-

So is that it for the financial technology boom? Is fintech finis? Are all those elevator pitches to be the Uber of banking Ober?

The latest and closely watched KPMG Fintech Year report suggests the peak is certainly passed.

"Success in fintech now is increasingly discussed in terms of which major incumbents are coming on board."

Andrew Cornell, BlueNotes managing editorBut equally, looking more closely at this and other data suggests the fintech cycle is following a rational path: the exuberance and fantasy of total disruption is passing, the reality of fintech being absorbed into – while transforming – the existing universe is emerging.

Success in fintech now is increasingly discussed in terms of which major incumbents are coming on board rather than which fintechs are going to kill off the dinosaurs.

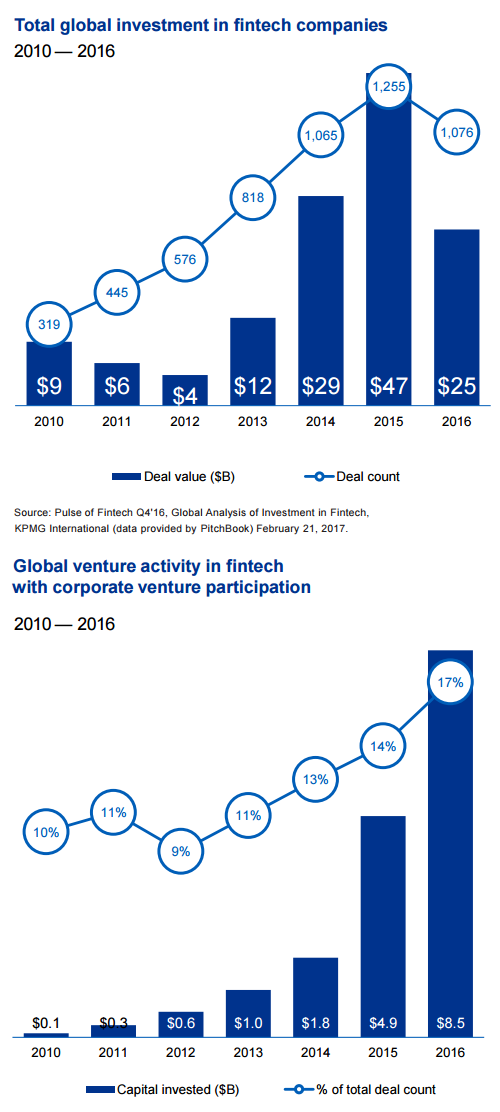

According to KPMG, globally fintech funding fell 47 per cent to $US25 billion in 2016 from $US47 billion in 2015. US fintech companies and deal activity plunged by more than 50 per cent to $US12.8 billion in 2016 from $US27 billion in 2015. Valuations of late stage fintechs averaged $US151 million – 40 per cent down on 2015 and 25 per cent on 2014.

Huge swathes of would-be disruptors will themselves be disrupted by a funding squeeze. Reports of fintech’s demise may be exaggerated but the rude, youthful health of even 12 months ago is definitely starting to wane. Except in one crucial sector – and it’s a sign of where the sector, not surprisingly, is heading.

Highest level

According to KPMG, Corporate Venture Capital activity (on a deal count basis) crept to its highest level ever at 145 deals in 2016. This represents an increase from 135 deals in 2015 and 107 deals in 2014. Since 2013, CVC activity has grown from $US1 billion to $US4 billion annually.

The re-direction of the fintech assault, from competition to cooperation, reflects the reality of incumbency: banks, life insurers and other financial services institutions sit behind scale, capital and, typically, regulatory clearance. These are tough barriers for insurgents to break through.

What existing players are looking for however is innovation and efficiency.

As KPMG noted, given the various mandated global agendas, whether they be in payments, regulation or open banking, “2017 is expected to put a global spotlight on fintech that can leverage open banking and API platforms”.

“This spotlight will likely bring increased investor interest in complementary technologies, such as data and analytics,” KPMG said. “Among corporate investors, artificial intelligence will likely be a hot area for investment. Most banks are keenly interested in finding ways to reduce costs and see AI as a key mechanism to achieve this objective.”

