-

Does China have a bad debt problem? Well, corporate debt levels in the country have risen and are higher than the global average. But it’s not quite as simple as that, with some factors unique to China which should be considered.

" At a time when China’s growth and inflation are slowing, nominal GDP growth is not keeping up with the pace of credit expansion."

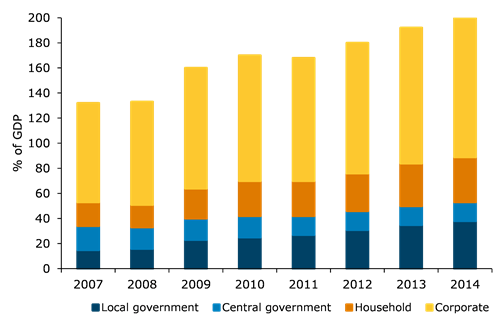

Raymond Yeung, ANZ Acting Chief Economist Greater ChinaIn early May the People’s Bank of China Governor Zhou Xiaochuan warned high levels of corporate debt could become a macroeconomic risk in the country. At ANZ, we estimate China’s total corporate debt was RMB98.2 trillion ($US15 trillion) by the end of 2015, equivalent to 145.2 per cent of the GDP, which is higher than the current US mark of 70 per cent.

{CF_IMAGE}

At a time when China’s growth and inflation are slowing, nominal GDP growth is not keeping up with the pace of credit expansion. So concerns are understandable.

China’s debt by sector

However

But it’s wrong to judge the risks of China’s loan problem by size alone. As China is still a medium-to-high growth country, high corporate leverage is needed to support investment. Given its rapid urbanisation process China requires intensive capital expenditure and higher-than-normal debt levels.

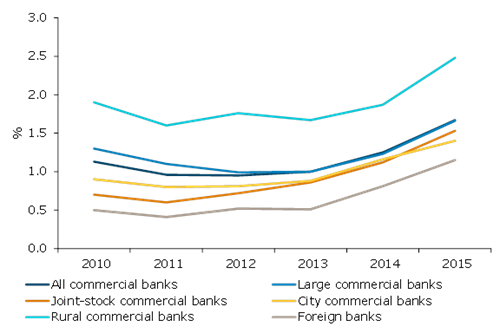

China’s rising non-performing loans (NPL) offer an insight into whether funds have flown into productive assets. China’s NPL ratio rose to 1.67 per cent by the end of 2015, the highest since 2009.

But that’s also not alarming, given in Premier Zhu Rongji’s (who rolled out reforms to China’s state-owned enterprise sector) time it sat at 35 per cent.

NPL ratio by types of banks

In ANZ’s view, China’s more pressing loan problems are structural. Large banks have their NPLs at about 1.7 per cent while the ratios of rural banks approach 2.5 per cent. Both are higher than other banks in China, especially when compared with foreign banks which embrace commercial principles.

Not a solution

Debt-equity swaps won’t solve the problem. Converting debt into equity would be required only if China’s NPL rises to an alarming level.

China regulators need to create a level playing field as foreign banks manage NPLs comparatively well. Re-labelling debt as equity won’t improve the quality of credit decisions.

The use of debt capital markets will help address the structural problem in China’s debt portfolio. Direct financing will enhance the transparency of the lending market and promote transferability of loan assets. These and other factors of system evolution are clear from ANZ’s Caged Tiger report.

The market size increased 107 per cent between 2011 and 2015 and the share of corporate bonds has risen from 16 per cent to 27 per cent. Shifting the funding model from bank loans to bonds will facilitate a proper valuation of loan assets.

Allowing foreign financial institutions to participate in the onshore bond market will also help quicken the development, by bringing in quality investors and foreign practices.

Raymond Yeung is Acting Chief Economist Greater China and Cecile Wu is Head of REI China at ANZ

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

EDITOR'S PICKS

-

China’s economy is changing and it’s hard to tell where it will end up. To try to find out, BlueNotes spoke to CEBM/Caxin Insight Group chief economist Minggao Shen on video in Hong Kong.

6 June 2016 -

Climate change is now widely recognised as presenting potential financial risk. Investors and other financial agents must decide exactly how they respond and take advantage of the opportunities which might arise.

7 June 2016 -

Similar to many of my peers – if I haven’t been dragged to the shopping malls - I buy almost everything online. Thanks to China’s rapid development in the internet age, this is now really a breeze.

16 May 2016