-

When is distribution like a circus act? When it’s about juggling and balancing.

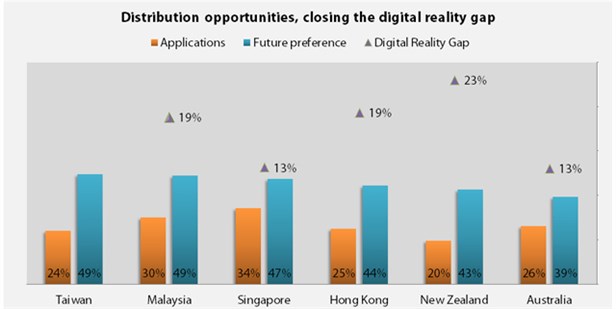

It is a global truism more consumers would prefer to conduct banking tasks and applications digitally than actually do so – this is the ‘Digital Reality Gap’. Banks and consumers are well aware of it. The difference between the two scenarios is effectively the opportunity an institution has to shift distribution to a less cost-heavy model.

"Consumers often switch between phone, digital and physical channels. Yet, the only channel to be a net beneficiary of all this switching was… the branch of course!"

Alan Shields, Managing Director, Research and Advisory, RFiBalancing the Digital Reality Gap

Encumbered as banks are by large branches and legacy systems, with all the associated fixed costs, this digital reality gap is particularly frustrating. In fact, across the six developed Asia-Pacific markets we studied in our Global Retail Banking Distribution Report, involving 26,000 interviews with retail banking customers across 13 markets, the ‘Digital Reality Gap’ ranged from 13 per cent to as high as 25 per cent. Put another way, banks from Australia or Taiwan, for example, have the opportunity to shift between one in seven to one in four application interactions to a digital channel.

Our study delved into the challenges faced by banks in juggling traditional channels with the emergence and maturity of digital channels.

{CF_IMAGE}

Beyond the gap, there is another factor which is actually even more difficult to swallow for banks. RFi studied banking customers’ ‘path to purchase’ from enquiry to application and found that in the step from enquiring to applying for a banking product, consumers often switch between phone, digital and physical channels. Yet, the only channel to be a net beneficiary of all this switching was… the branch of course!

The generational juggling act

On top of the challenge of balancing channel demand, there is the complication of the generational juggling act - the fact Gen Y thirsts for digital interaction and expects it while Gen X and Baby Boomers lag in their demand.

In the first instance this is evidenced when looking at past channel usage. Gen Y uses more channels in an average product application than other generations. In fact, Gen Y uses 1.2 channels per application, compared with 1.1 by Gen X and 1.0 by Baby Boomers. Further, this difference in channel usage lies almost entirely in the use of digital channels – 23 per cent for Baby Boomers versus 33 per cent and 36 per cent for Gen X and Gen Y respectively – and in fact there is almost no difference in branch usage across the generations.

Banks therefore find themselves in a conundrum whereby the demand for digital is increasing over time and with generational shifts, yet the branch remains relevant - but has a different meaning for younger customers.

The views and opinions expressed in this communication are those of the author and may not necessarily state or reflect those of ANZ.

-

EDITOR'S PICKS

-

Conventional wisdom tells us the battle to replace cash will be won or lost on public transport. At RFi we believed getting consumers to use non-cash methods for their daily commute would ingrain the habit of electronic payment - and thus set up a market for a broader payments evolution.

3 July 2014 -

What is digital? Is it data, platforms, an app? A website? Social? Content? The list goes on. And that's just beginning with the customer side of digital. There's a whole other list of questions when it comes to what is often called digitisation - transforming the underlying processes that support your business.

11 November 2014