-

Across the wider payments industry we are at a special moment in history. There is a confluence of secular trends converging in the right way at the right time. These include:

" [Visa is] opening our front door and providing open access to anyone – banks, merchants, the fintech community, developers and start-ups.

Robert Walls, Head of Product, Visa Australia, New Zealand and South Pacific- Smart connected devices that can perform a function automatically without needing to be prompted by a person.

- Geolocation. There are over a billion smartphone users in the Asia Pacific region, each one of them with GPS functionality and all the possibilities that brings inside their pocket.

- New data processing technology. Increased computing power and analytics capability gives companies the ability to interpret data in new, more valuable ways.

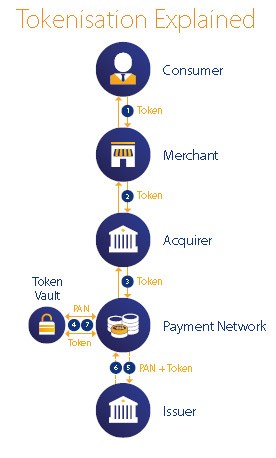

- The evolution of security. Technology like tokenisation enables us to add a layer of security to new form factors for payment.

Looking at these trends together it's easy to be inspired by the potential scenarios for the future of commerce.

This is why at Visa we've launched Visa Developer, a project to make our global retail payments network an open platform that will drive innovation in payments and commerce.

For the first time in our nearly 60-year history software application developers will have open access to leading payments technology, products and services by Visa. Developers will be able to leverage these industry trends to create secure, new payment experiences for connected devices, using geo-location and other new scenarios we haven't even seen yet.

For us, it is a recognition the world is changing, opening up to collaboration.

INFLECTION POINT

It's not just Visa thinking about ways the industry can better engage with the developer community. The inflection point from analogue to digital is not only playing out in financial services but across many industries. Application program interfaces, or APIs, have become the connective tissue in how the most successful companies operate.

Google, Facebook and Twitter each manage billions of API calls every day. If that sounds like a big number, think about how often an app or website integrates with your Facebook profile, or how many times you interact with Google Maps in another app or website, whether you're booking an Uber or browsing local restaurant reviews. It's easy to see the power of APIs.

When we began building the Visa Developer platform, we asked ourselves: how do we foster even more innovation than what's happening today? Our answer is to make it easier for electronic payments to create new experiences for consumers and merchants, more quickly than ever before.

Compare this with the much more controlled and proprietary world we had before.

In the past, we had a very prescribed way to connect to the Visa network and use our services. For example, when banks would get a bank identification number and want to issue cards, there was a very specific way they had to connect to Visa for clearing, authorisation and settlement.

Now, for the first time, we are opening our front door and providing open access to anyone – banks, merchants, the fintech community, developers and start-ups. They can work in our integrated sandbox to pick and choose different capabilities to create a new application. Of course, there will still be a process of certification and meeting commercial rules and conditions before something can be released, because security is one of our highest priorities.

Accessing Visa's APIs – the building blocks for innovation – is now integrated and immediate. In the past, using Visa's APIs had to happen through individual applications. We are now enabling applications to be built from different products at one time to create something unique and very specific to a market or a strategy of a company.

We're excited to see what new innovations emerge from the Visa Developer platform, whether through co-innovation with our partners or independent development. The way we see it is Visa is providing the scaffolding for innovation to happen on top of Visa's network.

We're sure what develops will be exciting and surprising.

Robert Walls is Head of Product, Visa Australia, New Zealand and South Pacific

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

EDITOR'S PICKS

-

The financial services industry in Australia has rightfully earned a reputation around the world for leading the way in innovation, particularly in payments.

30 November 2015 -

In his book The Tipping Point author Malcolm Gladwell provides insights into how trends are sparked and take hold. How what's not becomes what's hot; the case for something going viral; the cause of what some would call a 'WhatsApp moment'.

25 January 2016 -

Decades after the paperless office was first mooted and financial institutions started to talk about the end of cash, both paper and hard currency are still with us.

1 February 2016