-

In the 1950s, Australia’s prolific global reputation as a world-class wool producer united a country and we rode on the sheep’s back into post-war economic prosperity.

"While the Chinese market is cooling in the short term, now is the time to saddle up."

Andrew Roseby, Agribusiness regional executive, ANZProducers of today however – many whom have ridden ups and downs since then– would certainly conclude reputation alone isn’t enough to guarantee future growth in wool and sheep meat.

Key components beyond reputation include strong industry insights and innovation, all wrapped up into an inspiring vision of a future where our producers are empowered to contribute to the expected $A100 billion worth of agri exports by 2030.

In Western Australia, sheep producers have been the beneficiaries of a buoyant market for lamb and strong price rises for wool in recent times.

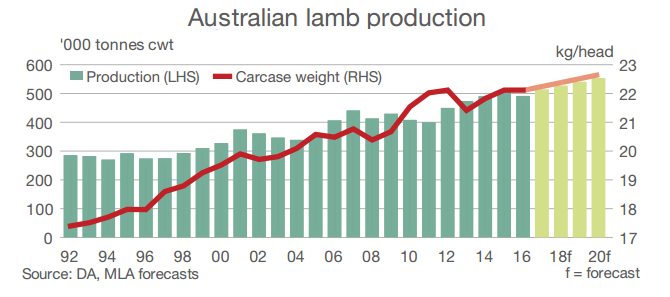

According to the latest Meat & Livestock Australia Sheep Industry projections, Australian lamb exports in 2016 are forecast to be fairly steady with the past two years, at 235,000 tonnes shipped weight, before gradually growing with production to 280,000 tonnes shipped weight (swt) by 2020.

{CF_IMAGE}

Despite historically low flock numbers, drought conditions in some areas and increasing costs, sheep farmers are seeing returns trend higher.

The challenge ahead will be riding out the mixed short-term outlook and preparing the industry to capitalise on long-term opportunities.

According to the MLA, in a “surprising result” the MLA and AWI wool and sheepmeat survey indicates as of end-February 2016, the Australian breeding ewe flock lifted 3 per cent from 2015 levels, to 42.0 million head.

This has underpinned the upward revision in flock, slaughter, production and exports, especially in 2016 and 2017.

“The rise in the national breeding ewe flock was largely driven by a 5 per cent increase in NSW (15.5 million head) – particularly across northern NSW and the Monaro region – although numbers in Victoria, Tasmania, WA and Queensland were also higher year-on-year,” the MLA said.

In the West and across the country, there is opportunity now for a focus on rebuilding sheep numbers, an increase in attention on the premium end of the wool and meat market, and innovation around value proposition for the wool clip onshore.

FLOCK NUMBERS & GENETICS

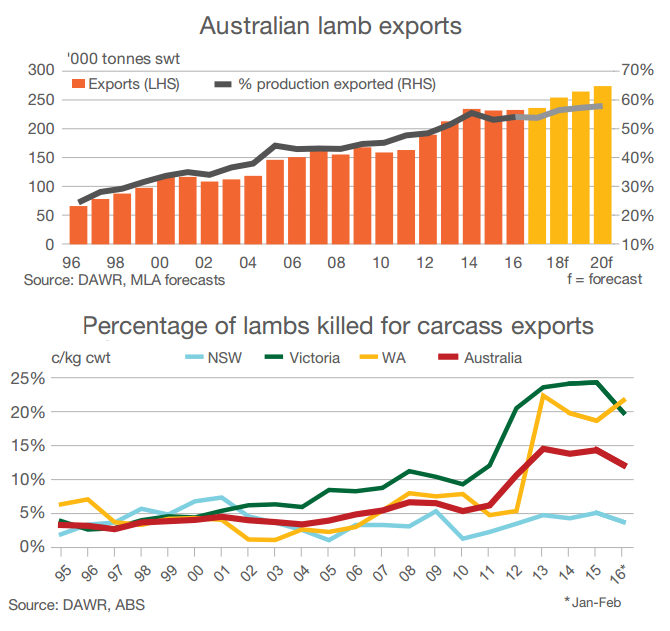

The key to the future of this industry lies with flock numbers and genetics, especially considering – despite the recent surprising data - both the MLA and Australian Wool Innovation predict flock numbers nationally will decline in 2015-16 due to drought and poor pasture conditions across much of the country.

In Western Australia alone, the flock number is expected to decline from 14 to 13 million based on a high turn-off rate and average lambing rate. When these numbers turn around by 2019, it will be due to better genetics and farm management techniques.

{CF_IMAGE}

Innovation, farm management and genetics should play a central role in our planning with the aim to bring a better product to market in higher volumes, which will in turn generate greater efficiencies and increased profitability.

Through the carrying of this mantra, we will ensure we’re ready and able to supply the increasing demand for niche ‘luxury’ sectors of fine wool garments and premium lamb that rising global incomes bring.

It is no surprise a large chunk of this demand comes from China, the most important market for both Western Australian wool and lamb.

It’s important to note though, the largest single market for lamb remains the domestic Australian market. It seems the MLA’s annual Australia Day campaigns are hitting the mark.

WOOL CLIP

When it comes to the Western Australian wool clip, at present China imports 85 per cent with this trend set to continue, only falling slightly due to low national flock and slowing economic conditions in China.

If we can get our numbers, genetics and farm practices right, the future export opportunities are bright.

Australia’s current sheep meat access to the EU comprises a more than 19,000 tonne per year quota with a zero per cent duty which Australian exports fill each year. In comparison, New Zealand has a fixed EU quota of around 228,000 tonnes carcass weight per year which it often does not fill.

So while the Chinese market is cooling in the short term, now is the time to saddle up – get the farm practices right, build the infrastructure and place greater focus on the little things that are going to enable us to do better, with less, for longer and add greater value to our sheep, meat and wool industry.

If we’re able to deliver on this, we may well return to prosperous times like the 1950s and ride the sheep’s back once again.

Andrew Roseby is an agribusiness regional executive at ANZ

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

-

anzcomau:Bluenotes/business-finance,anzcomau:Bluenotes/business-finance/agriculture

Australian lamb: back on the sheep’s back?

2016-06-27

/content/dam/anzcomau/bluenotes/images/articles/2016/June/RosebySheep_Thumb.jpg