-

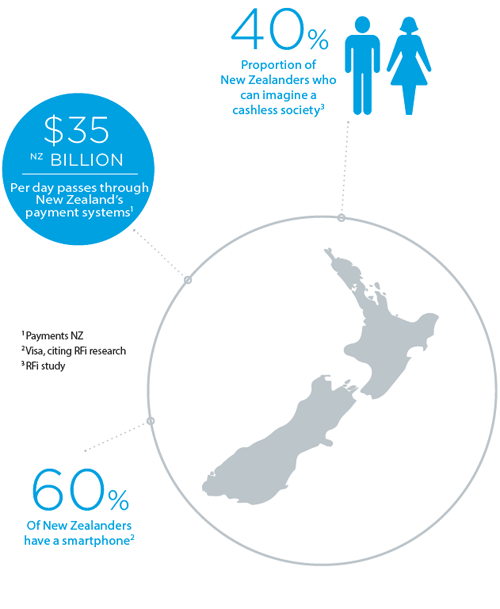

The decline of cheques, the move to a cashless society and the increasing use of smartphones are just some of the trends sweeping the payments world –and on a global scale, New Zealand is ahead of the curve.

Because of its relatively small population and strong adoption of the latest technologies, New Zealand can be seen as a testbed for the latest payments innovations.

" The payment stage of a daily habit… is becoming so easy people don’t even think about it."

Andrew Kershaw & David Tyrer, Head of Payments and Receivables & Director of Digital Channels, ANZ NZ

Kiwis began paying with Apple Pay last year, which shows how nowadays smartphones can be used for almost anything.

The payment stage of a daily habit – like grabbing a coffee or buying a newspaper – is becoming so easy people don’t even think about it.

This is just one step in the evolution of payments becoming faster, more transparent, and ultimately cheaper.

Behind the scenes, in the plumbing underpinning New Zealand’s payments system, other changes are underway to lay the basis for future innovation.

INITIATIVE

The ‘cleared funds initiative’ is now live, which means banks check money is in an account before sending an electronic payment.

This removes the scenario where a payment could be sent, received by the beneficiary, and then dishonoured by the sending bank because there is not enough money in the sender’s account.

Additionally, New Zealand’s banks have introduced changes which mean scheduled – or regular automatic payments – are sent earlier in the day, and settlement occurs at more regular intervals between the banks.

This brings New Zealand closer to real-time, or immediate, payments where the time lag between sending a payment and the receiver actually getting paid is getting shorter.

As many markets around the world move to real-time payments , New Zealand has less of a jump to make because it is already close to real-time.

We are seeing more businesses beginning to think about how they can reflect payments they receive into their own systems during the day.

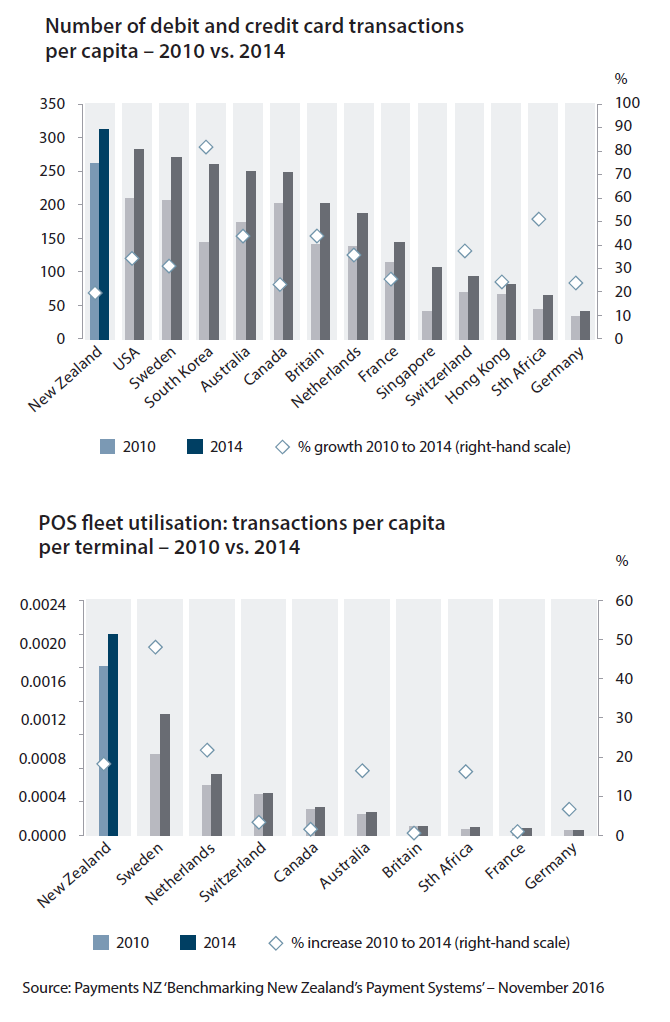

In fact, the payments system in New Zealand has been built on efficient foundations and the payments market is a world leader in many respects.

{CF_IMAGE}

Because of its efficient foundations, New Zealand is well placed to take advantage of the latest developments, whether it is real-time payments or trialling blockchain and distributed ledger technology.

This innovation will have consequences for consumers and businesses. How people are paying for goods and services is changing, and companies need to adapt to make the most of the opportunities this brings.

Faster payments mean people will receive their money quicker, which means people will have to adjust accordingly.

If payments are being settled throughout the day, a company’s systems will also need to keep pace. Accounting systems, for example, need to be able to show the money as it comes in.

There are positive reasons for adapting and staying ahead of the latest payments trends. Because of the nature of the payments infrastructure, New Zealand is well positioned to embrace this wave of innovation.

Andrew Kershaw is Head of Payments and Receivables, New Zealand and David Tyrer is Director of Digital Channels, New Zealand at ANZ

To read the Payments Innovation: New Zealand Gears Up for Change report, click HERE

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

EDITOR'S PICKS

-

When Shijin (Sking) Zeng, founder of one of Auckland’s largest online shops iFurniture, decided to move to New Zealand he dreamed of setting up his own business.

30 January 2017 -

The world is going cold on cash. Successive moves by global governments to consider or act on a reduction of banknotes in a bid to, among other things, clamp down on illicit purchases. Digital payment methods are of course the beneficiaries.

16 February 2017 -

In one of those frequent and much-looked-forward-to moments – apart from by his minders – when former National Australia Bank chief executive Don Argus went off script, he described his fellow Australian banks as “jelly backed” for ceding their domestic credit card monopoly to international schemes Visa and MasterCard.

17 January 2017