-

If the age of digital financial services has not yet arrived completely, it’s not for lack of publicity. Every consultant worth their MBA has contributed something on digital disruption and 2015 has kicked off with leagues of reports.

Many rehash familiar themes by variously stating the obvious but as the reality of digital transformation and the even more culturally challenging social revolution takes hold there is no doubt this is a fundamental shift. One which will eventually overshadow more proximate threats to the status quo like regulation or economic cycles.

"The temptation is always to focus on the whizz and the bang when the more profound forces may actually be more mundane."

The world will be digital and the world will be social. My colleague Pam Rebecca writes in BlueNotes today about the “non-negotiables” of a social workplace and appropriately the article has been extensively socialised – indeed it is not so much an insight with external commentary but an insight formed in concert with external commentary. It is social content.

Journalism of course is another traditional industry struggling with the social and digital transformation, already changed beyond recognition but with its future far from certain.

In financial services, indeed in any digitally challenged industry, the temptation is always to focus on the whizz and the bang when the more profound forces may actually be more mundane, indeed more boring.

Take two recent developments, summarised in RFi’s latest global review, the Global Retail Banker. One is the rapid take off of Apple Pay in the US, a trend which will be reinforced by the huge popularity of the newest iPhones.

Bank of America says more than 800,000 customers have activated more than 1.1 million credit cards using Apple Pay. Apple Pay has also been gaining traction with some of the major retailers in the US, Whole Foods reporting nearly 1 per cent of all transactions in November 2014 were made using Apple Pay, a figure likely to increase as the number of consumers with an Apple Pay enabled device grows, RFi reported

The firm says “many believe that Apple Pay will be the ‘tipping point’ for mobile payments. As awareness, usage and acceptance of Apple Pay become more widespread it is likely that consumers will become more open to using alternative mobile payment solutions, including Google Wallet”.

This is the high profile perspective on digital financial services – new product, new kit, plenty of marketing hype. No institution can ignore it, customers want it.

But a recent survey by another consultancy, Celent, found the most common reason banks invest in digital is they believe they have to do it to keep up with the competition. That reason was followed by aiming to improve customer relationships through digital engagement. A more distant third was aiming to attract new customers and upsell though mobile services.

In effect, banks are saying digital is, in Pam Rebecca’s phrase, non-negotiable. Digital and social are what customers want but there is little expectation they can deliver sustainable competitive advantages – that is attract new customers. This is something more and more industry players are recognising, driving the realisation digital innovation must actually complement superior customer service not try and lead it.

But RFi referred to a second important development.

The Obama administration in the US has called for the General Services Administration (GSA) to modernise out-of-date remittance technology as it reviews its contracts with major financial institutions.

“The consumer payment technology landscape has changed dramatically since GSA contracts were issued to Citibank, JP Morgan Chase and US Bank in 2008,” RFi reported, citing the Washington Post. The GSA is now under pressure to update its Smart Pay system, used by government officials to pay for work-related expenses.

New approaches being considered include smartphone and tablet-based methods, contactless cards, cardless charge accounts, digital wallets and cryptocurrencies. These would aim to strengthen security and anti-fraud measures and allow the GSA to aggregate and track government payment patterns for better monitoring and transparency. It’s hardly the razzmatazz of ApplePay.

This is a digital revolution of a different sort. Not new toys but new processes, government mandated. And they won’t just be government mandated but regulator mandated. And consider the pace of change: the GSA systems were only introduced in 2008. They’re not three decades old like some Australian payments protocols.

Just before the end of December the global regulators in Basel released a new year mail bag of regulatory modifications, the major ramifications being for capital and the risk weighting of assets. Less appreciated though was that the detail of the changes implied massive technological change in bank systems, a digital miasma.

As McKinsey & Co argued in yet another digital disruption opus, Strategic choices for banks in the digital age, governance, compliance and regulatory pressures will be major digital hurdles and critical to success.

“Revenues and profits will migrate at scale toward banks that successfully use digital technologies to automate processes, create new products, improve regulatory compliance, transform the experiences of their customers, and disrupt key components of the value chain,” McKinsey said.

“Institutions that resist digital innovation will be punished by customers, financial markets, and—sometimes—regulators. Indeed, our analysis suggests that digital laggards could see up to 35 per cent of net profit eroded, while winners may realise a profit upside of 40 per cent or more.”

The italics are mine but McKinsey insists in this report these more tedious battles in the digital revolution, the supply lines, the implementation of orders, the paperwork (digital or literal), are vital in the campaign.

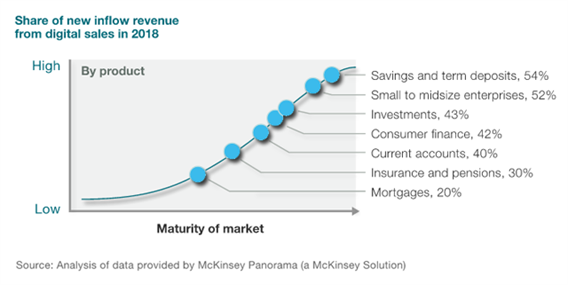

“Digital will touch every aspect of bank operations, from product development to risk management and human-capital management,” McKinsey argues. Some product lines, like ordinary savings deposits, are further ahead in the time line but all operations will eventually be affected.

The consultancy makes the point Pam Rebecca emphasises and which ANZ’s chief executive Mike Smith (they are of course far from alone) has remarked upon: the biggest challenge with digital is cultural. That is, it suffuses the way business is done and how people act.

“Across the value chain—from operations and IT to marketing and sales to product development and finance—the data and technology required to realise this vision in the bank often already exists,” McKinsey said. “What’s missing is the organisational orientation and mind-set to have small, cross-functional teams working together through rapid testing and improvement programs. “

All these reports and many, many more do a robust job of untangling the web of impacts digital and social will have. In a way that’s the easy part. Does the technology exist? Are the systems adequate? Is the management structure appropriate?

But it is the cultural challenge, for the institution and its people, which is the killer app. (A digital turn of phrase already outdated.)

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

EDITOR'S PICKS

-

As a journalist for more than three decades, two of them at the Australian Financial Review and the last five months here at ANZ, I’ve spent my career in the game and am heavily invested in its future.

20 May 2014 -

As a senior female leader in the digital world it’s difficult to avoid thinking about gender politics, even when you don’t want to. We like to believe the world has changed for women and it has most definitely. I could tell you some stories from early in my career that would probably draw a gasp. This would be cathartic for me but not entirely relevant!

30 January 2015 -

The digital age has many attributes - technology, innovation, mobile, cloud and data, but the superpower of the time is unquestionably social media. Here are five ways that social media is disrupting all that you thought you knew about leading a business.

3 February 2015