-

The seemingly inexorable trend towards a cashless society continues as contactless payments and mobile wallets replace cash in consumer commerce and real-time payments occur deeper and deeper into the world of small as well as large business.

But the path of evolution is punctuated rather than continuous. And cash is proving remarkably resilient.

"The path of [payments] evolution is punctuated rather than continuous."

Andrew Cornell, BlueNotes managing editorNevertheless, the changes wrought by digital transactions to the financial system are significant – and not always obvious.

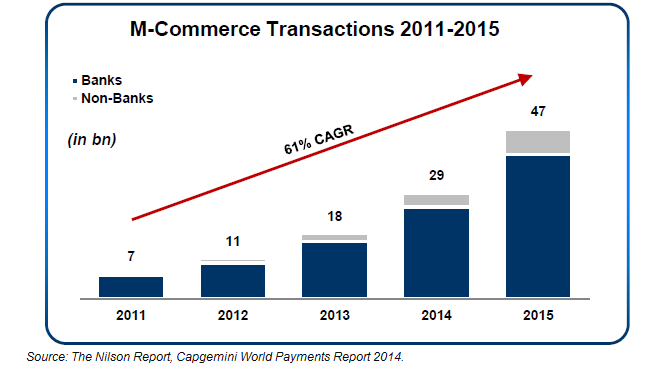

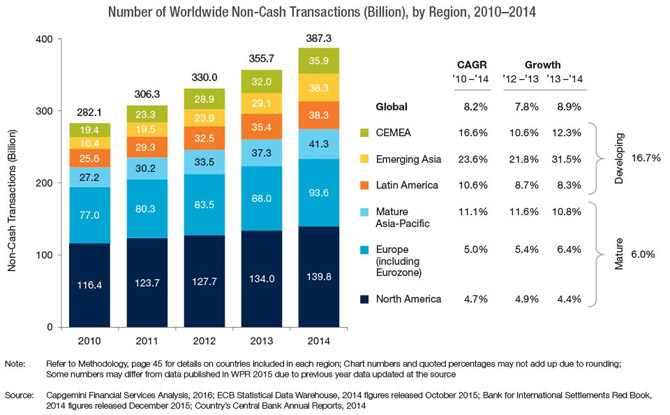

According to the latest Cap Gemini World Payments Report, global digital payment volumes are projected to top 10 per cent annual growth in 2016. The data show 426.3 billion digital payment transactions were made in 2015, up from 387.3 billion in 2014.

{CF_IMAGE}

Developing markets experienced the highest growth rates in digital payments at 6.7 per cent – in part because of the problems with cash in those markets.

However in the developing world, cash as a share of GDP actually rose, particularly in Europe and the US Cap Gemini attributes this to the utility and ‘cost-free’ nature of cash however other work shows large denomination bills distort the use of cash data and, with negative interest rates, cash is more attractive as a store of value. It is also attractive for tax avoidance and illicit finance, unfortunately.

Moreover, in markets with policy and market structures favourable to digital payments, such as Sweden, cash as share did decline.

THE WAY FORWARD

Contactless payments have been a huge driver of the shift away from cash for smaller value transactions in markets like Australia where cash was once favoured for payments under $A20.

The advent of mobile wallets, particularly device generic ones like Apple Pay and Android Pay, is likely to accelerate this trend.

Precise data is not yet available and it should also be recognised that mobile wallet contactless transactions will initially replace contactless card transactions – as users are comfortable with the technology – rather than convert cash users.

Phil Gomm, Banking Practice Lead at Capgemini Australia, believes Australia is poised to enter a period of “digital wallet transformation” although security remains an issue. In Australia 8.7 billion non cash transactions were made in the 2014/15 calendar year, placing Australia in the top five globally for non-cash payments per capita.

Gomm thinks collaboration between fintechs and banks will be particularly fruitful with smart phones “bringing increasingly seamless payment processing solutions to consumers”.

He sees a shift from the concept of ‘card-present’ transactions, where the card is presented physically at point of sale, to what he calls the new idea of ‘card-holder’ present – when a payment is confirmed through the use of smart device access verification via biometric and PIN options.

{CF_IMAGE}

The World Payments Report noted “cards remain the fastest growing digital payments instrument since 2010, while cheque usage continues to decline. Immediate payments have the potential to drive growth in digital transactions as an alternative to cash and cheques but efforts are needed to educate stakeholders, provide more value-added services, and upgrade infrastructure at merchants and corporates.”

The trends towards less cash are clear in the longer term yet uncertain in the short to medium.

While mobile wallets such as Apple and Android Pay are high profile, the over-arching penetration of such wallets is still shallow.

Some markets – notably the UAE and Singapore – have seen wallets widely adopted but typically online payments growth has been most successful in integrated sites like those built into Amazon, Uber and AirBnB.

Where digital consumer payments are not integrated – the case for much of the US for example outside sites like Amazon – the fragmented nature of terminal standards and merchant uptake means contactless cards, let alone smart phones, are far less prevalent.