Outside of the established financial services sector, KPMG sees the impetus is likely to come from large, non-banks – Google, Facebook etc – and notes China-based Alibaba Group is targeting promising fintech companies as a means to expand globally.

Celent, another specialty consultancy, noted in a series of reports on Banks, Retailers and Fintechs, that while banking is changing, banks will not disappear - at least not all of them.

“Today’s smartest banks will figure out a way to stay relevant for their customers,” the firm said.

“Some of today’s disruptors will become banks. Retailers, Fintech, and banks will acknowledge the value they each bring to the relationship and will learn to collaborate effectively.”

Partnerships

Speaking at a business forum last week, ANZ’s head of Institutional Banking Mark Whelan made exactly that point, arguing the traditional isolationism of banks needed to shift to acceptance of new partnerships with not just technology providers but platforms.

“To gain a foothold in the market, increasing numbers of foreign businesses are looking to sell goods into China through rapidly growing payment platforms belonging to Chinese giants like Alibaba and Wechat,” he said. “Australian banks must accept and embrace that or be left behind.”

The potential of partnerships is increasingly recognised. BNP Paribas’ head of international payments Bruno Mellado says “banks also play an essential role in supporting the development of fintechs’ client base and bringing their extensive data, network and liquidity to support them in a win-win combination”.

“Banks and fintechs must also work towards a business model capable of benefiting both parties, under which banks can take a stake in fintechs to support their scalability and sustainability.”

That the fintech revolution has evolved in this way shouldn’t surprise. History tells us incumbents are far more likely to recognise and absorb true revolutionaries than ignore them. Before Kodak had its moment it adopted Polaroid’s instant photo system (and was successfully sued by Polaroid).

More obviously, when the non-bank mortgage originators in Australia began to win significant market share off the banks in the 1990s, using securitisation to gain a pricing advantage, the banks initially adopted the same business model and eventually bought the major players.

Today the liveliest discussions in fintech are around how to be bought by banks. Celent recently released another series of reports under the headline “How to become a trusted partner of a bank”.

Moreover, and again as is typical as hype gives way to history, fintech is becoming more specialised, its various components better understood.

As the financial technology blogger Chris Skinner says “there is RegTech for Regulatory Technologies; WealthTech for Wealth Management Technologies; InsurTech for Insurance Technologies; and so on”.

“Then FinTech has also gained subcategories like Lending, Analytics, Digital Identity, Cybersecurity, SME Finance, Financial Inclusion, Payments, Roboadvice, Blockchain Distributed Ledgers, Neobanking and more,” he adds.

“Then there are also some generic technologies around Cloud, the Internet of Things, Artificial Intelligence, Machine Learning, Biometrics and others that are also creating FinTech themes and impacts.”

This evolution is being accelerated by the market forces evident in the funding surveys like KPMG’s – there is less money out there to fund ideas. And the money that is out there is not looking for another Uber or AirBnB, it’s looking for specific solutions like Atlassian.

Some in the venture capital community have already moved on: “the reality is the current fintech ideas are not revolutionary - they are improvements at the margins and they do not capture enough customers to create critical mass - an essential for success in any retail bank/payment product”, one veteran fintech investor told BlueNotes.

“Who will destroy retail banks or Visa and Mastercard ? Who is really trying to do this?” he asks.

“The whole P2P sector? Nothing - with one or two exceptions, those that remain faithful to the original model of matching individual consumers. The problem? This is very slow and doesn’t sit well with investors.”

“Currently they offer nothing different than existing lenders only trading on the appeal of anti-bank.”

Fintech will – and already has – made a difference. But it increasingly happening inside the castle walls, not outside. Maybe fintechs are Trojan horses… probably not.

Andrew Cornell is managing editor at BlueNotes

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

EDITOR'S PICKS

-

Touted as a revolutionary technology, blockchain is a shared, immutable ledger which can be used across various industries to record transaction histories, thus building trust through accountability and transparency.

9 March 2017 -

It’s no surprise digital technology and regaining community trust are key themes for banks globally but the two overlap in a third, vital area: financial inclusion.

23 February 2017 -

Trust is the word of the moment in banking: can customers trust banks? Can society? But banking has always been fundamentally a trust business: when neither borrowers nor lenders know one another well enough, they trust a bank to act as an intermediary.

28 February 2017