-

Global growth is in better shape. This is good news and will benefit small open economies in Asia, Australia and New Zealand. But I'm not convinced it's in substantially better shape.

Certainly with rates of growth still relatively low from a historical perspective it’s unlikely to be sufficient to bail us out of some of the difficult structural issues many countries are facing.

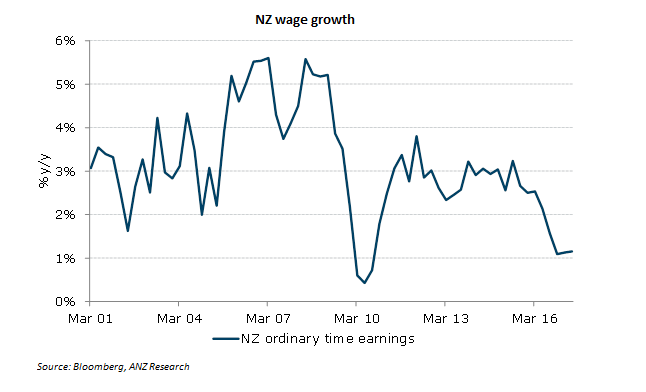

Compounding the urgency of these issues is wage growth in virtually every advanced economy is unusually weak. While a range of explanations present themselves, most are incomplete and often have a high degree of country specificity.

"In effect, the average worker is getting a shrinking slice of a barely expanding pie.” - Richard Yetsenga

Even in NZ, where economic fundamentals are very strong, wage growth is struggling. Common sense suggests the explanation must have a common global driver or explanation.

{CF_IMAGE}

Some sort of long-lived effect from the financial crisis is where many of the explanations have come from. The supportive evidence however is often patchy and most resulting explanations are very country-specific.

The other potential common explanation of course is technology. This certainly resonates with the scale of change we are seeing.

The implication

It may be what we are seeing with inflation and wages across a number of advanced economies is some slightly unusual wrinkles in an otherwise pretty regular economic cycle. Alternatively, there is accumulating evidence suggesting fundamental technology driven changes are occurring.

We need to take this possibility seriously. If the evidence continues to unfold in a manner consistent with it, the implications are widespread and significant.

• Cycles in wages and inflation will be more muted. Top-line economic growth will continue to accrue more to capital than to labour and the structural adjustment driven by the underlying dynamics will keep the aggregate wage bill down.

• The monetary policy focus in many advanced economies will therefore be more on macroprudential policy and managing the leverage cycle rather than rates and inflation.

• Competition (anti-trust) policy will become an increasing policy focus as industry concentration rises. It must also be acknowledged the speed and scope of change make the policy challenges here particularly significant.

• The sense of dissatisfaction voters hold towards their elected representatives will likely persist. This has tended to result in conflicting situations. On the one hand it has often resulted in votes for non-mainstream politicians and on the other a rising demand for equity to be a more mainstream policy focus.

• At the same time, with cyclical policy largely out of commission in most economies economic reform remains an under-focussed and under-delivered arm of policy.

The second half

A parable in the book The Second Machine Age helps describe the scale of change we are seeing.

In sixth century India the inventor of chess is asked to name his own reward. He asks for a grain of rice to be placed on the first square of the chessboard, with the number of grains on each subsequent square doubling the one before.

At the end of the first row there are 128 grains of rice; the second 33 thousand; the third 8.4 million and so on.

There are two messages from this sequence: (a) the grains increase extremely quickly; but (b) the initial squares hold a number we can easily relate with.

In the second half of the chess board however things change. Large numbers are doubling over short spans of time. The numbers get so large we find them difficult to grasp.

The last square, for instance, holds nine quintillion grains of rice. This exponential growth mirrors the change in computing power we have seen for more than 50 years.

We are now in the second half of the chessboard. In that portion of the game, things happen which are difficult for us to conceptualise and they happen at a speed which fundamentally challenges our thinking.

Impact

For the technology explanation to hold water we need to be able to identify broad-based shifts in the structure of the economy. Evidence of this is starting to emerge.

The IMF in July published a study on the declining share of income accruing to labour against capital. The study found the decline in the labour share was very widespread and common across most US states and industries.

Specifically, it suggests 90 per cent of the decline is due to a fall in the share within industries and states, with only 10 per cent due to changes in industry structure.

A second study from MIT and the NBER using data since 1982 found industry concentration has risen over the last 40 years, creating ‘winner-takes-most’ sectors.

Superstar firms don’t pay less (in fact they may pay more) but wages at these firms represent a smaller share of sales revenue. The labour share at the average firm hasn’t changed much. In effect, the average worker is getting a shrinking slice of a barely expanding pie.

While these two recent studies focus on the US, the evidence they provide is sufficiently general it likely has broader applicability.

Of course it’s conceivable a force other than technology is driving these trends. Consider though technology businesses more often present increasing returns to scale rather than the diminishing returns economics teaches us are the norm.

As a consequence increasing industry concentration across a range of sectors supports the idea of technology as a driving force. In virtually all the models tested the influence of global factors never exceeded technology.

Given the speed of technological change, the scale of its adoption and the resulting ability to disrupt (as we see in the second half of the chessboard), should we really be surprised if evidence continues to accumulate that macro relationships are being redrawn?

Richard Yetsenga is Chief economist at ANZ

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

anzcomau:Bluenotes/Economics,anzcomau:Bluenotes/global-economy

Wages, tech and the other half of the chessboard

2017-08-10

/content/dam/anzcomau/bluenotes/images/articles/2017/August/YetsengaWages_Thumb.jpg

EDITOR'S PICKS

-

Retailers are doing it tough but consumption in Australia is not what it seems.

1 August 2017 -

Trucking needs $A3.5 billion in new capital over the next five years. Where will it come from?

9 August 2017 -

Industry must remain focused on export opportunities, high-quality products and international competitiveness.

7 August 2017