-

Not all cows are alike. Nor sheep. Nor deer. Over the last two decades the gap between the top 20 per cent of red meat farmers in New Zealand's and the rest has doubled.

There's been further divergence in recent years. The top performers continue to push the boundaries beyond what was thought feasible just a few years ago. But if the sector as a whole is to reach its potential, it is the rest of the herd who need to improve.

"If you were marking the industry on the progress of its five-year plan, the scorecard wouldn’t read well."

Cameron Bagrie and Con Williams, Chief economist at ANZ NZ and Rural economist at ANZ NZ

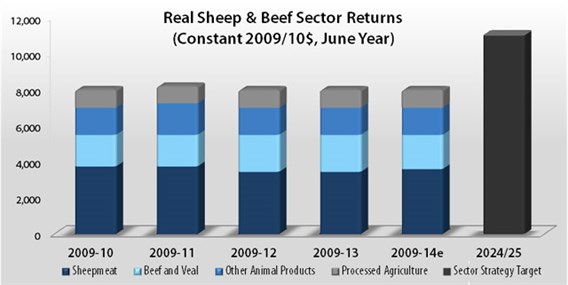

The red meat sector has lofty growth aspiration. The $NZ9 billion industry has plans to expand to around $NZ14 billion by 2025 but there are many pieces still missing from the puzzle.

One such piece is a divergence in financial performance between top farmers and the rest of the industry. From an industry-wide perspective the potential to increase on-farm performance is immense, with the top performers in the sector returning at least three times average levels.

Demand is not an issue. Asia wants more New Zealand red meat, a lot more. Rather growth will come from building on-farm supply side capacity through improving profitability and increasing investment.

This will be supported by emerging market demand, modernisation of the food chain in new markets, the westernisation of emerging Asian (and particularly Chinese) consumer preferences, opening up of new cultural segments, preferential access to a wide range of markets and strengthening business relationships between New Zealand and key multinational foodservices and retailers.

As Chinese President Xi Jinping mentioned on his trip to New Zealand in November, “New Zealand will have to worry about the fact that there is more Chinese demand than you can possibly supply".

A key part of lifting on-farm performance in the sector is New Zealand’s Red Meat Profit Partnership (RMPP).

The RMPP was formed through a consortium of agribusinesses and the government in a bid to build sustainable, long-term profits in the red meat sector. Its purpose was to provide an umbrella framework those within the red meat sector could utilise for growth and improvement.

The program is the first substantial step-up in industry investment focused on lifting on-farm performance.

Follow the best

For the red meat sector to reach its ambitious targets what needs to be looked at is on-farm performance and what sets the top farmers apart from the rest.

The first part of the RMPP has been aimed at better understanding what top performance looks like and its key drivers. In-depth interviews of top farmers found some key attributes. The main ones include:

- Vision and drive: well-defined personal and business goals

- Having the right skill set and a talented team, as well as using specialist advice when required

- Above-average execution of key farm management practices and mitigation of risks

- Passion and confidence in the sector, which drives investment and effort

The key attributes and practices of top farmers from the RMPP findings were heavily weighted toward ‘softer’ attributes and key farm management practices utilised to achieve top financial performance.

Room for optimism

There is plenty of room for optimism in the red meat sector despite the challenges it faces. There is no rocket science or too many secrets around the attributes and farm management practices needed to achieve top performance year-in and year-out.

First and foremost it comes back to one’s business motivations and goals. Ultimately farmers need the motivation and willingness to be able to reach the top. This is the same for any business.

The second aspect is having the right skillset and team. This involves investing in oneself, as well as having a skilled team. Equally, it involves having access to specialists who can provide quality advice in key areas to guide decisions.

Having the right skillset, team and access to specialists allows all the basics of farm management to be executed to an above-average standard on a more regular basis, leading to superior performance.

The link between the key drivers and successfully carrying out the connected farm-management practices is weaker with mid-tier farmers compared to their higher-performing counterparts. This suggests that most farmers have a sense of what needs to be done to perform at higher levels but it is only the top performers who know how to consistently execute.

EIGHT KEYS TO DETERMINING A FARM’S PROFITABILITY

We’ve analysed benchmarking data to help draw out which areas of the more measurable aspects of a farm are more or less important determinants of profit. Our findings regarding the key benchmark relationships are:

- There’s a strong relationship between earnings before interest, taxes and rent and the rate of return for all main farm types. The relationship gets progressively stronger when moving from more intensive/finishing operations to hill country/breeding units.

- There’s a similarly strong relationship between gross revenue and profitability for all the different land types. The same change in gross revenue yields a similar change in profit.

- There’s reasonably good relationship between the quantity of meat and fibre produced and profitability. Intuitively it wasn’t quite as strong as we expected, suggesting other farm management practices are equally – if not more – important determinants of profitability.

- Sheep productivity is the most important determinant of profitability for all farm types within the sector. There was no relationship between beef production and profitability for the main farm types.

- There’s a stronger relationship between profit and productivity for the enterprises that make up the largest proportion of total revenue for a particular farm type. This supports the notion that top performance requires investment and a focus on the areas of relative importance in a business.

- There’s no relationship between farm expenditure and profitability, but a strong relationship between profit and cost efficiency suggesting top performance is driven more by the quality of expenditure and focus of investment than quantity. Three key areas of investment that stood out were cropping/pasture renewal, genetics and infrastructure.

- There’s a strong link between profit and the equity within a farm (i.e. a lower equity position tends to lead to higher profitability).

- There’s a reasonably significant negative correlation between the age of the operator and profitability for all farm types.

Cameron Bagrie is chief economist at ANZ NZ and Con Williams a rural economist at ANZ NZ.

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

EDITOR'S PICKS

-

When the first shipment of red meat sailed from Dunedin in 1882, it was a turning point for New Zealand’s economy. Now the red meat sector faces another turning point having lost out to dairy as NZ’s star export.

22 July 2014 -

In the huge produce hall at Fieldays in Hamilton New Zealand, the southern hemisphere’s largest agricultural trade fair, a sausage and small goods maker was lamenting how difficult he was finding it to secure supplies of top quality beef and lamb.

23 June 2014 -

Prime Ministers John Key and Tony Abbott will be rightly satisfied with their APEC and G20 work after finalising long-delayed and much-needed trade deals with Korea and China respectively over the weekend.

20 November 2014