-

It sounds like the set up for a joke: a bunch of guys are sitting around for their regular get together, eating and drinking, before they realise none of them can pay.

This was sixty-odd years ago when even a cheque was a rarity. What they really needed was some form of IOU the restaurateur would trust. They needed a “credit card”. In fact, it was from this dinner credit – or more technically charge – cards had their genesis.

"People already have smart phones but is phone payment more convenient than the existing card?"

Andrew Cornell, Managing EditorThe diners came up with a scheme for a “Diners Club” card which meant they would never again have to knock back that final cognac for lack of immediate funds.

That Diners was the archetype for a whole range of payment cards is fascinating for payments nerds but the critical element of the story is that there was a gap in the market, one that consumers and merchants would benefit from if filled.

But is the same true of mobile payments? The ability to use your smart phone like a credit or ATM card?

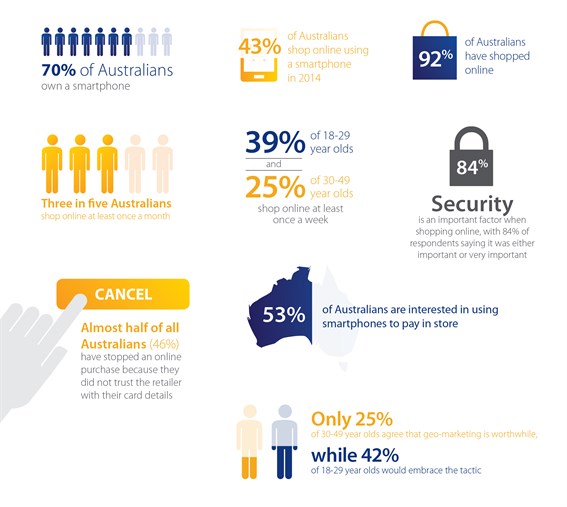

It sounds good. In fact, according to new research released today by Visa, undertaken by UMR Strategic, Australians not only have high smartphone adoption (70 per cent of the population own one) but a growing number are interested in using their mobile to make purchases (53 per cent).

What’s holding them back, according to the research, is security fears. Just under half those surveyed (46 per cent) have stopped a purchase when shopping online because they didn’t trust a merchant with their card details.

Visa says that impacts both sides of the transaction. Almost nine in 10 Australian merchants cited the importance of keeping customer credit card details secure as a high priority for their business.

A further 84 per cent of merchants say an additional layer of security is needed.

Visa indeed announced an additional layer of security with its research, so-called “tokenisation” to be rolled out this year in Australia. Tokenisation replaces the 16 digit card account number with a unique series of numbers (a “token”) that can be used for card payments in the digital world, without exposing a cardholder’s more sensitive account information.

Arch rival MasterCard has a similar view and last week announced a pilot program with First Tech Federal Credit Union in the US to use biometrics such as facial and voice recognition as well as fingerprint matching to authenticate transactions. Tokens are also on MasterCard’s agenda.

There’s no doubt extra security is important and will become increasingly so.

But is it enough to drive the sort of take up seen in Australia with tap’n’go cards? The secret to the phenomenal success of this is people already had the cards (new cards were gradually introduced with the technology), the system worked and it was more convenient.

Now people already have smart phones (well at least 70 per cent in Australia) but is it more convenient than the existing card?

Already in the US, where payment schemes are much less sophisticated than Australia and most of Asia, there has been some backlash against mobile payment devices such as Apple Pay not because they don’t work or are insecure but because they are less convenient than the existing card.

Visa and MasterCard need only dust off some of their other Australian research from the mid 90s when the first “smart” cards were introduced. Although they had a chip rather than magnetic stripe, these cards were simply electronic cash cards or “stored value cards”.

Large scale pilots were held on the Gold Coast and in Canberra and they went very well. But as soon as the marketing and pilot caravans moved on, people stopped using the cards. There was a large scale roll out too in the hip Tokyo suburb of Shibuya. That too shrivelled away.

The problem was there were existing, efficient alternatives to electronic cash. Including cash. And credit cards. The idea that the cards would replace cash was fanciful because no one was going to stop carrying cash at that time.

And one suspects this will be the challenge for mobile payments. Sure, the phone can do everything the plastic tap’n’go card can do but it is still difficult to imagine anyone venturing out with just their phone as a payment means.

Mobile payments don’t solve a clear and present problem like the Diners Club card did. Or indeed the original Bankcard in Australia which allowed merchants to largely do away with costly, bad debt ridden personal charge accounts.

A new layer of security is not enough. In the US, chip cards are only now being rolled out but in many US markets the logical next step in the security chain, using only Personal Identification Numbers (PINs) to authorise transactions is considered a step too far. So the US will stick with vastly less secure signature authorisation.

In the market, cool technology and an extra layer of security don’t always trump habit and convenience.

Stephen Karpin, Visa’s group country manager for Visa in Australia, New Zealand and South Pacific, disagrees.

He told BlueNotes that while the new layer of security tokenisation will bring will be largely invisible to consumers and merchants, it will nevertheless enhance the shift to pay by smart phone.

But Karpin does believe mobile payments need to do even more and the real impetus will come from bundling extra services in with the mobile payment, such as special offers or pre-orders, where the phone’s capabilities including location, loyalty, membership and payment can be brought together.

More significantly though is the advantage tokens will bring to online transactions. Because a token doesn’t represent the whole account number of a payment card, if it is compromised – either individually or via one of the all too frequent mass breaches – only the token need be disabled.

“Tokenisation will not only accelerate the move to mobile payments in Australia but also provide a secure foundation for previously unimagined ways to pay,” Karpin says. “In the future, any internet-connected device could become a secure way to make payments.”

This is certainly a convenience for consumers and merchants.

Visa’s head of emerging products and innovation George Lawson says another advantage of tokens is they can be programmed to be quite specific, preventing their broader use and lessoning the attraction for fraud.

“It is much more efficient to cancel a token than an account,” he says. “You can have multiple tokens on one anchor account. For digital transactions you can restrict domains, merchants, channels even.”

Karpin argues while security anxiety has hardly held up the surge in tap’n’go transactions it remains a major impediment for consumers.

“But equally it is merchants, banks and regulators who are most concentrated on security. That’s why these innovations are important,” he says.

The lessons of payments innovation tends to suggest there needs to be more than incremental improvement for consumers to change behaviour.

Those conditions don’t appear to exist yet for smart phones although if new service propositions emerge they might. As Karpin argues, tokenisation breaks down the barrier of risk around putting sensitive account information into more and varied devices.

Added layers of security for online transactions is however slightly different. That is where there is genuine consumer (and government and regulatory) concern. And opportunity.

After all, Diners started as a simple cardboard card. Today’s payment card is already an app on a mobile device.

Infographic by Visa Australia.

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

EDITOR'S PICKS

-

If my wife had said to me 10 years ago I would wake up at 3am to watch the launch of a new mobile phone on the other side of the world, I would have told her she was crazy and gone back to watching reruns of Seinfeld.

2014-10-20 18:52 -

As Australian – and global – reforms of payments systems have demonstrated, they are complex networks. Complex to operate, complex to regulate, complex to forecast. But they are vital to efficient economies.

2015-01-20 19:53 -

For many, many years I have presented at payments conferences about how consumer payments are habit forming. People tend to be “locked in” to how they pay for things by the time they are 30 years old. A much stronger – not just slightly stronger - “value proposition” is needed to knock them out of their old payment habit and into something new.

2015-01-14 18:33