For example, the latest data on US Card and Electronic transactions shows a total of $US9.4 trillion in 2015 while mobile comprises just $US47 billion, 0.5 per cent of total transactions, a decade after wallets were launched. Mobile makes up 3.5 per cent of US retail spend.

While this is changing as new apps and protocols enter the market, and more major banks and merchants enter the field, the challenge according to industry insiders is mobile wallets are perceived as clunky and insecure – for example, the perception smart phones are easy to hack – even when the reality may be different.

Some analysts are more bullish: The Accenture/MOBGEN report The Mobile Payments Landscape and its Opportunities found the global market for mobile payments in 2014 was valued at $US329 billion.

The report forecast compound annual growth of over 23 per cent over the next five years, taking the total market for mobile payments up to $US2.9 trillion by 2020. Meanwhile, processes such as contactless attach themselves to established systems such as plastic card payment.

{CF_IMAGE}

{CF_IMAGE}

HAS CASH A FUTURE?

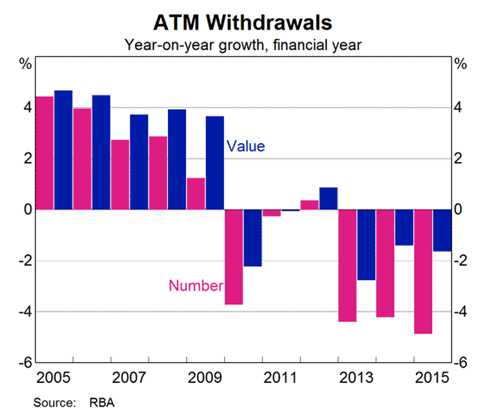

Cash endures. Comparing data from the Reserve Bank of Australia, two opposing trends appear to be taking place. ATM withdrawals, the standard proxy for cash use, are declining. The proxy is accurate because in order to have cash to use, people either need to go to a bank branch, get cash out with an Eftpos transaction or use an ATM. ATM data work well.

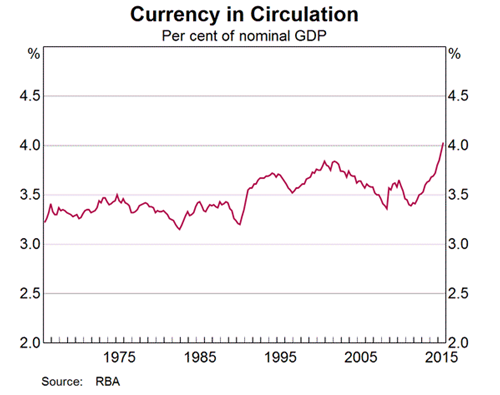

The RBA has also seen a surge in currency in circulation. What is happening here is ‘circulation’ is probably a misnomer – what is happening is more cash is simply being held as a store of value rather than a means to transact.

Tony Richards, the head of the RBA’s Payments Policy Department argued in a speech earlier this year cash “continues to have an important role as a store of value and there is some evidence – from demand for larger denomination notes – that this increased following the global financial crisis”.

“So, despite the decline in use in transactions, cash is likely to remain an important part of both the payments system and the economy more broadly for the foreseeable future,” Richards said.

“In particular, significant parts of the population appear to remain more comfortable with cash than with other payment methods in terms of ease of use for transactions or transfers, as a backup when electronic payment methods may not be available, or as an aide for household budgeting.”

The implications of cash versus digital payments go beyond the point of sale or smart technology. There are already signs of impact on bank balance sheets.

The more consumers leave cash in their accounts and deplete it piecemeal, via many small transactions, the less they debit their accounts in larger blocks. They don’t take $200 out in one go – debiting the account all at once – but take out $11.50, $3.50, $4.80, $15.60 and so on over time. The result is higher average account balances.

This is good for banks – they retain access to valuable deposits – but it is also better for consumers. While interest rates on transaction accounts are low, they exist. They don’t on cash withdrawn which, while it has a face value which can be transacted, is actually not worth the paper or polymer it is printed on when in a purse. Money in accounts is not lost or stolen either.

While for individuals this value is small, in aggregate for the banking system it will be significant as less cash is taken out in large amounts.

Andrew Cornell is managing editor at BlueNotes

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

-

-

-

EDITOR'S PICKS

-

I often hear about the fourth industrial revolution, the one in which digital, fintech and other disruptive innovations are creating a moment akin to when horse and carriage companies had to adjust to the launch of the motor car.

16 August 2016 -

Every day, payment disruptors and competitors across the globe are reminding banks the cross-border payment industry is ripe for rejuvenation, promising faster and lower cost alternatives to the current international payment process. Customers expect more and banks are investing to meet and exceed those expectations.

26 September 2016 -

What finally sees off an ageing, ailing business model is not always the most obvious threat. In journalism, for example, the end of print newspapers may not come just because Facebook or the iPhone are now what is read on trains.

30 August 2016