-

Spending a lifetime on a business, especially one you have established, built up and successfully run is an enormous achievement. It takes passion, commitment and resilience. So it is understandable when the time comes to step away it is a life-changing experience.

It's life changing from a financial perspective but also from a personal one as thoughts turn to what is next.

" The costs of getting succession wrong touch on the financial, personal and emotional and can heavily impact the family unit."

Mike Norfolk, Head of Private Banking Australia at ANZ Global WealthSuccession planning is incredibly important in Australia. With more than 70 per cent of businesses family owned it is vital these businesses survive and prosper from one generation to the next.

{CF_IMAGE}

Source: KPMG

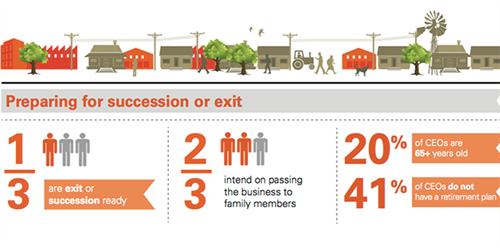

Aligned with Australia's ageing population, an increasing number of business owners in Australia are approaching retirement age and are consequently considering exiting. Some two-thirds of family business CEOs are aged 50 or over and nearly 20 percent are 65 years or older.

Two thirds of family companies intend to keep the business in the family and pass management and ownership onto the next generation in the next five plus years.

These owners have a myriad of issues to consider from changing business needs, succession options, personal financial requirements during and after the event, the emotional commitment during transition and intergenerational wealth transfer.

The costs of getting succession wrong touch on the financial, personal and emotional and can heavily impact the family unit.

Passion and conflict

Business succession expert Denise Kenyon-Rouvinez was recently in Australia as a guest of ANZ to share her insights. Kenyon-Rouvinez is Professor of Family Business Management with the IMD Global Family Business Center based in Switzerland.

After a career working in a number of multinational companies, Kenyon-Rouvinez was drawn to the area of family succession planning for the passion, entrepreneurial spirit and commitment family businesses demonstrate.

As she describes it, when there is a lot of passion and conflict involved the stakes are usually higher.

Kenyon-Rouvinez says succession is not only about preparing the next generation but also ensuring the business is prepared and can weather the unexpected without negative consequences.

The other important point she raised is while succession planning prepares the next generation for the business, what is often overlooked is preparing them for the wealth.

This is a vital piece – wealth can be lost very easily and it is extremely complex to make it last. There is also a lot to lose, with 81 per cent of owners intending to retire in the next 10 years generating a wealth transfer of $A3.5 trillion.

There is also the potential for conflict in succession planning, particularly in businesses transferring from the first to the second generation.

In these cases, the business founder is passing on a business which is essentially entrepreneurial to a team of siblings who need to learn to work as a team while keeping the legacy alive. This is a definite change in leadership style which can have far-reaching impacts, not least on the company's employees.

Conflict however is normal and allows for the adjustment to occur. There is great energy in conflict and it can lead to decisions but communication during this phase is crucial. While the transition and succession period can be difficult, it also brings great opportunities for the next generation to enhance the business.

As Kenyon-Rouvinez puts it, “businesses are not made to last but businesses are meant to be renewed”.

Letting go

Perhaps one of the most important parts of succession planning is knowing when to let go. Hanging on to a business for too long can be detrimental to the family as well as the business, but letting go can be very difficult for the owner.

If there is no financial securement for their retirement, the business is not going to transition. They also need something to retire to, meaningful activities such as charity or sports boards or philanthropic endeavours.

One evolving trend is for retired business owners to mentor the next generation of business and social entrepreneurs, bringing their wealth of knowledge to a new generation of business people.

Once an owner's business has successfully transitioned to the next generation, mentoring is a great way to ensure valuable knowledge gained from a lifetime of experience is also passed down the line.

We are seeing more of this at ANZ – business owners facing a life-changing occasion which for many is their 'moment of truth'. They need to prepare for business transition, in whichever form, and the significant change this brings to their banking and financial needs.

For owners of a family business, family succession is the option often chosen.

Mike Norfolk is Head of Private Banking Australia at ANZ Global Wealth

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

EDITOR'S PICKS

-

Agriculture in Australia: The Asian Food Bowl is real – but it can be harder to reach than many companies think.

30 May 2014 -

Education, industry collaboration keys to fighting cybercrime.

25 June 2014 -

“Entrepreneurs can do business now in their pyjamas,” says Maria Contreras-Sweet of the US Small Business Administration. She was speaking at National Small Business Week in the US about how technology has empowered small businesses and provided new opportunities.

20 June 2014