with merchants forced to use multiple terminals. There are no many unified omni-channel point-of sale solutions available.

{CF_IMAGE}

The second is in fast-growing digital markets many struggle with the rapid introduction of new, alternative payment methods. The continuous evolution is putting a pressure on the kind of customer experiences the merchants provide.

The final issue is the cost. Obviously there's a margin in holding and supporting multiple payment methods.

{CF_IMAGE}

Balaji Natarajan is Head of Payments and Cash Management Products, Asia at ANZ

Illustrations provided by Chris Kelly, corporate caricatures & illustrations.

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

-

-

-

-

anzcomau:Bluenotes/technology-innovation,anzcomau:Bluenotes/Banking

INFOGRAPHIC: Asia’s fintech feast

2018-04-16

/content/dam/anzcomau/bluenotes/images/articles/2018/April/Payments_thumb.jpg

EDITOR'S PICKS

-

We sit down with Chris Boncimino, Visa’s head of innovation, to chat about cryptocurrncies, QR codes, plastic cards, cash and all the other ways to pay.

21 March 2018 -

Once upon a time, fintech meant revolution – but it’s now part of the financial mainstream.

10 January 2018