-

“For last year's words belong to last year's language

And next year's words await another voice".

- “Little Gidding", TS ELIOTWas 2015 just the calm before the storm? Low interest rates, low inflation, low corporate-default rates (despite rising leverage), declining commodity prices, some deleveraging and increased regulation of the banking sector and low (but broadly stable) asset returns were all present throughout the year.

" With much economic commentary focused on easily observable data such as commodity prices, merchandise trade and manufacturing activity, we may be missing the silver lining."

Sally Reid, Global Head of Institutional Portfolio Management, ANZIt is possible 2016 may look the same but storm clouds are building and the silver lining looks thin. So what lies in store over the next 12 months? Here's five things to watch out for.

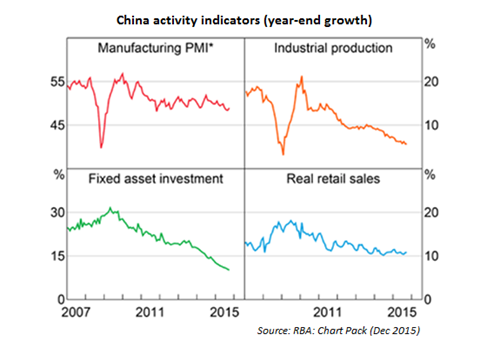

CHINA SLOWDOWN

Markets are currently focused on China's manufacturing and investment slowdown with implications for global trade, growth and potentially the export of deflationary conditions if the currency is further devalued.

{CF_IMAGE}

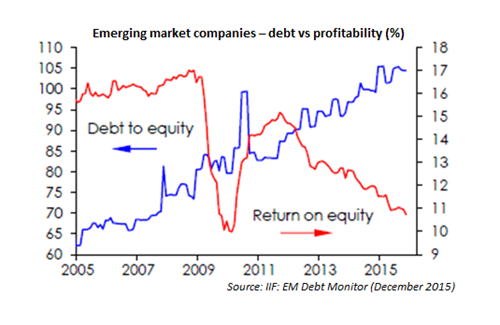

EMERGING MARKETS CORPORATE DEBT OVERHANG

Corporate indebtedness has risen sharply in emerging markets. Company level data on net debt implies “large mining, material and construction firms could face debt servicing difficulties in an environment of slow profit growth and higher US rates" according to theInstitute of International Finance (IIF).

The IIF sees reduced returns on equity and increased debt to equity for emerging market businesses in 2016. Increased corporate risk spills over into the banking sectors via higher capital charges (as ratings deteriorate) and potentially higher default rates.

{CF_IMAGE}

HEIGHTENED GEOPOLITICAL RISK

While much of the conflict in 2016 has been longstanding, the reluctance of the largest economies – US, Germany, Japan and China - to engage in crisis resolution leaves a leadership vacuum which has been exploited by chancers like Russia's Vladimir Putin.

For the Middle East and Europe, terrorism and the unprecedented volume of migration are likely to drive more hard-line domestic political agendas.

Rising tensions between Saudi Arabia and Iran, as well as the potential for 'Brexit' (British exit from the European Union) also loom over the year ahead.

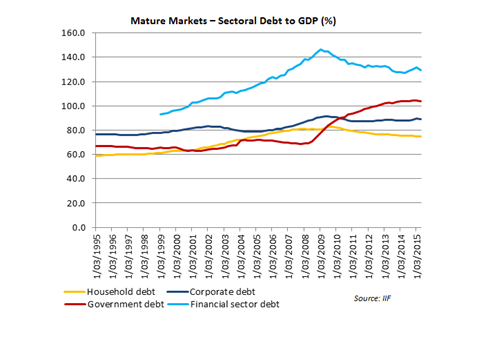

MATURE MARKETS SOVEREIGN RISK INCREASES

Post the global financial crisis, the leverage in the financial sector in mature markets (including Canada, US, Austria, Germany, Eurozone, UK etc) has decreased. However, this has been taken up by government leverage.

In those countries, risk has transferred from the financial sector to the government sector. Government debt to GDP for a number of key countries (amongst others) is now hovering around or over 100 per cent.

The US was 67 per cent in 2007 - now it is 95 per cent. France was 66 per cent in 2007 - now 98 per cent, Italy 102 per cent in 2007 - now 136 per cent, Japan 150 per cent in 2007 - now 212 per cent.

The implications of this increase in government indebtedness could include sovereign rating downgrades, a more limited ability (and willingness) for mature economies to intervene in global conflict situations and a requirement by the European Union for banks to raise capital, including subordinated debt, faster than currently expected to meet new 'bail in' rules to shift the burden from national authorities.

{CF_IMAGE}

PIVOT TO SERVICES – SILVER LINING?

The global economy has three main sectors – agriculture, industry and services. The relative importance of these sectors shifts with the stage of development of an economy.

When, as it has been, the engine of global economic growth is developing countries, a focus on agriculture and industry was key to understanding economic prospects.

However, with countries such as China (as it joins other large developed economies) moving from an industrialisation to post-industrialisation phase, the relative importance of the global services sector (including health, education, entertainment and telecommunications) becomes more of a driver of growth and employment.

If we are witnessing “a compositional shift of (global) GDP to services", as the IMF maintains, then the relative strength of the services sector may offset the relative weakness in industry and agriculture.

With much economic commentary focused on easily observable data such as commodity prices, merchandise trade and manufacturing activity, we may be missing the silver lining.

{CF_IMAGE}

Sally Reid is Global Head of Institutional Portfolio Management at ANZ

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

-

-

-

EDITOR'S PICKS

-

It's been a big year for ANZ BlueNotes in 2015 as we continue to strike to provide you with the best content at our disposal.

29 December 2015 -

The US Federal Reserve has tightened its monetary policy position for the first time in nearly a decade in a move reflecting little change in the central bank’s policy but greater consensus among its members.

17 December 2015 -

As digital technologies continue to reshape financial services, the question of how banks will operate in the future is a hot topic - but, like all crystal ball gazing, it's terribly difficult to get right. There are so many outlets making predictions these days it's inevitable a lot will be off the mark.

23 December 2015