-

Ahead of ASEAN’s Special Summit in Sydney this week, here are five charts which look at the future of agriculture in the ASEAN region.

ANZ research shows arable land across the region is beginning to peak.

"ASEAN has always been an important agri trade partner for Australia, even more so than China.”

Agri-land area makes up 30 per cent of total land area in the ASEAN region which in turn makes up 30 per cent of the world. These peaks may lead to an incremental increase in production due to technological investment.

Importantly, the relatively low percentage of agri land, compared to the world average, and to Australia, is a further sign of the growing food import needs of the region.

{CF_IMAGE}

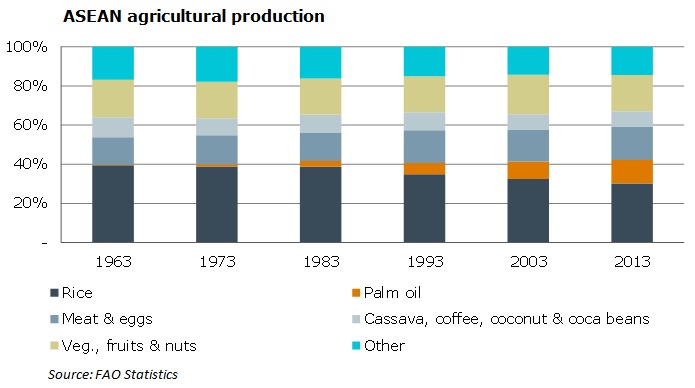

ASEAN agriculture is largely concentrated on rice production. Rice's gross value share of total agriculture production varies widely, including 25 per cent in the Philippines to 60 per cent Cambodia.

Malaysia remains a key exception with the majority of its agri production concentrated on palm oil.

{CF_IMAGE}

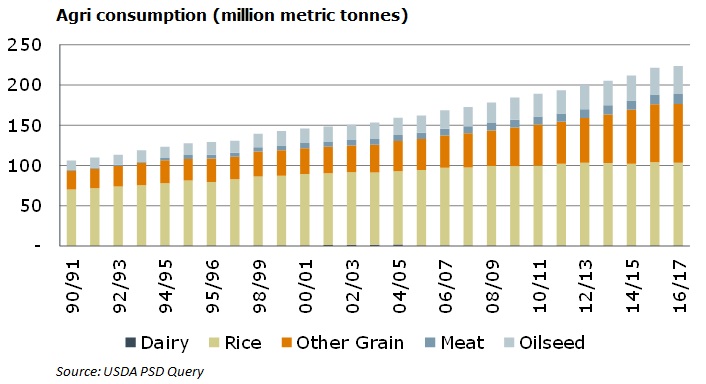

Agri consumption in ASEAN includes grains, dairy, meat (such as beef, pork and poultry) and oilseeds. Consumption of these products was estimated at 223 million metric tonnes in 2016/17.

ANZ research forecasts ASEAN agri consumption to grow to 285 million metric tonnes by 2024/25 – a growth of 62 million metric tonnes or 28 per cent. Around 60 per cent of this increase will be driven by income growth, whereas population growth will account for 40 per cent.

Rice remains the popular choice of grains, while wheat and corn consumption continue to gain share – wheat consumption has increased at 6.2 per cent per annum while corn consumption has increased at almost 5 per cent per annum.

Meat consumption is also expected to continue to rise, dominated by poultry (55 per cent), pork (38 per cent) and beef (7 per cent) in 2016/17, an increase of 4.5 per cent per annum since 2000.

Dairy product consumption grew at the lowest rate of 0.4 per cent, although growing health awareness is anticipated to stimulate growth at a higher rate in future.

{CF_IMAGE}

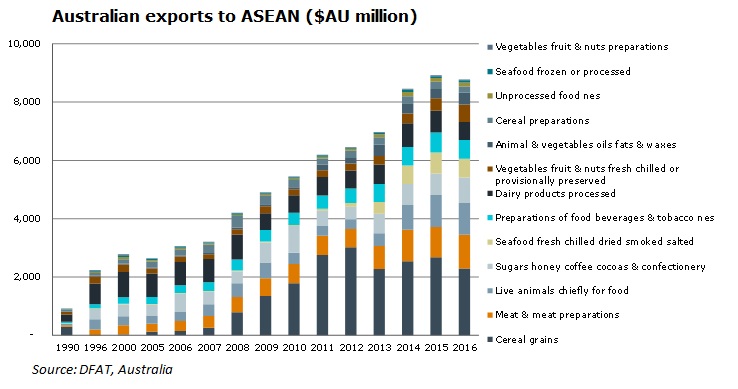

Rising populations and income levels are driving diversity in food consumption. On the back of this, Australia’s agriculture exports to ASEAN countries have increased by 216 per cent since 2000.

The proportion of these exports made up of grain, meat and live animals is around 52 per cent, which is up from 24 per cent in 2000.

Other key exports, such as meat and live animals exports remained nearly same. There has, however, been a notable decrease in dairy products exported to the region which is in line with stagnant consumption across the region.

{CF_IMAGE}

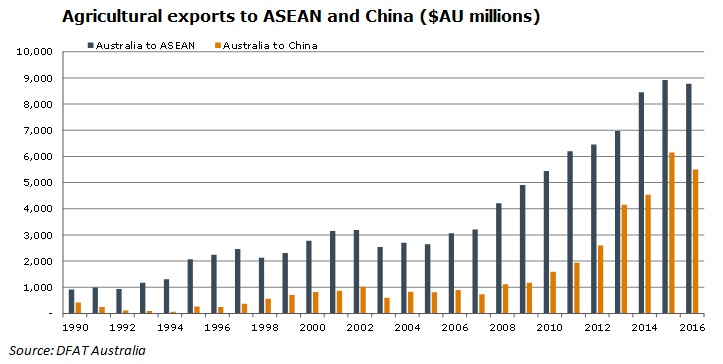

ASEAN has always been an important agri trade partner for Australia - even more so than China.

Australia’s exports to ASEAN are fairly comparable to that of China with exports including grains, meat and meat products and a small portion of dairy products however ANZ research indicates there is a broader diversity of export products to ASEAN.

Seafood, fruits and vegetables are among the key exports to ASEAN, followed by unprocessed foods, cereal preparations and preparations of food, beverages & tobacco.

{CF_IMAGE}

To read more insights into the ASEAN Special Summit click here.

Michael Whitehead is Head of Agri Insights at ANZ

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

-

-

-

-

anzcomau:Bluenotes/asia-pacific-region,anzcomau:Bluenotes/global-economy

ASEAN’s agri imports and exports in five charts

2018-03-15

/content/dam/anzcomau/bluenotes/images/articles/2018/March/ASEANWhitehead_banner.jpg

EDITOR'S PICKS

-

Australia is looking to shed its quarry or farm-based image at ASEAN as it prepares for a very different future.

13 March 2018 -

We bring you views and insights on what lies ahead for the ASEAN-Australian Special Summit.

15 March 2018